Small businesses all over the United States are reeling from the effects of COVID-19. Luckily, federal, state, and local governments are offering billions of dollars in loans to small businesses. Of course, navigating financial applications and government bureaucracy is not always easy. So we put this guide together to help streamline the process.

FAQs about Small business loans for businesses

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, signed into law on March 27, 2020, provides $376 billion in relief for American workers and small businesses. That was followed by another $310 billion a month later. While applications are being accepted until June 30, the programs are first-come, first-served.

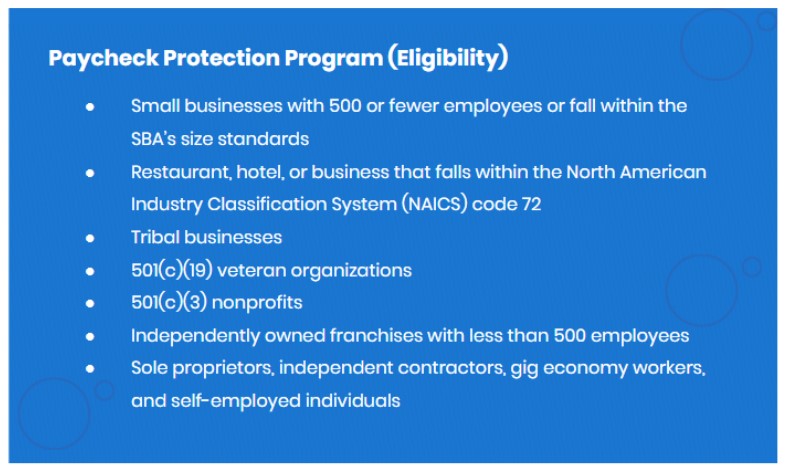

The Paycheck Protection Program

Paycheck Protection Program is funded by the CARES Act and, offers small business loans up to $10 million. The Paycheck Protection Program is designed to provide a direct incentive for small businesses to keep their workers on the payroll. In order to qualify for the Paycheck Protection Program, your business needs to employ fewer than 500 employees.

But not every small business is eligible. The SBA states that businesses are “engaged in any activity that is illegal under federal, state or local law,” are not qualified. That excludes businesses that are involved with cannabis or illegal gambling.

Businesses can even have loans partially or totally forgiven for maintaining or rehiring employees that have been laid off. Businesses will have their loans completely forgiven if they maintain the same number of employees and wages for at least 8 weeks. Here’s a list of banks accepting Paycheck Protection loan applications. If you’re looking for a local lender, use this online tool from the SBA.

What if you have already laid off a portion of your employees?

You can still have your loan forgiven. You just need to hire them back before you actually receive your loan money.

Of course, the Small Business Administration is offering other loans that may be a better fit for your business’s unique needs. Check out the SBA’s full list of programs to determine which program might be best for your business.

State governments are also offering small business loan programs. Check out this article for a comprehensive list of state loan programs.

Of course, remember also to take some time and schedule an appointment with your local bank. You can go over the different loan options they may have available for you.

Are there any options for ‘Grants’?

Loans aren’t the only option you have. Some organizations are offering grants to small businesses. Unlike loans, grants don’t need to be paid off. While that sounds almost too good to be true, grants sometimes come with conditions that need to be met. Here are some grants that are being offered due to the COVID-19 pandemic.

- Facebook announced a program to give $300 million in grants to 3000 small businesses. The application is now open to all eligible US cities. Click here to apply.

- Google has offered $340 million in advertising credit for small and medium-sized businesses that can be used to purchase Google Ads. This free advertising credit must be used by December 31, 2020. Click here for more information.

- When you raise at least $500 on GoFundMe, GoFundMe will issue matching $500 grants to qualified businesses.

- In addition, states and cities all over the United States are offering grants to local businesses. Check out this list from Grantwatch to find grants offered by your city and/or state government.

Credit options

If you want some more flexibility about how you spend your money, consider applying for a small business credit card. This can allow you to make purchases for your business that don’t have the restrictions typical for grants or loans. Of course, you’ll most likely be paying a much higher interest rate.

If you want to consider credit options for your business, consider applying for a small business credit card. Check out this article from Nerdwallet.com that breaks down different business credit cards from companies like American Express, Amazon, and Visa.

In conclusion

While you evaluate your different options, check out this guide that we put together for small businesses in need.

Originally published

![[Feature image] The best AI tools for business in 2025 A complete guide for productivity, content, and growth](https://birdeye.com/blog/wp-content/uploads/Feature-image-The-best-AI-tools-for-business-in-2025-A-complete-guide-for-productivity-content-and-growth-375x195.jpg)