Every business owner is on the lookout for growth opportunities and a strategy that allows them to increase market control. Integrations are one of the most tried and tested strategies in this regard.

But it is definitely not a one size fits all solution by any means. Every business needs to weigh horizontal vs vertical integration and make the right decision for best results.

In this blog, we’ll investigate horizontal vs. vertical integration strategies to understand what is more beneficial for your business.

Table of contents

The only all-in-one platform that integrates with 3000+ software systems.

Want to see the impact of Birdeye on your business? Watch the Free Demo Now.

What is horizontal integration?

Horizontal integration is when a company acquires its competitors or other companies in the same industry to increase market share and reduce competition.

By owning more of the market, your company can tap into different aspects of production and supply chains. This type of strategy allows you to control costs through centralization and create more efficient operations.

What are the pros and cons of horizontal integration?

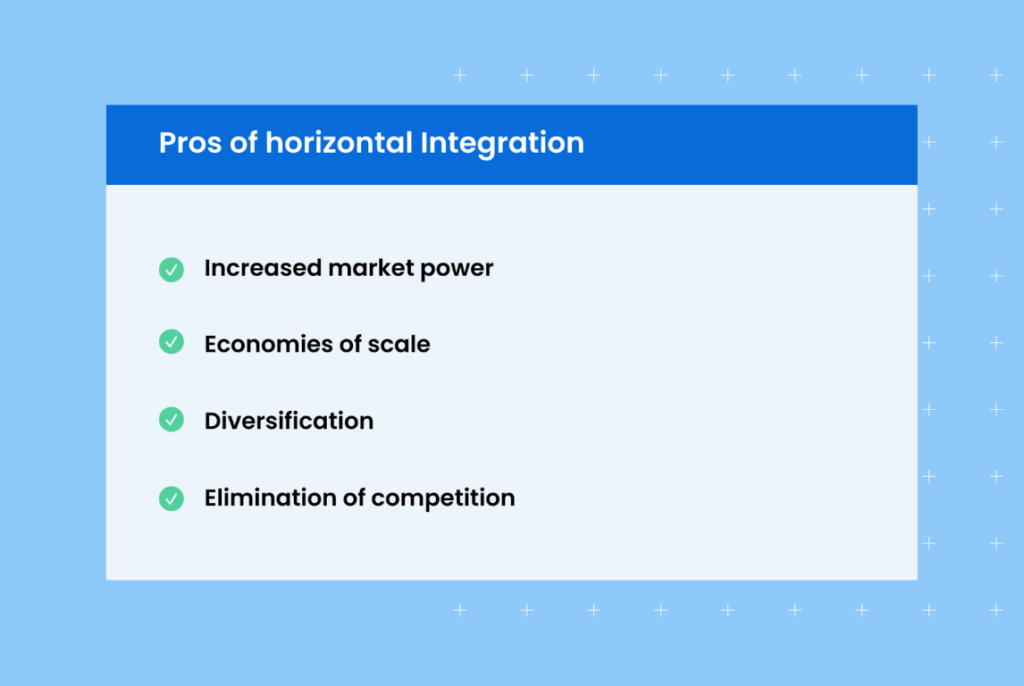

Horizontal integration is a common business strategy because it can strengthen your market power while reducing production costs. However, there are genuine risks, like difficulties with integration and losing your focus as a team. Here are a few more pros and cons to consider.

Pros of horizontal integration

- Increased market power

You may have heard “market power” referred to as “pricing power.” Pricing power is the ability of a company to affect the price of its products in the marketplace. If your company faces intense competition, you are what is known as a “price-taker.”

If you expand your company through horizontal integration, your increased size may give you the power to manipulate your prices. Long-term price increases of 2% to 4% can translate into an increase in profit of 15% to 25%, according to global consulting firm McKinsey & Company.

- Economies of scale

If you become a larger company using a horizontal integration strategy, you’ll likely be able to produce more units of your smokeless fire pits, robotic floor mops, or whatever it is that you make. This is because you’ll control more of the operation helping you reduce costs to make a unit of your product. If you make more units and it costs less to produce them, you’ll increase your margins and increase profits.

- Diversification

Diversification of products is a good thing. Say you are producing a security camera that resembles a light bulb. Your customer base begins to demand a more subtle approach, fearing that an intruder may recognize the light bulb as a camera and smash it.

If you have merged with a company that produces a device that looks like a doorbell, you can begin to diversify your product line with the new product. This will give your customers more options to choose from and increase sales since you are now able to meet different customer needs.

