Starting a business in Australia is more than just filing paperwork; it’s the beginning of an adventure. Picture this: the excitement of becoming your own boss, shaping a bold business idea, and watching it grow into a successful business.

Sounds inspiring, right? But every dream comes with its hurdles. From choosing the proper business structure to meeting tax obligations, securing business funds, and building a strong marketing presence, the path can feel like a maze.

That’s exactly why this roadmap exists. It simplifies every first step, from validating your idea to registering your company, organising your business finances, and utilizing modern tools like Birdeye to accelerate growth.

So, where should you begin? Dig into your market: talk to your potential customers, size the demand, and sharpen your idea until it clearly solves a real problem. In this blog, we will walk you through every step of starting a business in Australia successfully.

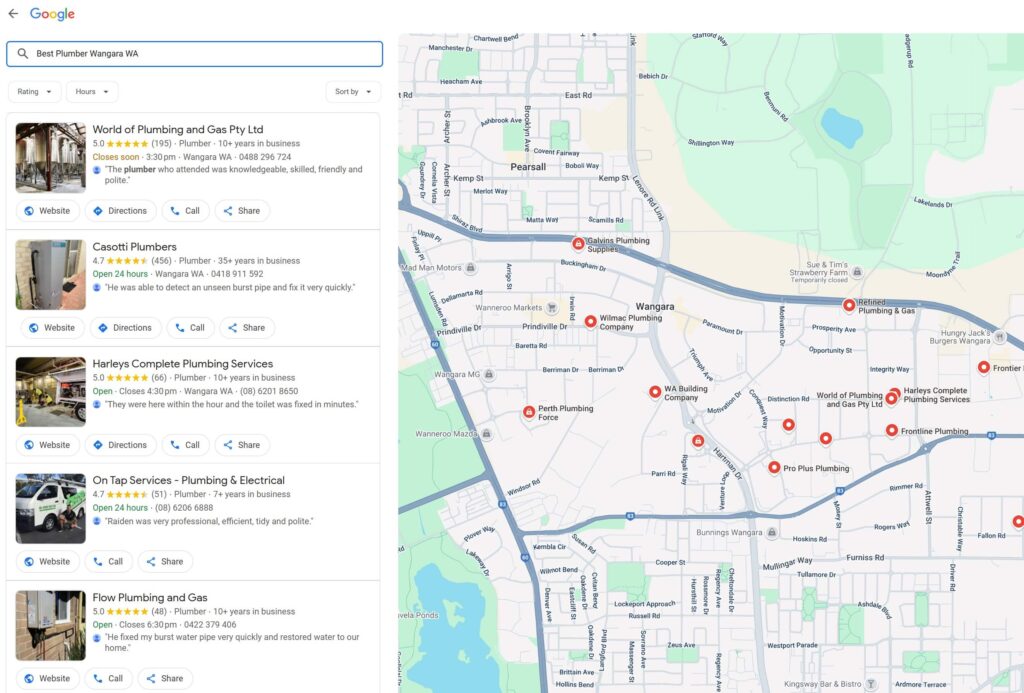

And here’s something every entrepreneur should know: growth today depends on trust. Customers no longer choose blindly. Whenever they look for a new restaurant, plumber, or product, the first step they take is reading reviews.

That’s why smart businesses are working harder to collect them. In fact, according to Birdeye’s 2025 State of Online Reviews, businesses sent 25% more review requests in 2024 compared to 2023. This is a clear sign that reputation, whether for big or small businesses, is now the fuel for long-term success.

Table of contents

10 Steps to start a business in Australia (2026)

Starting a business in Australia is a series of smart decisions. From a validated idea, a clear plan, the right setup, clean compliance, and a go-to-market that earns trust. Use this as your working playbook from spark to first sale (and beyond).

Step 1: Craft a business idea customers actually want

Goal: Move from assumption to evidence.

How to do it

- Map the problem: Write the customer’s experience/pain in one sentence (“I can’t get X done because Y.”) If it isn’t crystal clear, research again.

- Demand signals: Use Google Trends, Reddit, and industry forums to spot rising topics. Collect 10–20 questions customers ask in the market.

- Competitor gap scan: List five competitors and note price, promise, proof (reviews), and friction (delivery time, fees, returns). Highlight gaps you can own.

- Audience interviews: Speak with 8–12 prospective buyers. Ask what they currently pay, what they tried, what failed, and what “perfect” looks like.

- Pilot program: Launch a small example (limited features, limited audience, time-boxed) and measure response, conversion, and objections.

What to measure

- Problem clarity (can a stranger repeat it?)

