Competitive AI search intelligence shows multi-location enterprises how AI answer engines talk about their brand versus competitors, and where they are quietly winning or losing the recommendation battle across platforms, queries, and locations.

Summary Competitive AI search intelligence replaces traditional SEO comparison with a unified view of how AI platforms like ChatGPT, Perplexity, Gemini, and more actually talk about your brand versus your competitors across every market you serve. It helps you understand where you are silently losing visibility, even if you still rank well in traditional SEO, and gives your teams clear levers to improve AI visibility. Birdeye Search AI is the intelligence layer that powers this approach for multi-location brands, providing one place to monitor AI answers, understand why competitors win, and act to become the default choice across AI engines.

In this guide, you will see how to audit your current AI visibility, uncover where competitors are winning inside AI answers, and build an enterprise plan to outrank them in every market.

Table of contents

- The new competitive landscape: Why traditional SEO comparisons are obsolete

- The competitive AI maturity model

- The AI Search competitive audit framework: What to measure

- Reverse engineering success: Decoding why competitors win AI mentions

- Competitive gap analysis: Finding your advantage points

- The three-tier competitive threat assessment

- Offensive strategies: How to displace entrenched competitors

- The win/loss analysis framework

- Defensive strategies: Protecting your AI search market share

- The competitive intelligence dashboard: Operationalizing ongoing monitoring

- Birdeye Search AI: Powering competitive intelligence for multi-location brands

- FAQs on competitive AI search intelligence

- Final thoughts

The new competitive landscape: Why traditional SEO comparisons are obsolete

OpenAI’s recent usage research shows that ChatGPT serves information at a massive scale and shapes how people seek answers, reinforcing the need to treat these platforms as first-class search channels.

AI search has changed how people discover, compare, and choose brands, and it no longer follows the rules of traditional SEO or SERPs. Zero-click search and AI-generated answers now sit between your customers and your website, which means the real competition happens inside ChatGPT, Perplexity, Gemini, and other answer engines, not just on page one of Google.

Now, let’s take a closer look at how this new competitive reality is taking shape:

- AI platforms create a new competitive hierarchy, where authority signals, entity strength, review ecosystems, and structured data—not traditional SERP factors determine which brands dominate AI-generated answers.

- AI platforms accelerate the silent displacement problem, allowing a brand to rank #1 on Google yet never appear in ChatGPT, Perplexity, or Gemini because these systems rely on knowledge graphs and aggregated trust signals instead of page-level rankings.

- The AI platforms enforce winner-take-all dynamics, where a small set of brands capture most visibility because there is no “page two” and few alternative discovery paths inside AI answers.

- AI tools redefine what counts as a competitor, surfacing aggregators, marketplaces, and new digital-first brands alongside incumbents, based on entity and review strength rather than legacy SERP rankings.

- AI platforms reward early movers with compounding entity authority, making it difficult for slower brands to catch up as knowledge graph strength, citations, and review ecosystems snowball faster than in traditional SEO.

Traditional “AI-powered SEO” uses AI to analyze keywords, SERPs, and backlinks, but still treats Google rankings as the main scoreboard. Competitive AI search intelligence flips this view and asks a different question: “When a customer asks an AI engine what to do or who to choose, which brands does it actually recommend, and why?”

To navigate this new landscape, enterprises need a clear understanding of where they currently stand in the AI search ecosystem. That’s where the competitive AI maturity model comes in.

