Creating a business plan is one of the most important steps for any entrepreneur or established company in the UK. Without it, even the best business ideas can fail to attract investors or secure funding. The challenge? Many founders aren’t sure where to start, what data to include, and how to tailor their plan for banks or venture capitalists. Without this clarity, a business plan can easily become vague or poorly organised, which can stall growth and weaken credibility.

The good news is that you don’t have to start from scratch. By studying proven business plan examples in the UK, you can see exactly how successful companies showcase the components, strategies, financials, and formats in a way that wins the confidence of lenders, partners, and stakeholders. In this guide, you’ll see practical examples and free templates you can replicate for your own business.

Bottom line up front

A strong business plan doesn’t just win funding, it sets the pace for sustainable growth. By reviewing UK-specific examples, you’ll learn how to present your vision in a way that convinces investors, inspires teams, and scales operations.

Table of contents

- Components of the top business plans in the UK: What to include?

- How to write a business plan in UK: Top tips and strategies

- 9 business plan examples for the UK startups and companies

- Free business plan templates for your organization

- Conclusion

- FAQs on business plan examples UK

- Grow your UK business with Birdeye

Components of the top business plans in the UK: What to include?

A business plan is a standard document, and every investor, banker, or advisor in the UK would have some expectations about it. Here is what you should definitely include in your business plan:

- Executive Summary

- Company description

- Market analysis

- Products and services

- Marketing and sales plan

- Logistics and operations plan

- Management team

- Financial plan

Let us understand each of these components in detail.

Executive summary

This is the first impression of your business plan and should highlight your mission, key objectives, and business’s USP. Keep it short but persuasive, showing potential investors why your idea matters and how you plan to achieve success.

Company description

Here, you explain your company structure, industry focus, and long-term goals. It matters because it sets the context for your business model and helps readers quickly understand your positioning.

Market analysis

A detailed market analysis shows your deep understanding of the target market, buying habits, and indirect competitors. Present it using market research and industry reports to build credibility.

Products and services

Describe what you sell, how it solves customer problems, and why it stands out. Linking features with benefits ensures potential customers see clear value.

Marketing and sales plan

This section outlines your promotional strategy and sales forecast. Show how you’ll attract customers, cover objectives, and align marketing strategies with your target audience.

Logistics and operations plan

Explain how your business delivers products or services efficiently, including resources, supply chain, and working capital requirements. Investors want to see operational feasibility and associated costs.

Management team

Introduce your management team and highlight relevant experience, skills, and achievements. Strong leadership reassures lenders and investors that your business can stay focused on its goals.

Financial plan

The financial section contains financial forecasts, sales forecasts, break-even analysis, and long-term financial projections. Present numbers clearly with supporting documents so stakeholders can assess viability.