- Willingness to pay (actual preorders > “sounds good”)

- Pilot conversion rate and top 3 objections

Quick Tip: Validation ≠ perfection. Seek direction, not consensus.

Step 2: Build a resilient business plan

Goal: Create a living plan that guides decisions and adapts to reality.

What to include

- Mission & vision: Why exist now, and where to be in 3 years.

- Business goals: 3–5 measurable goals (e.g., “$25k MRR in 12 months”).

- Business model: Product/service/online/hybrid; pricing and unit economics.

- Go-to-market: Channels, messaging, business marketing calendar, and conversion journey.

- Financials: Cash flow forecast, P&L projections, runway, and “what if” scenarios.

- Ops rhythm: Weekly metrics, monthly reviews, quarterly resets.

How to use it

- Review monthly; adapt based on signal (sales cycle, CAC/LTV, churn rates/returns).

- Tie spend to validated opportunities; pause nice-to-haves.

Plans may fail when they’re static. Schedule a recurring “assumption check” every 30 days. You can also create a one-page summary for lenders/investors and a detailed working plan for the team.

Step 3: Choose how the business will be set up

Goal: Align liability, tax, and growth with the right structure so you don’t redo it later.

Common setups

- Sole trader: Fast, low cost; personal liability; report profit in your return. Good for testing.

- Partnership: Shared control and profit; use a written partnership agreement covering roles, IP, and exits.

- Company (Pty Ltd): Separate legal entity with limited liability; register with ASIC, get ACN, and a Director ID. Best for growth and investment.

- Public company: For large-scale and public capital; heavier compliance.

- Trust (often with a corporate trustee): Useful for asset protection, income distribution, or holding IP.

Decision drivers (use these to narrow your choice)

- Risk tolerance: How much personal exposure can you accept? If low, consider a company or trust structure.

- Tax planning: What tax rate and distribution flexibility do you need? Companies have fixed rates; trusts allow distributions (with rules).

- Fundraising path: Will you seek investors or bank loans? Companies are cleaner for equity rounds and employee share plans.

- Ownership and control: Who holds voting power? How easy is it to add or remove owners? Companies make this simpler and clearer.

- Exit plans: Selling shares in a company is usually cleaner than selling a sole trader or partnership. Plan for the future you.

- Compliance appetite: Are you ready for director duties, ASIC filings, and formal accounts? If yes, a company structure supports scale.

Lock down IP early

Assign IP in employee/contractor agreements, register trade marks with IP Australia, and set licences if a separate entity holds IP.

Pro Tip: Spend on legal and accounting advice now to avoid costly restructures and ownership disputes later.

Step 4: Register correctly, from name to numbers

Goal: Make it official, protect the brand, and enable trading.

Key steps

- Name & brand checks: Search ASIC’s company register, IP Australia for trade mark, and domains/socials for consistency.

- ABN/TFN: Apply via the Australian Business Register (ABR) for an Australian Business Number (ABN) and a Tax File Number.

- ACN & officeholders: If a company obtains an ACN via ASIC, record company officeholders, principal place, and business address (plus trading address if different).

- Licences & permits: Confirm industry/state requirements on official government sites.

- Records: Keep copies of constitutions, written consent from directors/partners, and opening resolutions.

Quick Tip: Keep a single source-of-truth doc listing ABN, ACN, TFN, Director IDs, principal address, and licence details. Also, secure a domain and social handles the same day you file the name, before publicity.

Step 5: Understand tax obligations

Goal: Stay compliant from day one and avoid penalties that eat into your cash.

Think of taxes like road signs. Ignore them, and you’ll get fined. Read them early, and you’ll drive faster with confidence.

Start with the real questions

- What is your business structure? (Sole trader, partnership, company, trust)

- Will you cross the GST threshold this year?

- Will you hire staff or pay contractors?

- Which state or territory are you operating in?

Core obligations, explained

- Income tax: You pay based on your structure and profit. Companies pay at the company tax rate; sole traders report business income in their personal return.

- Goods and Services Tax (GST): Register for GST when your turnover is expected to exceed $75,000, and lodge your BAS monthly if your turnover is over $20 million quarterly, as per official ATO guidance

Pro Tip: Set aside GST as money you’re holding for the ATO, not revenue.

- PAYG withholding: If you hire staff or pay certain contractors, you must withhold and remit tax. Set up payroll software that calculates it correctly.

- Superannuation and payroll tax: Super applies to eligible employees. Payroll tax is state-based and kicks in once your wage bill crosses that state’s threshold.

- Record-keeping: Keep invoices, receipts, payroll reports, bank statements, and contracts organized and up-to-date. Use folders named by month, or better, an app that auto-files them.