- Elimination of competition

“I will eliminate my competition” sounds like something The Borg of Star Trek would robotically repeat as they set about their destructive missions. However, companies, particularly giant companies, use horizontal integration to remove their competition. For example, Snapple, the tea and juice drink company, acquired Motts which is known for its apple juice to reduce competition and maintain their market share.

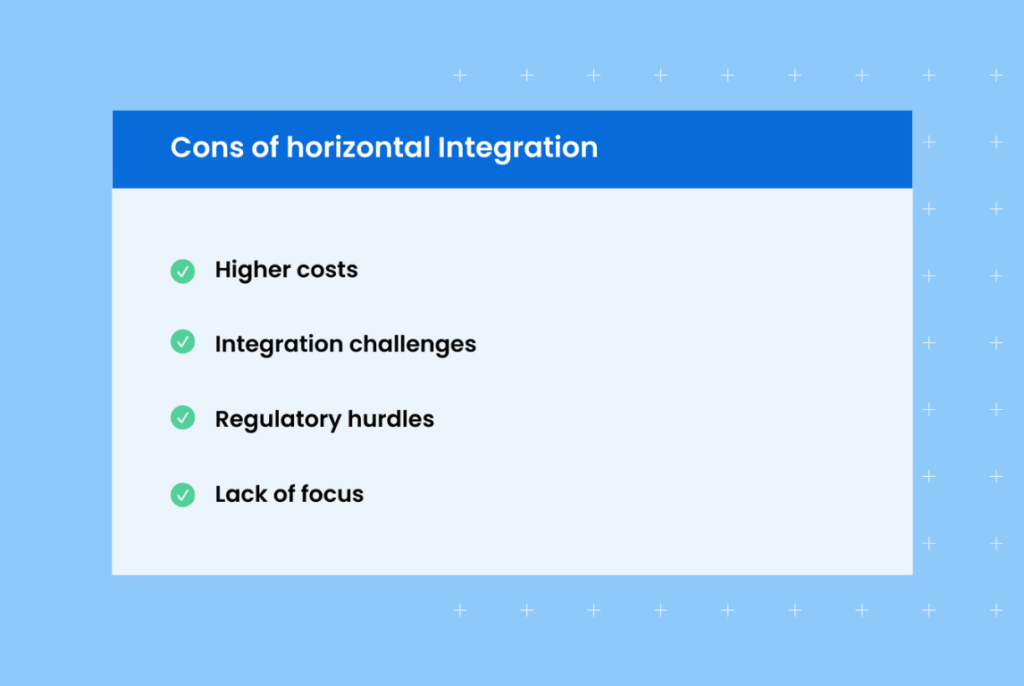

Cons of horizontal integration

- Higher costs: Acquiring another business, or merging two businesses can be very costly. In addition to the cost of purchasing a company, there may also be additional costs associated with integrating the new business into your existing operations like training, IT infrastructure upgrades, etc.

- Integration challenges: Merging two businesses into one is often a challenging process. There are typically many different processes, systems, and people to integrate. This can be difficult to manage and costly if not done properly. For example, let’s say you run a retail business and you purchase an e-commerce company. Integrating the online store into your existing operations may require significant changes to both systems.

- Regulatory hurdles: In 2014, Comcast Corporation wanted to buy Time Warner Cable. Both companies supported the sale. The American government shut the deal down by threatening to sue both companies under antitrust legislation. The government does not usually prevent small and mid-sized businesses like yours from integrating. However, you should be aware of other common hurdles, like state and federal rules, which can make integration more difficult.

- Lack of focus: We know that horizontal integration can result in product diversification, less direct competition, economies of scale, and increased market power. However, successfully merging or acquiring another company requires your full attention so that the integration runs smoothly. This means less time to focus on other aspects of the business, such as marketing or product development. This lack of focus could have a negative effect on the long-term success of your business.

What are the different types of horizontal integration strategies?

Horizontal integration can take a few different forms. Here are the most popular strategies.

- Merger

A merger is when two distinct companies agree to become one company. The duo that comes together typically has lots in common, such as target customers, similar products and services, or the same goals. They also usually have similar levels of financial stability, expertise, and resources. In a merger situation, both companies bring something valuable to the table, but no one company owns the other.

- Acquisition

An acquisition is when one company buys most of the shares or assets of another company, and both companies survive. Acquisitions can be friendly or hostile. When the dust settles, the parent company controls the purchased company, with the same primary goals that underlie a merger.