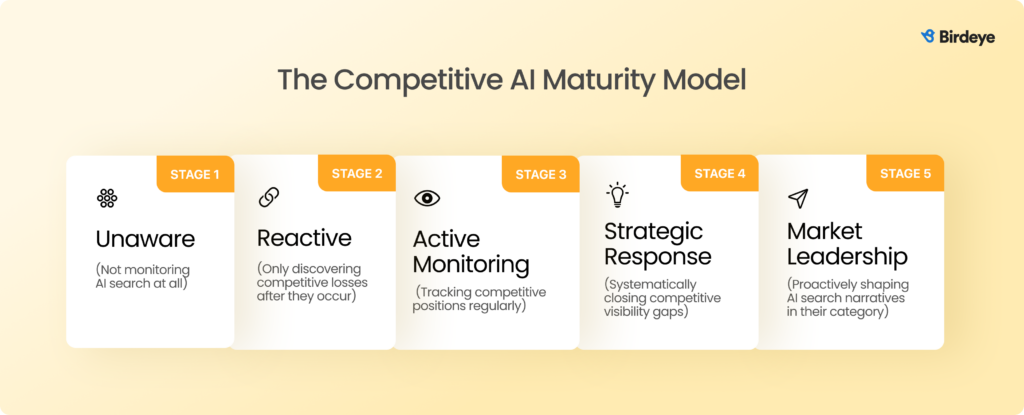

The competitive AI maturity model

The competitive AI maturity model outlines five stages that multi-location organizations move through as they shift from treating AI search as an SEO byproduct to actively managing AI answer visibility across categories and locations.

The AI Search competitive audit framework: What to measure

A systematic data-driven audit is essential to reveal competitive positioning across AI platforms. To achieve that, enterprise businesses must focus on these core metrics:

1. Category ownership analysis

Identify which brands AI platforms consistently cite for core service or product categories across your industry. This enables category leaders, emerging challengers, and areas where AI platforms default to generic answers due to weak entity authority.

2. Frequency benchmarking

Measure how often AI platforms mention your brand versus competitors across a standardized query set. This establishes your AI “share of voice,” showing whether your visibility is concentrated, fragmented, or absent in high-value queries.

3. Citation quality assessment

Evaluate how AI systems describe your brand — accuracy, depth, sentiment, and specificity compared with competitor descriptions. Citation quality often signals which brands AI considers authoritative and trusted.

4. Feature trigger analysis

Determine which competitors activate AI features such as knowledge panels, comparison tables, local packs, or direct recommendations. These signals show which entities are structurally dominant and where structured data gaps exist.

5. Location-level mapping

Map competitive visibility by market or region to identify where competitors outrank you in AI recommendations at the local level. This is essential for multi-location organizations where AI platforms weigh local signals heavily.

6. Query intent segmentation

Assess performance across navigational, informational, transactional, and comparison queries. Competitors often dominate one intent type while leaving others open for strategic entry.

7. Platform-specific positioning

Compare how your brand ranks and appears across AI platforms—ChatGPT, Perplexity, Gemini, and vertical industry-specific AI engines. Each system weighs brands differently, so strengths and weaknesses vary across the ecosystem.

Do you know? New AI answer engines such as Perplexity reported ~780M queries in May 2025, up from ~230M mid-2024. This acceleration means enterprise brands can no longer treat non-Google AI engines as fringe; they already handle hundreds of millions of queries per month.

Reverse engineering success: Decoding why competitors win AI mentions

Moving beyond “what” to understand “why” competitors dominate AI results is critical. These patterns reveal the levers that give certain brands a persistent advantage across AI-generated results.

Key tactical signals sit inside an AI authority stack that most winning competitors share:

- Entity clarity: Structured data, knowledge graph presence, and cross‑web consistency that give AI systems a stable understanding of who the brand is and what it offers.

- Content depth: Pillar pages, detailed service guides, and topical clusters that let AI extract rich, specific answers instead of generic summaries.

- Review ecosystem: High review volume, recency, ratings, and detailed responses that validate real‑world performance, especially for local and category‑level queries.

- Multi-platform consistency: Clean NAP data and aligned categories across GBP, directories, social profiles, and structured databases that signal reliability.

- External validation: Media mentions, industry citations, partner listings, and authoritative backlinks that confirm credibility beyond the brand’s own properties.

- Conversational fit: Content written to mirror how people actually ask questions, so AI systems can lift ready‑made, context‑aware answers.