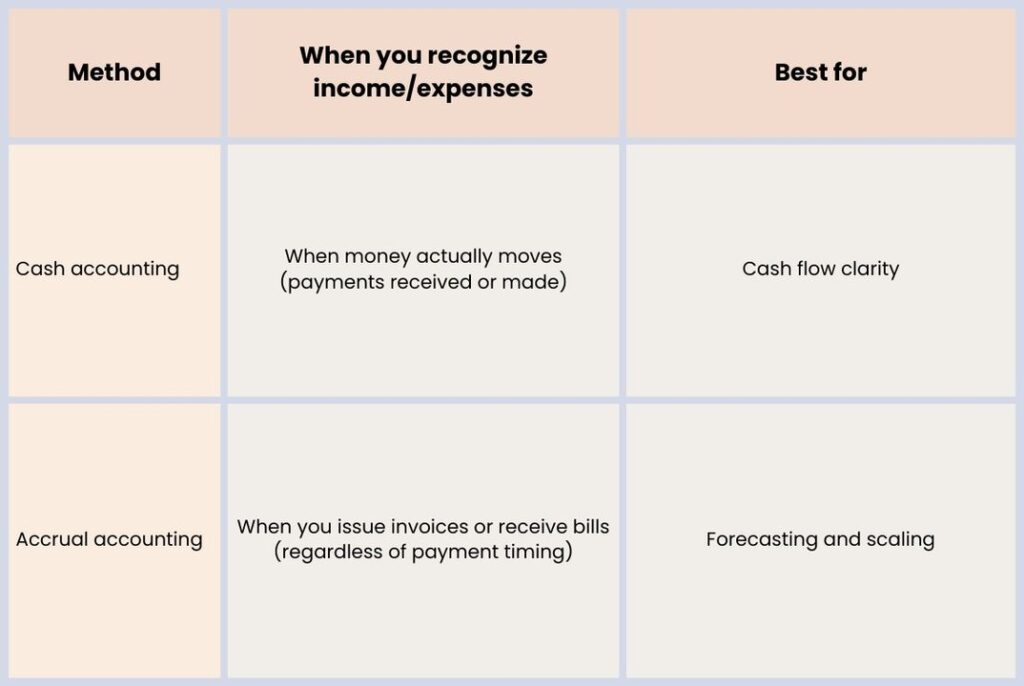

Cash vs. accrual: Choose on purpose

Choose the method that matches your growth plans and BAS obligations.

Mini tax checklist for Australian businesses

-ABN and TFN in place

-GST registration decision made

-BAS lodgement frequency set

-Payroll, PAYG, and super configured

-Bookkeeping system running from week one

A great tax accountant is a valuable asset. They help with forecasting, deductions, structures, and on-time lodgements, so you don’t learn the hard way.

Step 6: Build strong business finances

Goal: Separate money cleanly, see reality early, and fund growth without stress.

Treat your finances like a scoreboard. If it’s messy or delayed, you can’t coach the next play.

Lay the right foundations

- Dedicated accounts: Open a separate business bank account and a distinct payments stack (cards, payment gateways). This keeps personal spending out of business books.

- Chart of accounts: Tailor categories to your model. A service firm needs lines for billable labor and WIP; an eCommerce brand needs COGS and shipping.

- Tools that do the heavy lifting: Cloud accounting, automated bank feeds, receipt capture, and real-time dashboards. See yesterday’s spend and today’s cash at a glance.

- Controls that protect you: Two-to-approve for large payments, monthly bank reconciliations, and clear spending limits.

Cash discipline that helps your business in the long term

- Invoice fast: Send invoices the same day you deliver value. Add clear terms and late fees.

- Collect on time: Use automated reminders at 3, 7, and 14 days. Escalate with a friendly call before it becomes a problem.

- Know your runway: Model best, mid, and worst cases. Track burn rate monthly so surprises don’t sink you.

- Mind the gap: “Profitable” and “liquid” are different. You can show a profit and still run out of cash if customers pay late or inventory levels increase. Watch working capital: receivables, payables, and stock.

Pro Tip: If you plan to raise capital or secure a loan, prepare a clean data room that includes 12–24 months of financial statements, bank statements, major contracts, a current cap table, compliance documents, and key policies. Clean numbers build trust and speed up diligence.

Step 7: Secure funding and support

Goal: Choose the right capital at the right time so you can grow without losing control.

Options and fit

- Loans or overdrafts: Non-dilutive. You’ll need to demonstrate repayment capacity and often provide security.

- Equity: Dilutive. Best for high-growth plays where speed matters more than ownership.

- Crowdfunding: Combines capital with marketing. Requires a crisp story and strong social proof.