An example of a hostile takeover is when Kraft Foods Inc. bought Cadbury PLC, paying $19.6 billion for the company in 2010. The deal was so controversial that it spurred the British government to change its rules around foreign companies buying British.

- Joint Venture

When two companies have a mutual goal or project, they may pool their resources to achieve said goal while remaining distinct companies. For example, Mercedes and Volvo created a joint venture to create charging stations for electric vehicles. Uber and Volvo came together to build self-driving cars.

Examples of horizontal integrations

Let’s reinforce our understanding of horizontal integrations by considering a few examples that have affected mainstream culture.

Disney’s acquisition of Pixar

In 2006, Disney bought Pixar. It was, and is a big deal. Bob Iger, Disney’s CEO, famously describes this acquisition as “his proudest decision.” Pixar was sailing high when Disney purchased it. Its hit Toy Story established it as dominant in the animation field.

And, despite cultural concerns that Disney would crush the agile creativity at Pixar, Disney has since made great movies like Ratatouille, Toy Story 3, and now, Elio. By acquiring Pixar, Disney set itself up for success and gives them more control in the animation industry.

Facebook’s acquisition of Instagram

It’s mind-blowing that Instagram had only 13 employees when Facebook bought it for $715 million in 2012. These thirteen employees had attracted 30 million users in the two years before being scooped up by Facebook. Instagram now has a staggering two billion global users.

Bloomberg has reported that Instagram brought in $20 billion in ad revenue in 2019. Facebook’s decision to buy Instagram has obviously been a great success. It’s not only increased the social network’s user base but also strengthened its ad revenue stream.

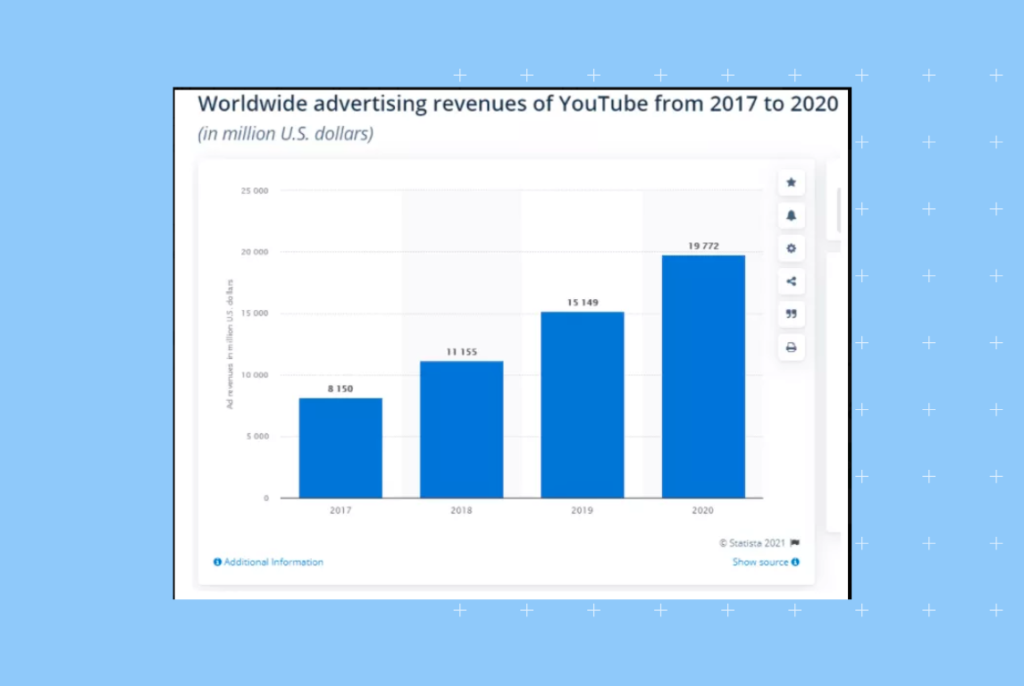

Google’s acquisition of YouTube

YouTube was a toddler, just two years old, when Google scooped it up. YouTube proved to be a good buy. It posted revenues of $20 billion in 2020, up from eight billion dollars just three years earlier, in 2017.

Google’s purchase of YouTube has provided the search giant with access to a wide range of content. It has also enabled it to tap into the lucrative online video ad market and expand its audience reach. The deal has been great for both parties. YouTube remains one of the most popular websites in the world, and Google’s revenue from online video ads has skyrocketed.

What is vertical integration?