Once you map how competitors perform across this stack, patterns emerge: the brands dominating AI answers usually have no single silver bullet, but a more complete, consistent set of authority signals than anyone else in the category.

Competitive gap analysis: Finding your advantage points

Identifying competitive gaps requires a structured, enterprise-level assessment that reveals where competitors are vulnerable and where your brand can gain visibility. The following areas provide the strongest signals for uncovering those gaps.

The competitor absence map

Identify queries, topics, and categories where competitors aren’t being cited. These “whitespace” areas represent fast-win opportunities for your organization to establish authority early and shape the default narrative that AI systems adopt.

Quality vulnerability assessment

Pinpoint instances where competitors may appear in AI answers but with thin, outdated, or generic descriptions. These weak citations create openings for brands with stronger authority stack signals to step in and become the default answer.

Location-specific opportunities

For multi-location organizations, AI visibility often varies by geography. Identify markets or neighbourhoods where competitors show weak or inconsistent AI presence, even if they perform well in traditional SEO. This allows targeted, regional wins at scale.

Emerging query patterns

AI engines frequently adopt new conversational behaviours and question formats. By spotting rising query patterns early, your brand can build first-mover authority before competitors catch up, giving you a durable advantage.

Platform-specific gaps

Many competitors still underperform on platforms like Perplexity or emerging vertical AI search tools. This creates blue ocean visibility opportunities where your business can become the preferred answer ahead of the market.

Sentiment differentiation

Not all competitor citations are positive or persuasive. By identifying mentions with unclear, generic, or weak positioning, your brand can respond with stronger messaging tied to your unique services, operational strengths, and value propositions. This leads AI systems to favour your content for similar queries.

The long-tail entity strategy

Look for hyper-specific expertise areas that competitors overlook. Building authority in these niche spaces strengthens overall brand recognition and improves your AI visibility across broader categories.

The three-tier competitive threat assessment

Before presenting competitive gap insights visually, it’s important to categorize competitors based on the scale and nature of the threat they pose to your AI visibility. This framework helps teams prioritize where to take action and where rapid gains are possible.

These insights create a roadmap for targeted action, setting up the strategic foundation that helps you displace competitors.

Offensive strategies: How to displace entrenched competitors

The following offensive playbooks help enterprise brands take market share and reshape the narratives AI platforms rely on.

The comprehensive content replacement strategy

Develop resources that are more detailed, accurate, and structured than competitors’ content. For example, instead of a simple “10 tips for local SEO” page, create a multi-layered guide with step-by-step instructions, location-specific case studies, embedded FAQs, and AI-ready snippets. This positions your content as the definitive resource AI platforms prefer over thinner competitor pages.

Structured data superiority

Implement rich schema markup, knowledge graph connections, and other entity-enhancing data for each location, products/services, etc. Clear, comprehensive, structured data helps AI platforms fully understand your brand, increasing the likelihood of citations compared to competitors.

Outrank Play 1: Review velocity campaigns

Drive a consistent stream of authentic, detailed reviews for products, services, and locations, especially where competitors’ profiles are stagnant or thin.

Birdeye Reviews AI automates review generation and responses at enterprise scale, ensuring a consistent stream of authentic reviews for every location. These review signals also appear directly in AI search audits and correlate with increases in AI share of voice.

Outrank Play 2: Entity relationship building

Build strategic partnerships, co-citations, and brand associations that strengthen your knowledge graph presence. AI systems interpret these relationships as signals of trust and authority, boosting citation frequency.

Outrank Play 3: Comparative content development

Produce side-by-side comparisons and analysis resources that clearly highlight your differentiators. This trains AI platforms to present your brand favorably in responses where competitors are currently cited.

Local authority amplification

Focus on hyper-local credibility by engaging in community initiatives, local press coverage, and partnerships. For multi-location enterprises, strong local-entity signals ensure each location secures visibility in regional AI answers.

Rapid response to inaccuracy

Continuously monitor AI outputs for misinformation about your brand and correct it quickly. Highlight competitor inaccuracies where relevant to reclaim or capture citations and strengthen AI trust.