- Grants: Non-dilutive and competitive. Only apply when your project clearly matches the program’s goals.

How to execute

- Build a clear deck: problem, solution, traction, business model, team, and use of funds.

- Prepare a one-pager and a basic data room: financials, key legal docs, licences, and KPIs.

- Line up references: customers, advisors, and mentors who can vouch for results.

Pro Tip: Time your raise around traction peaks (pilot results, landmark partnership, or a marquee hire). Momentum improves terms.

Step 8: Hire employees and manage payroll

Goal: Add capacity without adding chaos.

Before hiring

- Define the role, outcomes, and 90-day success criteria.

- Draft compliant contracts and obtain written consents where required.

- Register for PAYG and superannuation, and decide your payroll cadence.

Set up

- Centralize employee records: IDs, right-to-work, addresses, tax details.

- Implement core policies: leave, conduct, privacy, and safety.

- Standardize onboarding: equipment, accounts, training plans, and KPIs.

Operate

- Run weekly 1:1s and monthly goal reviews with a simple feedback loop.

- Document responsibilities to reduce key-person risk.

- Hire for slope (learning and growth), not just current skills.

Step 9: Protect the operation with insurance

Goal: Transfer the risks that could cripple your business so one incident doesn’t derail growth.

Why it matters

If a customer slips in your store, a delivery damages property, a staff email triggers a data breach, or a flood shuts your doors for weeks, could you cover the costs and lost income? Insurance makes that survivable.

Core cover to consider

- Public & product liability: Covers third-party injury or property damage.

Example: A customer trips in your foyer, or a product you sell causes damage. - Professional indemnity (PI): Covers losses from advice or service errors; often mandatory for regulated professions. For example, a consulting mistake causes client loss, and they claim damages.

- Property & contents – Protects equipment, inventory, furniture, and fit-out against events like fire, theft, or storm. You can check that the sums insured match today’s replacement cost, not last year’s.

- Business interruption – Replaces lost income and helps pay ongoing costs while you recover from an insured event. You can choose an indemnity period long enough (often 12–24 months) to rebuild, restock, and win customers back.

- Cyber – Covers incident response, data restoration, ransom negotiations (where legal), liability, and PR support. Good policies include:

- 24/7 breach hotline

- Forensics

- Notification guidance

- Workers’ compensation: Mandatory if you employ staff; state-based rules and rates apply. Also, ensure that you register in the correct state/territory and keep your payroll data current.

Start strong. Scale your business across Australia.

Want to see the impact of Birdeye on your business? Watch the Free Demo Now.

Tune your policy like a pro

- Set smart deductibles (excess): Higher excess lowers premiums, balance it with your cash buffer.

- Check exclusions & endorsements: Ensure key activities, new products, and subcontractors are covered.

- Understand the claims basis: PI is often claims-made; confirm your retroactive date and keep run-off coverage if you change insurers.

- Match coverage to contracts: Many landlords and enterprise clients specify minimum limits to align before you sign.

Pro Tip: Keep an incident playbook: who to call, what to capture, how to communicate.

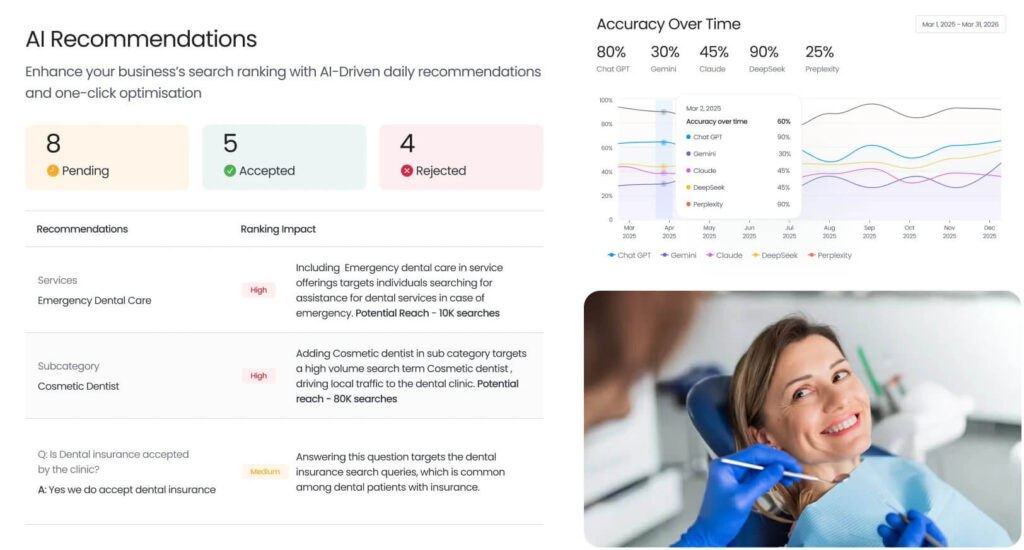

Step 10: Scale your business with the right tools like Birdeye

Goal: Be easy to find, easy to trust, and easy to contact at scale.