Vertical integration is when a company expands into related lines of business as part of its overall strategy. SImply put, it’s when a company starts taking control of the entire supply chain. A remarkable example of vertical Integration is Ikea’s purchase of an entire forest in Romania in 2015. Sure, they still source wood elsewhere, but they now have a forest when supply crunches come.

What are the pros and cons of vertical integration?

Just like horizontal integration, vertical integration has its own set of benefits and pitfalls. Here are some of the pros and cons to help put this strategy into perspective.

Pros of vertical integration

- Cost savings

It’s assumed that Ikea reduced its costs and mitigated harmful supply chain disruptions by giving themselves the ability to harvest wood from its own forest. Now, your situation may not require an entire forest, but there are things that you do need. For example, if your delivery costs have been steadily rising over the last decade, there may be a delivery company that you could snap up, cutting costs and improving the fulfillment operation.

- Improved supply chain control

The COVID-19 pandemic is a tragedy that allowed humans to learn new things. We collectively learned that having more control over your supply chain can prevent crippling disruptions. So, if you make EV charging stations, you can gain more control over your supply chain by purchasing a stainless steel or aluminum supplier. At the very least, the vertical integration approach will likely allow you to see problems in the supply chain before your competitors do, giving you more time to react. ]

- Enhanced quality control

If you make EV charging stations, it’s important to ensure that the charging station is properly built and of high-quality. Purchasing a stainless steel or aluminum supplier can help you do just that — your team will have more control over the production process, which ultimately translates into higher quality products. Plus, if something does go wrong with a component, you’ll be able to identify it more quickly and take corrective action.

- Competitive advantage:

By controlling production and having direct contact with suppliers, you’re able to understand the needs of customers better than competitors who purchase components from third parties. This helps you create a product differentiation that meets customer demands more closely — making it easier to stay ahead of the competition.

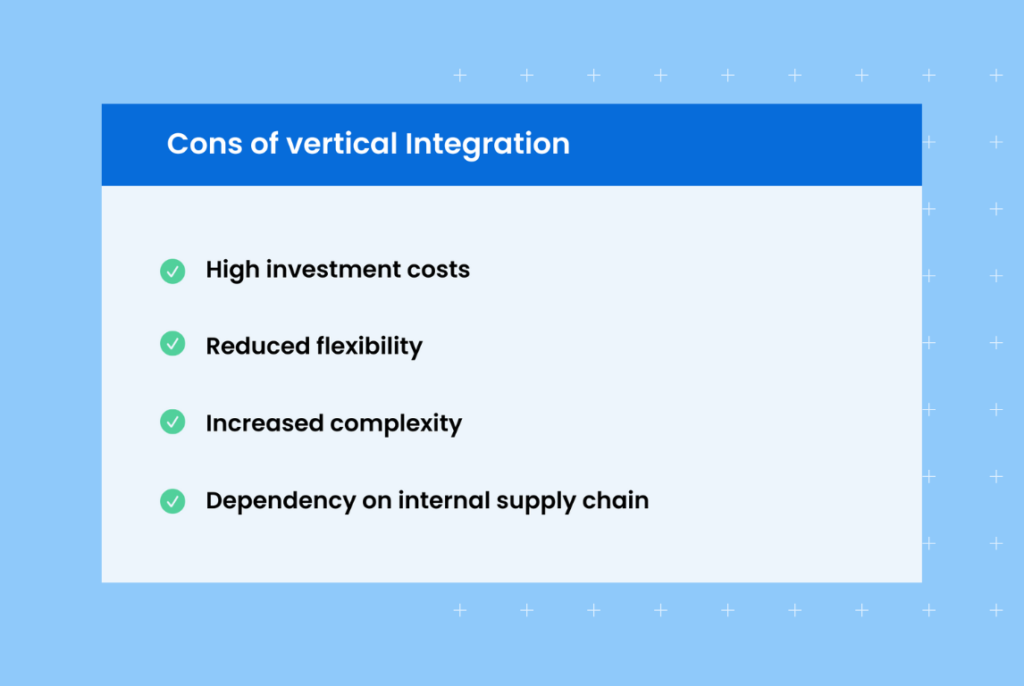

Cons of vertical integration

- High investment costs

Vertical integration is usually more expensive when compared to other strategies like horizontal integration. Bringing a new company into the fold is a complex process that requires investing significant capital to coordinate. Also keep in mind that when you acquire a new company you could also inherit their debt.

- Reduced flexibility:

When you’re vertically integrated, it’s harder to adjust operations in response to external conditions. This is because the company has multiple layers of operations and each layer needs its own set of adjustments. It can also be difficult to manage different teams with varying levels of expertise which could slow down the entire process.

