Managing a multi-location mortgage business in today’s fast-paced market requires juggling multiple priorities: client relationships, loan processing, compliance requirements, and team coordination. As your business expands across locations, these challenges escalate exponentially, demanding innovative solutions. That’s where Generative Artificial Intelligence (GenAI) comes into play.

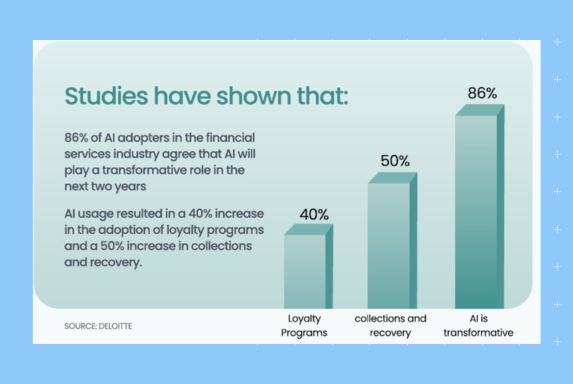

According to Deloitte studies, 86% of AI adopters in the financial services industry agree that AI will play a transformative role within the next two years. Notably, AI adoption has already yielded significant benefits, including a 40% increase in loyalty program adoption and a 50% improvement in collections and recovery.

Wondering how to effectively use AI in the mortgage industry for a competitive edge? Check out our detailed guide now for all the answers you seek.

Let’s explore how GenAI tools can transform your growing mortgage business into a more efficient, client-focused operation.

Table of contents

- Enhancing client experience with Artificial intelligence (AI)

- Operational efficiency through AI

- Stronger AI-powered marketing campaigns

- Data-driven decision making

- Bringing GenAI in the right way in mortgage

- Conclusion

- Frequently asked questions on AI in mortgage industries

- Delivering excellence in your mortgage business with Birdeye’s GenAI solutions

Enhancing client experience with Artificial intelligence (AI)

In the competitive mortgage industry, client experience is a make-or-break differentiator. Implementing GenAI in the mortgage industry helps bridge the gap between client expectations and service delivery by automating and personalizing mortgage solutions at scale to elevate the overall experience.

“We launched bots to help with the appraisal process and document setup. We also empower loan officers with Birdeye’s AI tools to respond to reviews and streamline communications. It helps us create content better and more quickly on the marketing side. We use AI as a thought partner to create content that engages and wins over new businesses.”

Erica Goodwin, Senior Vice President – Marketing, First Heritage Mortgage

Streamlined application and mortgage lending process

Mortgage agents often face resistance from clients during application processing, document collection, and other administrative tasks. These additional processes can be daunting for homebuyers already overwhelmed by document management. Decreased engagement at this critical stage can have negative consequences for the mortgage business.

GenAI solutions can step in and transform this notoriously complex experience by:

- Creating interactive, step-by-step application guides tailored to each client’s situation

- Automatically extracting and validating information from supporting documents

- Identifying missing or incorrect information before submission

- Reducing processing times from weeks to days through AI-led preliminary assessments

- Providing real-time status updates to keep clients informed

Automation at this stage accelerates the process significantly, reduces errors, and improves client satisfaction rates.

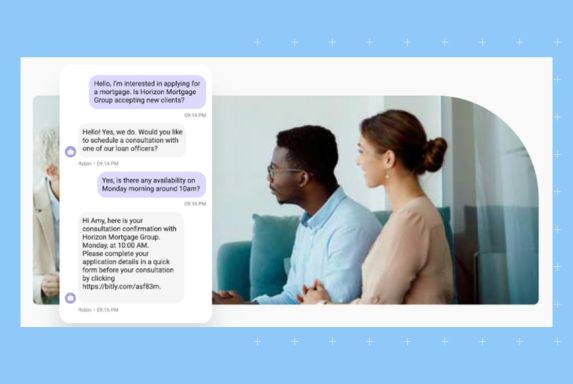

Intelligent AI chatbots

Mortgage lenders, especially agents are constantly torn between answering routine questions vs. diving into interpersonal relationships to improve client experience. First-time homebuyers often have countless questions, but having agents 24/7 isn’t always a feasible or sustainable solution. Modern mortgage clients expect instant responses and round-the-clock support. GenAI chatbots deliver this without straining resources by:

- Providing immediate responses to common mortgage queries

- Offering step-by-step guidance through complex application processes

- Sending automated updates on application status

- Supporting multiple languages for diverse clients

Personalized loan recommendations

Every borrower’s financial situation is unique, requiring tailored solutions. Businesses that move beyond one-size-fits-all approaches become the top choice for home buyers and realtors alike. However, most mortgage businesses struggle to execute personalized mortgage solutions at scale due to the immense workload it brings.

GenAI addresses this challenge by analyzing multiple factors, including financial profiles, income patterns, market conditions, and historical cases, to quickly provide mortgage solutions and other financing options.

Operational efficiency through AI

Typically, mortgage businesses operate as follows: connecting with prospects and collecting, processing, and managing documents daily for multiple clients. This document-heavy mortgage process is ripe for automation.

Manual processing is error-prone and can significantly prolong the overall processing time, ultimately impacting client experience.

“When customers enter our system, they’re mapped to our CRM systems to automate responses at various intervals in their journey. This includes giving them tips and tricks, notifying them of what’s coming, and telling them what they must look forward to in the loan process.”

Ericka Smith, VP- Sales and marketing optimization, Waterstone Mortgage

On the other hand, working with AI in mortgage processing can prove to be a significant asset in improving the overall operational efficiency of your mortgage business. Here is how it works.

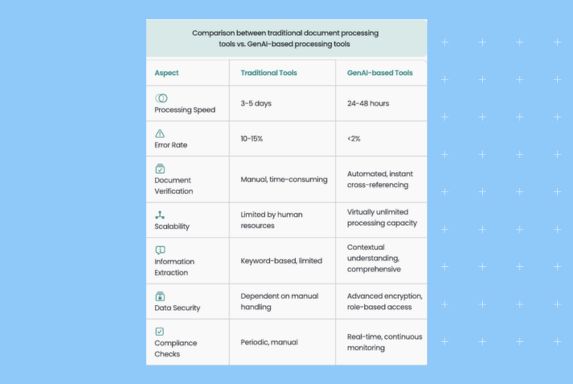

Automated document processing

Rather than relying on your agents or admin staff to be buried in documents and routine tasks, automate the processes with GenAI tools for faster and more accurate results. This also frees up your team to focus on complex queries that can elevate the brand and overall client experience.

GenAI solutions can automate document processing and help mortgage businesses:

- Reduce processing time from 3-5 days to 24-48 hours

- Achieve over 98% accuracy in data extraction

- Automatically validate information across multiple sources

- Pre-screen applications for potential issues

- Maintain consistent processing standards across locations

- Flag discrepancies for human review

- Generate automated document summaries for analysis and quicker action

Risk assessment and underwriting aid for mortgage lenders

How well your mortgage business anticipates risk and processes claims significantly impacts the bottom line. However, it can be a challenge to manage risk and streamline underwriting as they require immense mortgage industry expertise, time, and an eye for detail.

AI driven solutions can help you bring intelligence to this process and avoid any possible errors by:

- Analyzing vast amounts of financial data in seconds

- Identifying concerning patterns early in the process

- Reducing human bias in decision-making

- Setup processes to identify potential risks across locations

Fraud detection

Choosing the right clients and the ability to identify any fraud quickly secures the mortgage operation. However, details can slip out when your agents process multiple applications, especially for a multi-location operation. That is where using AI in mortgage processing comes in handy.

GenAI’s advanced fraud detection capabilities equip mortgage companies with:

- Real-time suspicious pattern detection

- Multi-source data cross-referencing

- Early fraud attempt identification

- Automated red flag alerts

- Historical pattern analysis

Compliance monitoring for the mortgage industry

Mortgage lenders are responsible for complying with NAR regulations, conveying to clients what steps they take for compliance, and actively setting up systems that prevent non-compliance.