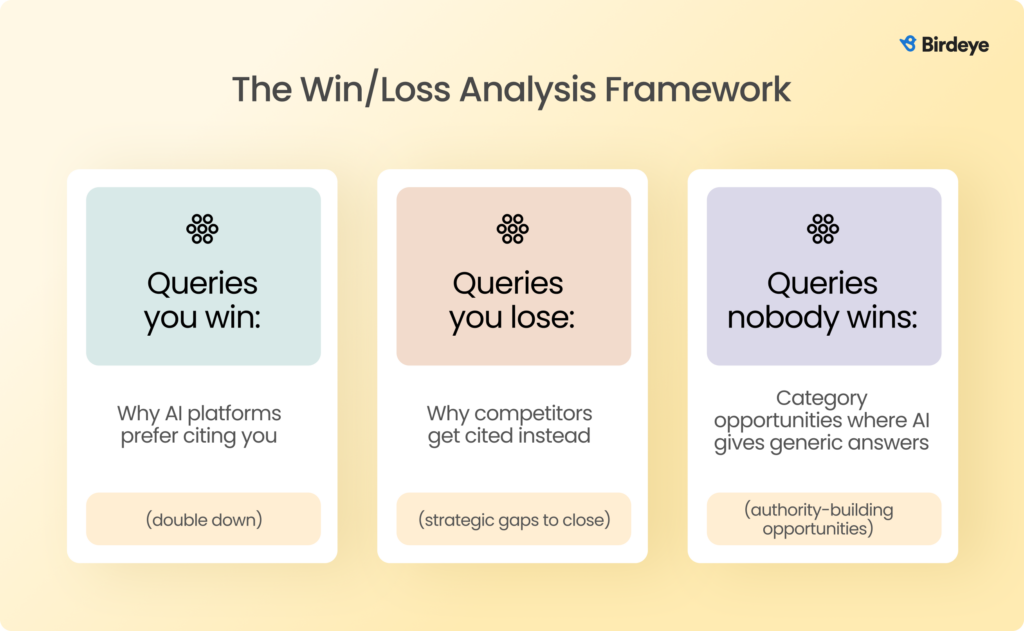

The win/loss analysis framework

The win/loss analysis framework helps you identify where to reinforce strengths, where to close competitive gaps, and where to claim new authority before anyone else does.

Defensive strategies: Protecting your AI search market share

Once your brand has established AI visibility, defending it requires ongoing monitoring and systematic processes to prevent competitor displacement:

Continuous entity maintenance

Conduct regular audits of structured data, knowledge graph connections, citations, and location information to keep your AI authority stack signals accurate, complete, and current.

Content freshness protocols

Maintain a schedule for updating content. Regular refreshes whether adding new data, revising examples, or expanding sections help AI engines recognize your brand as an active, authoritative, and up-to-date source.

Review management excellence

Generate ongoing reviews with an effective review management system and provide thoughtful, detailed responses to maintain high engagement signals and reinforce credibility across locations.

Monitoring and alert systems

Track AI-generated mentions of your brand in real time to identify emerging threats, misinformation, or competitor surges before they become entrenched.

Birdeye Insights AI tracks brand mentions by analyzing reviews, surveys, social media, and forums to reveal sentiment, highlight key themes, and summarize feedback automatically. It benchmarks performance across locations and against competitors, turning hundreds or thousands of mentions into actionable insights for enterprise teams.

Relationship fortification

Strengthen external validation signals such as press coverage, partnerships, and industry recognition to cement authority and trust.

Multi-platform diversification

Avoid over-reliance on any single AI platform by ensuring a consistent presence across all relevant generative search engines and vertical tools.

Innovation narrative

Publish thought leadership, new initiatives, and emerging category content to position your brand as the forward-looking, go-to authority on AI platforms for evolving trends.

This way, by combining proactive defense with continuous monitoring and actionable insights, enterprises can protect their AI search presence and scale.