- Increased complexity

With a vertical integration strategy, your organization will instantly become more complex, requiring that you integrate new processes and systems into your existing ones. Remember, vertical integration is not meant to be an instant fix for your company’s woes but a long-term strategy to yield eventual gains.

- Dependency on your internal supply chain:

The idea of being in control is alluring, but vertical integration also places a lot of emphasis on your internal supply chain. This means that if any of the links in your chain fail, it will directly affect your operations. It’s essential to have reliable suppliers and partners in order to make sure that you can maintain a healthy flow of materials and services.

What are the different types of vertical integration strategies?

There are many types of vertical integration that can help your business in different ways. Here are the most important ones.

- Backward integration

Let’s say you own a mid-sized company that produces air fryers. If you buy a ceramic coatings company, you are into backward integration. Backward integration refers to purchasing the providers or raw materials or services you need to make your product.

- Forward integration

Suppose you decide to sell these air fryers exclusively online to university students through your own platform, focusing on your use of non-toxic materials. This is an example of forward integration because you are in control of the sales process.

- Balanced integration

Balanced integration involves a company buying suppliers of its raw materials and its retail spaces. It’s not as common a tactic due to the high costs associated with the strategy. Apple designs its own semiconductors and owns its stores.

Sure, other retailers sell Apple products, and, in 2022, Apple made only 38% of its sales through its own retail spaces. However, they use their retail spaces to serve their existing customers, providing them with a memorable experience, and further build upon their brand.

- Partial integration

Partial integration, also known as selective backward or forward integration, is a type of vertical integration that allows companies to choose which aspects of the supply chain they wish to control. It involves retaining a certain level of independence while still having some degree of control within the production process.

An example would be Amazon’s third-party marketplace model, where vendors can list their products on the platform. This allows Amazon to maintain a level of control over its supply chain while still providing customers with access to a variety of products from different vendors.

Examples of vertical integrations

Let’s get into some concrete examples of how investing in a vertical integration strategy can benefit companies.

Apple’s integration of hardware and software

Apple is the most well-known of the companies that use vertical integration. When you sit to type on your Mac Pro (hardware) you’re likely using applications like Pages or iMovie (software). These products are created by Apple. To take things a step further, Apple has also created the operating system for all its devices, the macOS.

The company’s hardware and software integration has given it almost unimaginable control over its supply chain. Its yearly revenue at the end of March 2023, was more than $385 billion. Only seven countries have a higher gross national product than Apple’s revenue.

Amazon’s acquisition of Whole Foods Market

Most were surprised when Amazon bought Whole Foods Market in 2017. It was a $13.7 billion acquisition that allowed Amazon to enter into the grocery industry in a big way. By leveraging its massive logistics network, Amazon now has the ability to deliver groceries fast and efficiently to customers around the world. This will likely have an effect on how grocery stores operate in the future as well as other sectors such as the restaurant industry.

Tesla’s gigafactory

If you don’t live in a cave on a remote island, then you know that Tesla CEO Elon Musk is passionate about electric vehicles (EVs). EVs require lithium-ion batteries. So, in a bold vertical move, Tesla has opened a gigafactory in Nevada, producing these batteries and other parts that EVs need.

The gigafactory is being built in phases, with each phase increasing the amount of lithium-ion batteries that can be produced, bringing down costs. This will enable Tesla to increase its production of EVs and help make them more affordable for consumers.

FAQs about horizontal vs. vertical integration

Horizontal integration is the process of merging two or more businesses that are at the same stage of production while vertical integration involves uniting operations that span multiple stages of production, such as when a business buys out its suppliers or distributors.

An example of vertical integration is when a company controls both the production and distribution of its products. For example, if a car manufacturer owns factories that produce their cars, as well as dealerships that sell those cars.

In simple terms, horizontal integration happens when two or more businesses come together at the same stage of production. For example, a company may acquire another business that produces a similar product in order to gain economies of scale and reduce costs.

Horizontal vs. vertical integration: Which strategy fits your business?

The insights in this blog post should help with your understanding between horizontal vs vertical integration strategies. Before you make the final decision , make sure you investigate your business well and understand the benefits/challenges of each strategy.

And while each tactic comes with its challenges, deciding on a tool to merge your customer marketing needs isn’t. Birdeye makes it easy by letting you integrate with over 3,000 software systems which is one less hassle for you to worry about. Watch our free demo by clicking the banner below.

Originally published