Why this matters now

- Discovery is AI-assisted; answers pull from listings, reviews, and public content.

- Trust is review-led; consistent, recent, detailed reviews drive selection.

- Conversion hinges on fast, accurate responses and clear address/contact details.

You’ve nailed the basics, now it’s time to accelerate. At this stage, three key decisions determine how fast you grow:

- How your brand shows up online

- How you turn happy customers into proof

- How do you convert interest into conversations

Birdeye helps you get the key things right while staying aligned with the law and day-to-day realities.

- Birdeye Listings AI: Show up everywhere, accurately.

Keep your contact details (business name, phone, hours, business address) accurate across major sites. Birdeye Listings AI helps you stay compliant with legal obligations (use your registered name, not just your own name, and respect trademark usage).

One quick example: Update holiday hours once in Birdeye, and it syncs across your profiles, reducing support friction and lost calls.

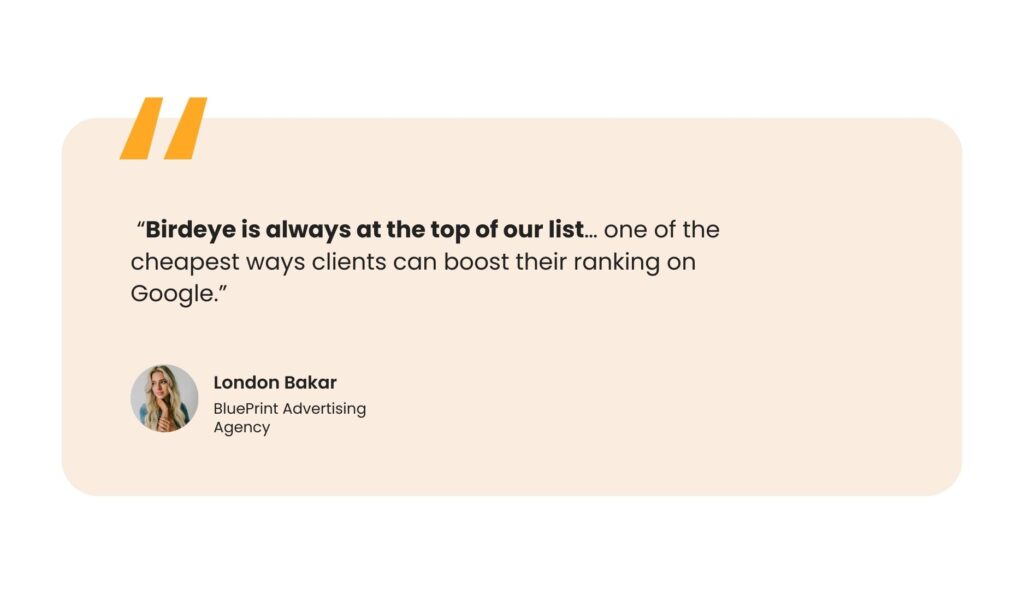

BluePrint Advertising Agency’s London Bakar says:

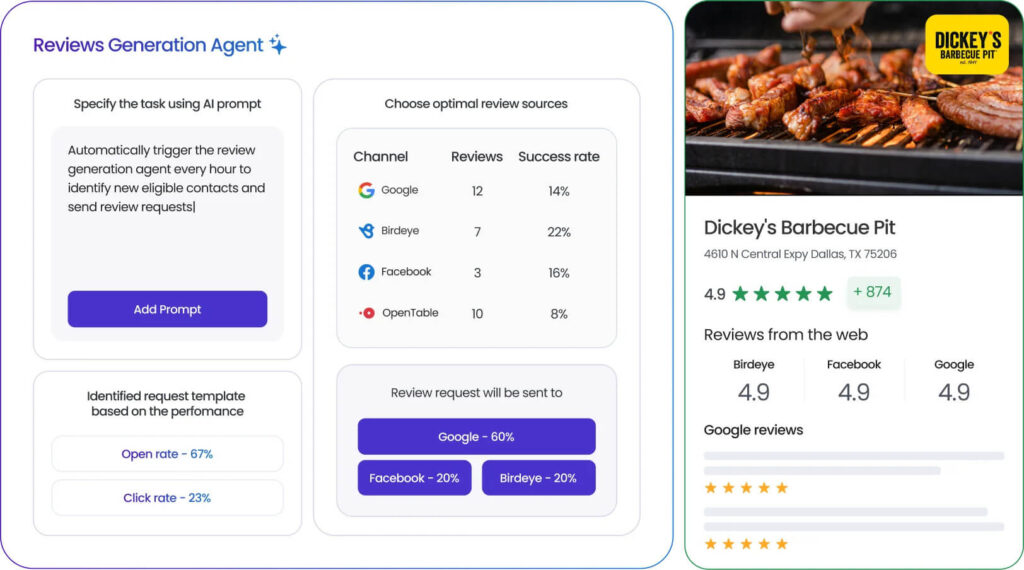

- Bideye Reviews AI – Turn great work into visible trust.

Automate review collection and responses with Birdeye Reviews AI so your reputation grows consistently. Also, Birdeye’s Review Generation Agent identifies satisfied customers and selects the optimal platform and message. It sends requests at the right time, automatically, with no manual work. Expect more quality reviews, quicker replies, and more substantial local rankings without extra ad spend.

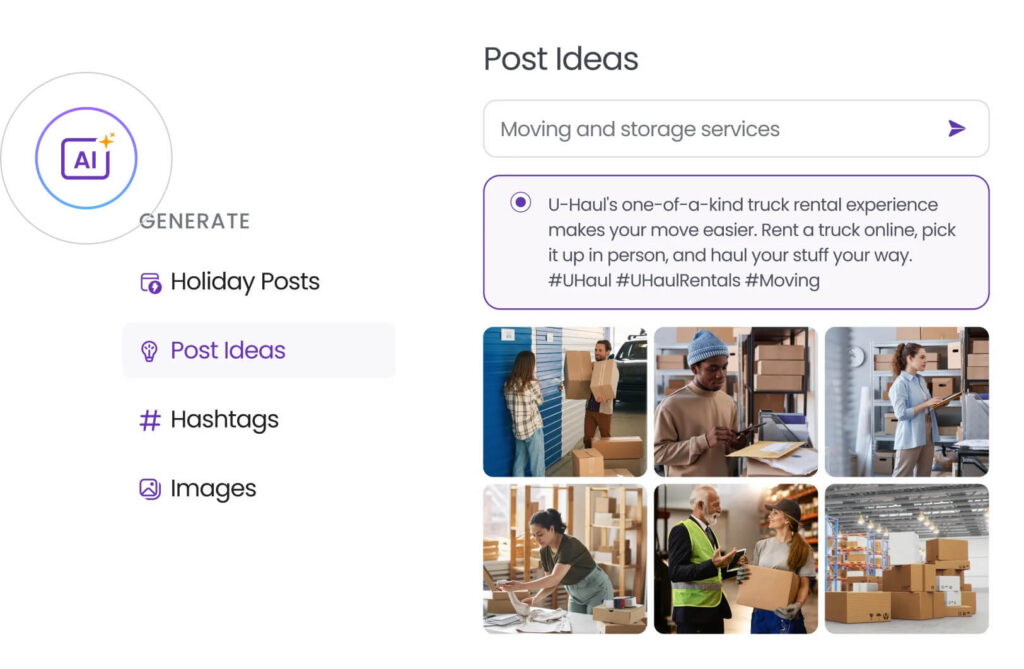

- Birdeye Social AI – Be consistently present.

With Birdeye Social AI, plan, schedule, and publish across channels so your business marketing stays on message, with no gaps when the team is overwhelmed. Amanda Nicholls, Office Manager at Stanton & Taylor Real Estate, shares her Birdeye experience:

“Unlike other programs that we have subscribed to in the past, Birdeye constantly touches base to support and make sure that we are using their program to its fullest potential. I also like that it covers a lot of the components of SEO for our business, such as keeping on top of reviews, keeping our listings consistent across the web, and making social media management simple. It’s a one-stop shop for managing the marketing side of our business.”

Amanda Nicholls, Office Manager, Stanton & Taylor Real Estate

Create engaging posts in minutes with Birdeye Social AI’s GenAI content generator. Use GenAI to craft industry-specific copy and tailor it to your audience. You can also get smart image recommendations that match your prompts so every post looks and reads on brand.