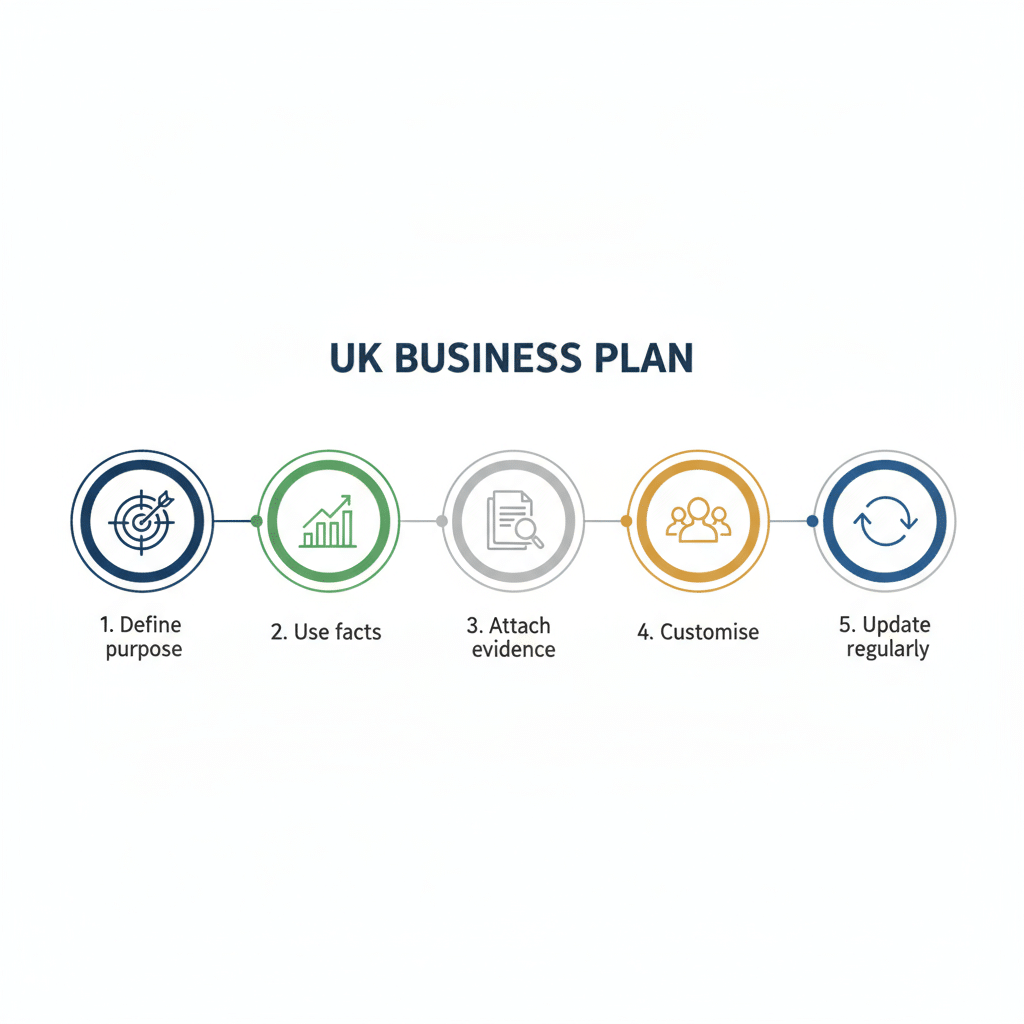

How to write a business plan in UK: Top tips and strategies

Crafting a business plan can feel overwhelming, especially if you’re writing one for the first time. Many entrepreneurs wonder whether the details truly matter, or if investors even read every page. The truth is, a strong business plan doesn’t just tick boxes for lenders, it tells the story of your business in a way that builds trust, clarifies direction, and keeps you accountable. Here’s how to make yours stand out.

Define the business plan’s purpose

Too many businesses start writing without knowing who they’re writing for. In the UK, a plan written for a Start Up Loans application looks very different from one meant for attracting venture capital. If you’re applying for government-backed funding, lenders expect detailed cash flow forecasts; investors, on the other hand, might want a sharp overview of growth potential.

Defining the purpose first (whether securing funding, guiding employees, or attracting partners) ensures your plan speaks the correct language and resonates with the right audience.

Stick to facts and reasonable predictions

Every investor or lender has seen business plans promising to “become the next Amazon.” Unrealistic claims instantly raise red flags. For instance, a café owner in Manchester predicting revenues based on “foot traffic alone” may raise eyebrows. Therefore, including local council demographic data or British Retail Consortium statistics makes the forecast credible.

Facts earn trust; inflated numbers raise doubts.

Attach supporting data and documents

Numbers on their own can feel abstract. But when paired with surveys, customer testimonials, or independent research, they become powerful proof.

Imagine presenting a retail expansion plan without proof of existing sales—it would struggle to pass the scrutiny of a NatWest or HSBC loan officer. By attaching evidence such as Companies House filings, market research from UK industry bodies, or pilot location results, you turn claims into evidence. This reassures funders that your plan is built on reality.

Take time to review and revise

Markets change, and so should your plan. A business plan written once and forgotten is like a GPS that never updates, it may send you down the wrong road.