In such a strict regulatory environment, multi-location mortgage businesses require GenAI solutions to step in by:

- Automatically tracking regulatory changes

- Flagging potential compliance issues in real-time

- Conducting regular automated audits

- Documenting compliance procedures

- Generating compliance reports

- Maintaining consistent standards across locations to ensure strict regulatory compliance

Stronger AI-powered marketing campaigns

The mortgage industry is highly competitive, and most agents are vying for the same home buyers and realtor connections. More often than not, how you position and promote your mortgage business determines the success of your lead generation campaigns.

GenAI can help mortgage businesses develop tailored marketing campaigns, monitor and manage online reputation, and help rank higher on local searches across multiple locations.

“We track our competitors very closely, especially locally, to see what individual loan officers are being ranked for and what consumer or referral partner sentiment is regarding their products and process.”

Erica Goodwin, Senior Vice President – Marketing, First Heritage Mortgage

Customer segmentation

A strong marketing campaign begins with a precise definition of the target customer base. Mortgage businesses that have a strong customer segmentation process can tailor campaigns, choose the right platforms, and allocate resources effectively.

Understand your market and optimize your business for growth with GenAI solutions by:

- Analyzing behavioral patterns across channels

- Identifying high-value customer segments

- Spotting emerging market opportunities

- Tracking engagement patterns

- Mapping customer journeys

Personalized marketing strategies

Marketing campaigns are significantly more successful if the message directly reaches out to customers and addresses their problems. However, large multi-location mortgage businesses handle a diverse group of customers, and personalizing campaigns for each set can be challenging and tiring.

GenAI tools can help you understand different client demographics, tailor campaigns, and seek better results.

“When customers enter our system, they’re mapped to our CRM systems to automate responses at various intervals in their journey. This can include giving them tips and tricks to help them along, notifying them of what’s coming, and telling them what they have to look forward to in the loan process.”

Ericka Smith, VP- Sales and marketing optimization, Waterstone Mortgage

Scale your marketing personalization efforts effectively with GenAI in the following ways:

- Create dynamic content for multiple channels

- Optimize campaign timing and channel selection

- Predict engagement likelihood

- Automate campaign adjustments

Rank higher in local searches

Performing well in local searches can significantly impact your business, generating a higher volume of leads, building a stronger local brand, and fostering trust. However, optimizing listings across multiple platforms and locations can be a cumbersome and error-prone process.

GenAI solutions can simplify this task, enabling mortgage businesses to create, manage, and monitor multiple listings with just a single click.

With GenAI solutions like Birdeye, businesses can boost local search rankings by:

- Optimizing local search rankings

- Managing online reviews effectively

- Maintaining consistent business listings

- Tracking competitor positions

- Identifying high-performing keywords

- Generating location-specific content

- Monitoring local market trends

Data-driven decision making

AI solutions not only solve administrative and operational challenges but also set your business on the path of excellence. With GenAI solutions, you can extract keen insights from the vast amounts of data collected at every customer interaction. This data helps you make the right decisions, invest smarter, and tailor strategies to improve client experience.

“We integrate the review management tool with our CRM and LOS so that customers and agents immediately get that link that says, “Hey, if you had a good experience, please leave us a review” on a platform they choose. We love that they can leave the review directly on the platform rather than through an intermediary; it boosts SEO and makes it much more credible. We also follow up via text and automate responses based on the review’s sentiment.”

Erica Goodwin, Senior Vice President – Marketing, First Heritage Mortgage

Predictive analytics for lending

Wondering how to set yourself apart in a competitive market? How about diving into the market trends and understanding what your clients would need in the coming months, even before they tell you? Yes, that is possible with GenAI tools that analyze large volumes of data and unearth trends to help you make smarter lending decisions.