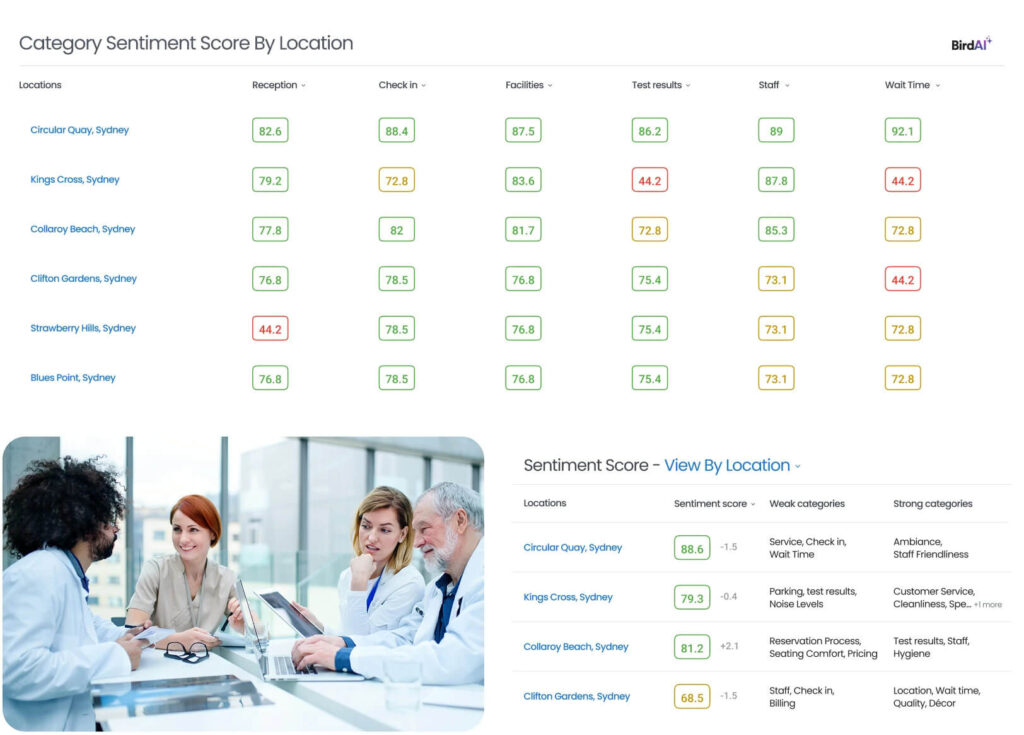

- Birdeye Insights AI – Know what to fix first.

Turn reviews and messages into prioritized actions. Birdeye Insights AI pinpoints what customers value, which is speed, service quality, and price. That clarity helps Australian businesses operate with focus and turn insight into measurable success.

Track sentiment, reputation management, and online presence with Birdeye Score and AI insights, then act on targeted recommendations across locations.

Keep your Australian Business Number ABN current in the Australian Business Register, and safeguard intellectual property with trademark checks so changes align with government rules and law. For example, flagging a region with slower response times and fixing it first.

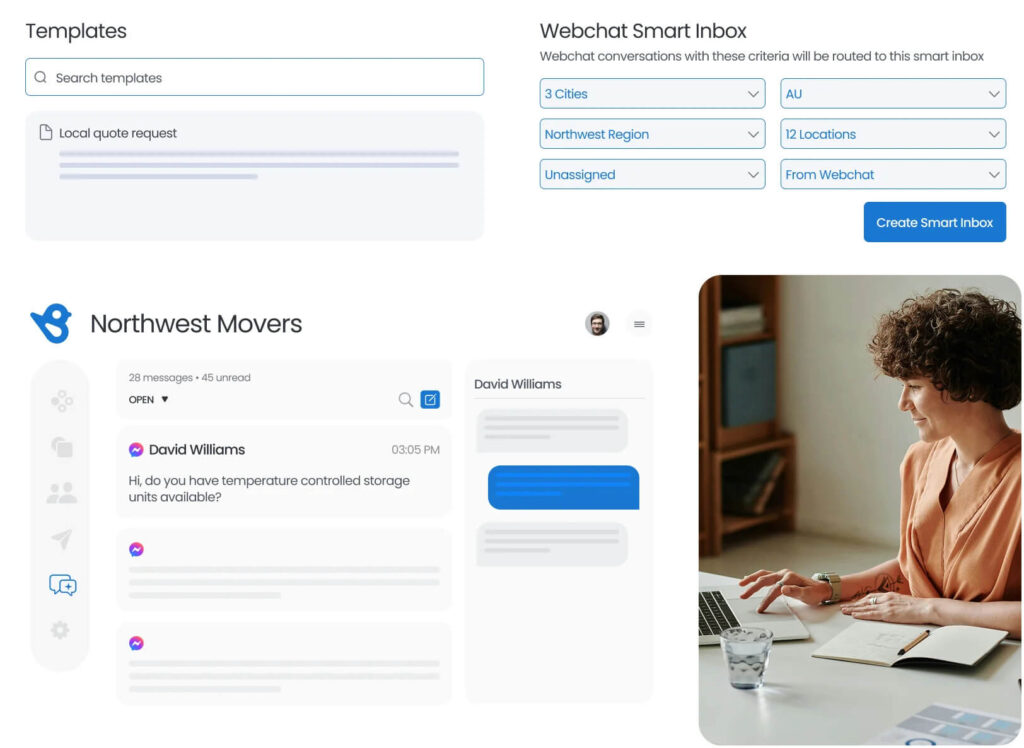

- Birdeye Chatbot AI – Capture leads 24/7.