The UK market, specifically, is shaped by constant change—think Brexit regulations, inflation, or new tax policies. A static business plan written two years ago might already be outdated. By regularly reviewing and updating, you can reflect new regulatory requirements or shifts in consumer behavior. This agility shows that your business is resilient and able to navigate uncertainties in the UK economy.

Showcase the team behind the business

At the end of the day, investors back people, not just ideas. A great business plan highlights the leadership team, their expertise, and their proven ability to deliver results. Picture a start-up led by former industry experts, the credibility of their background instantly strengthens the story the plan is trying to tell.

Highlighting UK-specific qualifications (like FCA registration for financial services or NHS partnerships for healthcare) strengthens credibility and helps funders trust your leadership.

Customise the business plan to the occasion

There is no one-size-fits-all business plan. A 50-page document may be perfect for a British Business Bank loan, but excessive for a private investor pitch. Similarly, a one-page executive summary might work well for angel investors in London but not for traditional bank financing.

Customizing your plan ensures it lands well with the intended audience, increasing the likelihood of approval or investment.

Competitor and market analysis

UK investors and lenders expect a business plan to demonstrate not just your idea, but also how it performs against the competition. A strong competitor and market analysis identifies the main players in your industry, highlights indirect competitors, and shows where your business has an advantage. This strengthens credibility and proves you’ve done the groundwork to understand market realities.

Take an example of a dental clinic in Manchester writing its business plan. Instead of simply stating that demand for cosmetic dentistry is rising, the clinic could better demonstrate demand or gaps in the market, such as patients often complaining about long wait times or limited services at competing practices.

This is where tools like Birdeye Competitors AI and Insights AI can give UK businesses an edge. Competitors AI benchmarks your performance against rivals, identifying gaps in customer experience and visibility.

Insights AI digs deeper into customer reviews and social media feeds, turning sentiment analysis into actionable insights. Together, they reveal what competitors are doing well, where they’re falling short, and how your business can position itself to win.

Including this level of competitor intelligence in your business plan writing shows funders that you’re not only aware of the market but also prepared to outperform it.

Now that we know what to include, let’s jump into exploring the different business plan examples that work best for the UK market.

9 business plan examples for the UK startups and companies

While it is universally accepted that a successful business starts with a strong business plan, it is critical to know that not any business plan would do for your organization. It needs to fit the purpose of drafting the plan, your audience, and many other such factors.

Here are a few business plan examples for UK businesses to refer and leverage accordingly.

Startup business plan

A startup business plan is a structured written document that outlines a new company’s mission, target market, business model, and financial forecasts. It’s used to prove that the business idea is viable and to persuade potential investors, lenders, or partners to provide funding or support.

In the UK, startup business plans are often required when applying for a Start Up Loan, pitching to angel investors, or entering accelerator programmes.

Key sections and points to cover

- Executive summary

- Problem and solution

- Market analysis and industry reports

- Business model and revenue streams

- Management team

- Financial projections (3–5 years)

- Funding requirements

Enterprise business plan

Large enterprises or franchises need multi-location operations plans that go beyond the basics. These plans typically cover multi-location operations, logistics, organizational structure, team details, financial management, and expansion strategies.

Enterprise business plans are usually created for private equity investors, corporate lenders, or strategic partners who need to see clear evidence of scalability, operational control, and long-term growth potential.

Key sections and points to cover

- Executive summary

- Company overview (history, size, legal structure)

- Market opportunity (with industry reports)

- Business model (multi-location or franchise)

- Management team and governance

- Growth and expansion strategy

- Operations and logistics

- Financial projections (5 years+)

- Investment requirements.

E-commerce business plan

An e-commerce business plan in the UK must focus on digital marketing, pricing strategy, and fulfillment. Since most online ventures aim for rapid growth, investors also look for scalability and tech readiness. This plan is useful when launching an online store, expanding digital operations, or seeking funding for online retail. It demonstrates how you’ll acquire customers, manage logistics, and handle compliance.