Here are some ways GenAI tools can strengthen your mortgage business:

- Borrower repayment probability

- Default risk assessment

- Interest rate trend analysis

- Refinancing opportunity identification

- Market demand forecasting

- Portfolio risk management

- Economic indicator impacts

Market trend forecasting

Knowing what lies ahead in the mortgage market helps you plan for resources, marketing campaigns, and lending decisions. However, tracking market trends across multiple locations can be challenging and require specialized solutions.

GenAI tools can help you stay ahead of the competition with insights that:

- Predicts market shifts

- Identifies emerging opportunities

- Optimizes product offerings

- Tracks seasonal patterns

- Monitors competitive landscape

- Analyzes economic indicators

- Provides actionable recommendations

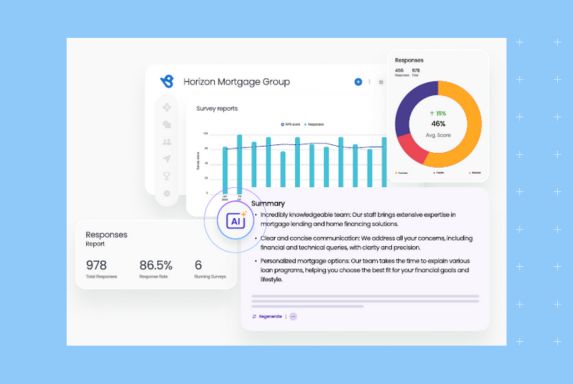

Feedback analysis for improved operations

Customer feedback contains a wealth of information. However, for a multi-location mortgage business, this data is spread across multiple channels—reviews, social media, text messaging, and surveys. This makes it challenging to accurately predict trends and customer requirements.

GenAI solutions can help businesses manage large volumes of customer feedback across multiple channels and locations with a single click.

With GenAI-driven feedback analysis, your mortgage business can:

- Analyze sentiment across channels

- Identify common pain points

- Track satisfaction trends

- Measure improvement impacts

- Generate automated insights

- Monitor location-specific feedback

- Create action plans based on data

“Birdeye has integrations with our loan origination system. So, we’re automating surveys that we send out to our customers and sending review requests based on data points in the loan process. It gives our loan officers and people time to focus on personal touches and make personal connections.”

Ericka Smith, VP- Sales and marketing optimization, Waterstone Mortgage

AI-powered reputation management

Your reputation determines how many clients choose you over your competition. It also significantly affects search visibility, social media growth, conversion rates, and brand awareness. Such a critical task requires a sophisticated AI tool that can cater to your unique industry needs while simplifying reputation management across locations.

Businesses must ensure a stronger brand positioning by using reputation management tools with:

- Automated review response management

- Sentiment analysis across platforms

- Real-time reputation monitoring

- Competitor benchmarking

- Performance tracking by location

- Improvement recommendations

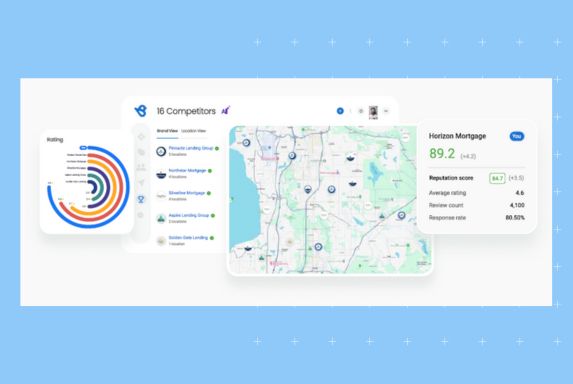

Competitive differentiation

“We track our competitors very closely, especially locally, to see what individual loan officers are being ranked for and what consumer or referral partner sentiment is regarding their products and process.”

Erica Goodwin, Senior Vice President – Marketing, First Heritage Mortgage

Every locality has a handful of players vying for client attention, trying to outsmart each other at every turn. Mortgage is a location-specific game, and any advantage you can get over your competition sets you on the path to success and consistent growth. Your business must tailor local strategies while ensuring that the goals align with the global brand.