Be the #1 answer on all AI engines

Want to see the impact of Birdeye on your business? Watch the Free Demo Now.

The competitive intelligence dashboard: Operationalizing ongoing monitoring

To maintain a competitive edge in AI search, multi-location enterprises need a centralized competitive intelligence tool and dashboard to track, analyze, and act on insights continuously. Below are the essential components your competitive intelligence dashboard should include.

- Weekly competitive scorecards: Automatically track mention frequency, sentiment shifts, and new competitor entries across priority queries to identify early momentum changes.

- Monthly market share analysis: Trend your AI impression share versus top competitors to understand shifts in visibility and pinpoint areas requiring strategic focus.

- Quarterly strategic reviews: Conduct deep-dive analyses to evaluate competitive positioning, assess emerging threats, and refine tactical priorities.

- Alert triggers: Set thresholds that flag significant competitor movements, such as sudden surges, new entrant dominance, or your brand’s displacement, enabling rapid response.

- Cross-functional intelligence sharing: Share AI insights across sales, product, marketing, and executive teams to inform broader enterprise strategies and ensure alignment.

- Predictive modeling: Leverage historical competitive data to forecast AI search dynamics and anticipate emerging opportunities, allowing proactive positioning before competitors act.

This approach turns competitive AI monitoring from a one‑time audit into an ongoing practice that treats AI answers as a live competitive channel, not a passive byproduct of SEO.

Birdeye Search AI: Powering competitive intelligence for multi-location brands

Birdeye Search AI is the generative engine optimization (GEO) platform that turns the competitive AI search intelligence frameworks described in this article into a real‑time system of record for multi‑location enterprises.

With Birdeye Search AI, enterprises can:

- Monitor AI citations, mentions, and sentiment across ChatGPT, Perplexity, Gemini, and other leading platforms from one unified dashboard.

- Measure your AI share of voice – how often your brand is cited compared to competitors across categories and locations – to quantify the frequency benchmarking described earlier.

- Conduct detailed competitive audits to identify which competitors dominate AI features such as knowledge panels, local packs, comparison blocks, and direct recommendations.

- Map location-specific AI visibility with geographic heatmaps to identify markets where your brand needs to strengthen its presence or can exploit competitor weaknesses.

- Analyze citation quality by assessing detail, accuracy, and sentiment to optimize your brand narrative and messaging for AI trust and preference.

- Track shifts in AI search dynamics over time with automated scorecards, alerting your teams to emerging threats, new entrants, or opportunity shifts.

By integrating competitive intelligence directly into day-to-day workflows, Birdeye Search AI becomes the intelligence layer enterprises need to defend AI visibility, reclaim lost citations, and build long-term authority in an increasingly competitive AI search ecosystem.

FAQs on competitive AI search intelligence

Competitive AI Search Intelligence focuses on which brands AI platforms mention and recommend, beyond just traditional keyword rankings, providing a more accurate view of AI-driven visibility.

AI share of voice shows how often your brand is cited by AI across locations and queries, helping identify where you lead or lag against competitors in AI-driven customer touchpoints.

By auditing category ownership, mention frequency, citation quality, feature triggers, and location-level AI presence using a unified AI competitive intelligence platform like Birdeye Search AI.

Review volume, recency, and quality impact AI’s trust signals and recommendation likelihood, influencing how often your brand is cited versus competitors.

Continuous monitoring with weekly or monthly scorecards and real-time alerts is essential to respond swiftly to changes in AI search dynamics and competitor movements.

Final thoughts

As AI answer engines become the primary discovery layer, traditional SEO alone is no longer enough. Multi-location enterprises must combine offensive and defensive strategies with continuous monitoring to secure and expand their visibility.

Structured dashboards and AI-powered platforms like Birdeye provide the operational backbone, enabling teams to turn intelligence into actionable strategies at scale. Staying proactive, consistent, and strategic ensures your brand remains the default citation across AI platforms, now and into the future. Book a demo now to get ahead in AI search.

Originally published