Key sections and points to cover

- Executive summary

- Target market and online buyer behaviour

- Products and pricing strategy

- Marketing and SEO plan

- Fulfilment and logistics (shipping, returns)

- Technology stack (platform, integrations)

- Sales forecast

- Funding required

One-page business plan

One-page plans provide a bird’s-eye view of the business, perfect for quick pitches. They highlight key objectives and first impressions. Use a one-page plan when pitching at events, networking with investors, or providing a quick snapshot to stakeholders. It’s best for early-stage ideas or when time is limited.

Key sections and points to cover

- Mission statement

- Target market

- USP and key objectives

- Business model in one line

- Sales goal

- Funding requirement

Comprehensive business plan

Comprehensive plans are detailed documents covering all sections: executive summary, market analysis, operations, and financial projections. These are often needed for bank or VC funding entering regulated industries like finance or healthcare. It gives a 360-degree view of the company.

Key sections and points to cover

- Executive summary

- Company description

- Market analysis with competitor benchmarking

- Products and services

- Marketing and promotional strategy

- Operations and logistics

- Management team

- SWOT analysis

- Financial projections (cash flow, P&L, balance sheet)

- Funding requirement

Internal business plan

An internal plan focuses on operations, resources, and employees rather than external funding. It helps keep the team aligned.

Key sections and points to cover

- Executive summary (internal objectives)

- Current performance overview

- Departmental goals

- Resources required

- KPIs and milestones

- Internal budget forecasts

Growth business plan

Growth plans are designed to attract funding for expansion, new markets, or franchising. They emphasise scaling strategies. Unlike a startup or small business plan, which proves initial viability, a growth plan builds on existing performance data. It highlights market opportunities, financial forecasts tied to expansion, and funding requirements for scaling.

UK investors and lenders expect to see how the business will manage resources, maintain profitability, and achieve long-term business goals while growing.

Key sections and points to cover

- Executive summary

- Current business performance

- Market opportunity for expansion

- Growth strategies (new locations, products, or partnerships)

- Financial projections tied to expansion

- Funding required

Feasibility study business plan

Feasibility plans determine if a business idea is worth pursuing. It helps analyse risks, costs, and potential returns before committing.

For best results, businesses should back every claim with market research, realistic financial projections, and supporting documents. Instead of only describing the business idea, show evidence of demand, highlight risks, and present a clear break-even analysis.

UK investors also expect a comparison with competitors, explaining why your model offers a better return or addresses unmet needs in the target market. Adding customer insights, pilot results, or review sentiment analysis strengthens credibility and proves that the opportunity is grounded in reality, not just theory.

Key sections and points to cover

- Executive summary

- Business idea description

- Market research findings

- SWOT and risk assessment

- Cost analysis and working capital needs

- Financial projections and break-even analysis

- Recommendation

Non-profit business plan

Charities and non-profits in the UK require plans showing mission-driven goals, funding sources, and compliance with charity law. Use a non-profit plan when applying for UK charity registration, seeking grants, or pitching to councils and donors. It focuses on mission impact rather than profit.

Key sections and points to cover

- Mission and vision

- Target audience (beneficiaries)

- Community needs analysis

- Programmes and services

- Fundraising strategy

- Management and governance

- Budget and funding sources

Free business plan templates for your organization

Here are ready-to-use templates that you can adapt for your business. Each form is structured to make filling in details easy, whether you’re a start-up, small business, or scaling enterprise in the UK.