Simplify competitor management with GenAI tools that help you:

- Track competitor activities

- Identify market gaps

- Monitor performance metrics

- Spot growth opportunities

- Analyze competitive strengths

- Develop unique value propositions

- Track market share changes

GenAI-driven competitor analysis tools ensure you know what your competitor is doing without spending hours on their website or social media profiles. Get the data you need at your fingertips.

Bringing GenAI in the right way in mortgage

GenAI tools have transitioned from good-to-have to a must-have solution for every mortgage business. These solutions bring order to the administrative chaos, streamline processing, improve client experience, and provide unmatched insights to outshine competitors. However, implementing GenAI is not as easy as it sounds.

Businesses must ensure they implement GenAI in their organizations while maintaining industry ethics, compliance regulations, and human oversight so that the tools are durable.

“AI is to transform the way we work completely. Companies who use AI and embrace AI tools to solve a business problem and approach it the right way will replace those who do not embrace AI.”

Erica Goodwin, Senior Vice President – Marketing, First Heritage Mortgage

Data privacy and security

Mortgage businesses must ensure that their GenAI tools do not compromise data privacy and security, especially for sensitive financial and personal information. Work with tools that allow:

- End-to-end encryption protocols

- Role-based access controls

- Transparent data handling

- Compliance monitoring

- Data retention policies

- Regular security audits

Building provisions for human oversight and intervention

“While AI and automation are helpful, the personal touch is still number one. Loan officers’ relationships with borrowers and realtors are paramount, so automation supports rather than replaces those interactions.”

Erica Goodwin, Senior Vice President – Marketing, First Heritage Mortgage

While GenAI solutions bring automation and intelligence to the business, the AI algorithm is limited by their training sets and risk introducing bias into the system. That is why it is essential that while you allow GenAI to supplement the human loan officers’ work, you build provisions that allow human agent intervention and supervision.

The GenAI solution must allow for:

- Clear escalation protocols

- Regular human review of AI decisions

- Decision override capabilities

- Quality assurance checks

- Documentation of decision criteria

- Regular equity audits

Conclusion

The mortgage industry is at a turning point, with GenAI leading the transformation. For multi-location mortgage lenders, embracing AI isn’t just about keeping up – it’s about setting new standards in client service, operational efficiency, and industry stakeholder involvement, and leadership. By implementing AI solutions strategically across operations, marketing, and customer service, your business can achieve remarkable results while maintaining ethical standards and the essential human touch that clients value.

Frequently asked questions on AI in mortgage industries

AI automates document verification and customer data extraction, reducing processing time while improving accuracy.

AI systems detect suspicious patterns and cross-reference customer data in real time, reducing fraud attempts.

AI analyzes financial data to identify potential risks and make consistent, unbiased lending decisions, reducing underwriting time significantly.

AI provides 24/7 support through chatbots, automates routine queries, and enables personalized communication, improving customer satisfaction.

Modern AI systems are designed with built-in compliance monitoring and can automatically adapt to regulatory changes while maintaining audit trails.

Delivering excellence in your mortgage business with Birdeye’s GenAI solutions

Mortgage businesses can become the price choice for every realtor and home buyer by integrating Birdeye’s GenAI solutions into their business process. Take your business to the next level with Birdeye products that:

- Streamline communication with Message AI: Centrally manage messages across multiple channels with AI responses, communication analysis, and multi-language support to ensure customer satisfaction

- Supercharge reputation management with Reviews AI and Listings AI: Automate review and listing management and leverage AI for responses, insights, and business descriptions

- Dominate markets with Competitors AI: Understand local competitors, conduct local and global SWOT analysis, benchmark performance, and generate recommendations to outshine at every stage

- Make data-driven decisions with Insights AI: Generate smart insights from reviews, local search performance, social media analysis, and feedback analysis.

Transform your mortgage business with Birdeye’s GenAI solutions – where innovation meets excellence in financial services. Watch a free demo to learn more.

Originally published