With Birdeye Chatbot AI, Australian businesses can turn their website into a front desk that never sleeps. It answers FAQs, books appointments, and routes complex queries in real time, cutting response times and lifting conversions without adding headcount.

Manage every interaction from one AI inbox. Funnel, filter, and organise web chat by location, time, or conversation type, then use templates and GenAI-assisted replies to keep responses fast and consistent.

Pro Tip: Before you scale ad spend or accept new platform fees, run a quick audit: Are your contact details consistent? Are you asking for reviews after every job? If not, start there; those two moves often deliver the most significant lift with the least effort.

Case study: How Casotti Plumbers boosted inbound calls by 1066%

Brand

Casotti Plumbers is a Perth-based plumbing company serving residential, commercial, and maintenance needs.

Challenge

They needed to significantly lift local visibility, inbound call volume, and their presence in the digital marketing world. A lean team with limited time made consistent marketing and profile management difficult.

Results

- Inbound calls surged by 1066%.

- Website visits jumped 1049%.

- Direction requests climbed 991%.

- Google Business Profile views rose 990%.

Learn more about Birdeye and the Casotti Plumbers case study

The ultimate startup checklist

-Validate your business idea

-Draft your business plan

-Choose from different business structures

-Register your business (ABN, TFN, ACN, licences)

-Define your business address and principal place

-Manage your business finances and secure business funds

-Understand tax obligations and lodge tax returns

-Hire employees with proper insurance

-Safeguard assets with the right coverage

-Scale visibility with AI-powered platforms like Birdeye

FAQs about starting a business in Australia

The decision depends on the growth plan, risk tolerance, and compliance obligations. A sole trader is simple but lacks limited liability; a company is a separate legal entity with clearer risk separation; a partnership shares control and responsibility. Many owners seek advice from an accountant to align structure with tax, legal, and funding goals.

The registration process typically starts on ASIC’s portal to register your business name, followed by ABN and TFN applications, and an ACN if forming a company. Government resources outline steps, required documents, and fees. The responsible person must confirm details such as principal address and business contacts.

Typical costs include registration fees, licences and permits, insurance, basic software tools, marketing, and accounting setup. Ongoing costs often include bookkeeping, payroll, and compliance lodgments; engaging an accountant can help manage these expenses efficiently. Clear budgeting within the business plan reduces reliance on debt.

Key obligations include income tax, Goods and Services Tax (GST) when the turnover exceeds the threshold, PAYG withholding for staff, and on-time lodgement of BAS and tax returns. Good records help manage cash flow and avoid tax debt; professional advice is common for accuracy and planning.

Not every venture requires one, but many industries necessitate specific licenses or permits, each with its own fees and compliance obligations. Official resources list licence requirements by sector and location, helping an owner map the correct process during registration.

A practical plan, reliable support, and the right tools make a measurable difference. Many teams use platforms like Birdeye to automate reviews, manage engagement, and trim costs, while periodic advice from an accountant keeps compliance on track and decisions data-driven.

Conclusion: Your launchpad for success

Whether the goal is to start a business or formalize an existing one, long-term success comes from clarity, compliance, and consistent execution. Validate the market, select the model that suits (including a partnership if applicable), register with ASIC and the ABR, appoint the responsible person, confirm the principal address and any trading address, and establish the rules to operate with confidence.

Next smart moves

- Secure funding, insurance, and maintain clean records to prevent scaling from outpacing control.

- Make visibility compound with accurate listings, consistent addresses, and reviews that convert interest into action.

- Run a weekly improvement loop: read insights, refine the plan, and reallocate spend to what the market proves is working.

Do the fundamentals well, then let evidence from the market guide what to scale. That cadence helps small businesses compete, innovate, and grow through 2026 and beyond. Join Birdeye to scale with ease. Watch a demo.

Originally published

![[Feature image] Starting a business in Australia-the complete roadmap for 2025](https://birdeye.com/blog/wp-content/uploads/Feature-image-Starting-a-business-in-Australia-the-complete-roadmap-for-2025-1140x596.jpg)