1. One-page business plan template (quick fill)

Business name: __________________________

Mission statement (Why you exist): __________________________

Target market (Who you serve): __________________________

Unique selling proposition (What makes you different): __________________________

Products or services: __________________________

Sales and marketing strategy: __________________________

Sales goal (Year 1): __________________________

Funding required (if any): __________________________

2. Standard business plan template (bank-friendly)

Executive summary

- Business overview: __________________________

- Key objectives: __________________________

- Funding requirement: __________________________

Company description

- Legal structure: __________________________

- Location: __________________________

- Company history (if any): __________________________

- Mission & vision: __________________________

Market analysis

- Target customers: __________________________

- Market research findings: __________________________

- Competitors (direct + indirect): __________________________

- SWOT analysis: __________________________

Products and services

- Product/service descriptions: __________________________

- Pricing strategy: __________________________

- Business’s USP: __________________________

Marketing and sales plan

- Promotional strategy: __________________________

- Sales forecast (monthly/annual): __________________________

Logistics and operations

- Suppliers/partners: __________________________

- Resources required: __________________________

- Staffing and company structure: __________________________

Management team

- Key team members: __________________________

- Roles and responsibilities: __________________________

Financial plan

- Financial projections (3–5 years): __________________________

- Break even analysis: __________________________

- Associated costs: __________________________

- Working capital needs: __________________________

3. Growth business plan template (expansion-focused)

Current business performance

- Current revenue: __________________________

- Existing locations/customers: __________________________

Expansion opportunity

- New markets to enter: __________________________

- New products/services: __________________________

Growth strategies

- Marketing campaigns: __________________________

- Partnerships: __________________________

- Hiring plan: __________________________

Financials

- Projected revenue growth: __________________________

- Investment required: __________________________

- ROI for investors: __________________________

4. Non-profit business plan template

Mission statement: __________________________

Community needs addressed: __________________________

Beneficiaries (target audience): __________________________

Programs/services offered: __________________________

Fundraising strategy (grants, donors, sponsorships): __________________________

Governance (board, trustees, volunteers): __________________________

Budget overview: __________________________

Long-term goals: __________________________

Conclusion

A well-written business plan is more than a formality, it’s the backbone of your business’s growth journey. Whether you are a first-time founder or an established company in the UK, the right plan helps you secure investment, stay focused, and adapt to changes in the market.

The 9 business plan examples shared in this guide show you when to use each type and how to structure them, while the free templates give you practical forms you can start filling out today. Instead of struggling with a blank page, you now have a blueprint you can adapt to your own business idea, funding goals, or expansion strategy for your business.

The strongest business plans are not just written once; they are reviewed, updated, and refined as the business grows. With the examples, strategies, and templates in this blog, you can confidently create a plan that wins credibility with investors, guides your team, and sets a clear path toward long-term success.

FAQs on business plan examples UK

Yes. Most UK banks, including HSBC, Lloyds, and NatWest, require a detailed business plan with financial forecasts, sales projections, and a clear repayment strategy. A well-structured plan demonstrates financial management and reassures lenders that your company is viable.

Review and revise your plan at least once a year. Regular updates reflect changes in the regulatory environment, customer demand, or expansion into new markets. This keeps your strategy aligned and makes your business plan writing more effective.

A one-page plan works well for an elevator pitch or early-stage business idea validation. However, for funding or bank loans in the UK, a comprehensive written document with financial projections and supporting documents is recommended.

All industries benefit, but small business owners in retail, hospitality, healthcare, and technology often rely heavily on structured business plan examples in the UK to guide growth. Templates provide a clear framework to attract customers, manage resources, and achieve specific goals.

Grow your UK business with Birdeye

Writing a business plan is just the first step; turning it into measurable growth requires the right tools. That’s where Birdeye comes in. Trusted by thousands of UK businesses, Birdeye is an AI company that helps organizations manage reputation, attract customers, and grow faster across multiple locations.

With Birdeye, you can:

- Win more reviews: Automate review requests and manage them in one dashboard.

- Boost local visibility: Optimize your listings so customers easily find you on Google Maps and search.

- Engage customers at scale: Use GenAI-powered social media and messaging to attract and retain your target audience.

- Turn insights into action: Access AI-driven analytics on customer sentiment, location performance, and competitor trends.

Whether you’re a startup drafting your first business plan or an enterprise rolling out a growth strategy, Birdeye ensures your vision is backed by execution.

Ready to grow? Book a demo with Birdeye UK and see how your business plan can translate into tangible results.

Originally published