For local businesses, every customer interaction counts, including how they pay. Choosing the right payment processor can transform your checkout into a gateway for customer satisfaction and business growth.

The tricky part is that there are a lot of online payment processing solutions to choose from. And now, it has become more critical than ever for small businesses to adopt and implement the best online payment methods and processing services to enhance their overall growth potential.

Whether you’re looking for your first online payment solution or your business needs to upgrade to a more robust payment processing option, you’ve come to the right place. In this blog, we’ll teach you everything you need to know about payment processing and share a list of the best payment processing solutions on the market.

Table of contents

What is online payment processing?

Online payment processing refers to the payment solutions you use to accept digital transactions. Investing in a payment processing solution eliminates the need to create a proprietary, compliant, and secure solution — which can be a timely and costly endeavor.

Payment processing solutions are instrumental for your business. They are your key to accepting payments via credit cards, debit cards, Automated Clearing House (ACH) bank transfers, mobile wallets, and more.

By accepting various forms of payment, you make your services and products available to more potential customers and ultimately increase your sales.

Benefits of online payment processing

If your business doesn’t accept payments online, you’re literally leaving money on the table. But boosting sales isn’t the only reason to invest in an online payment processing solution.

Below, we’ll explore the main benefits of online payment processing services.

Complete Payment Solution for Local Businesses

Looking for a payment processing solution? See how Birdeye can help.

Online payment processing improves the customer experience

It’s convenient for customers to make payments online. When they decide they want a product, they can enter their shipping and payment details, and voilà — the product is on its way to their doorstep. This streamlined process eliminates the need for a trip to the store, saving customers both time and effort.

Adopting online payment solutions can also help you improve your online reputation. A smooth purchasing experience, bolstered by hassle-free payment processing, will positively influence customer perception. Customers who encounter reliable and efficient online transactions are more likely to recommend your business to others and sing your praises through online reviews.

Online payment processing ensures speedy transactions

In today’s fast-paced digital marketplace, customers expect to find the product they’re looking for, add it to their shopping cart, and pay for it in a matter of minutes, if not seconds.

Online payment processing is the key to meeting these expectations and ensuring a speedy shopping experience.

Ultimately, with the right online payment processing solution, you can sell quickly, get paid quickly, and deliver quickly — which is huge for your customers and your bottom line.

The 8 best online payment processing solutions

So, what’s the best online payment processing service? It depends on your commerce type and business needs.

We researched for you, though, and the following eight should cover most needs. We’ll tell you what you need to know about each payment processing company — the pros, the cons, and everything in between.

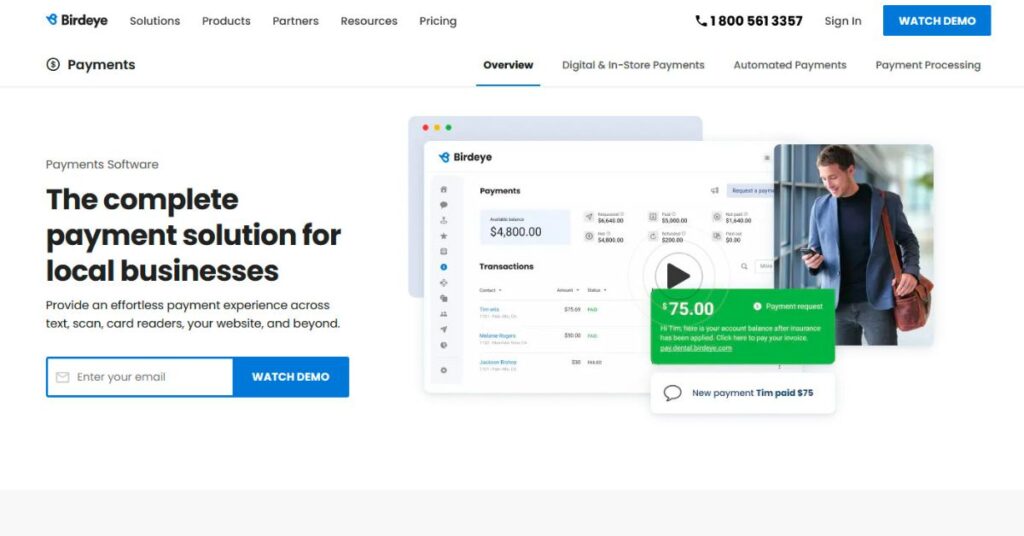

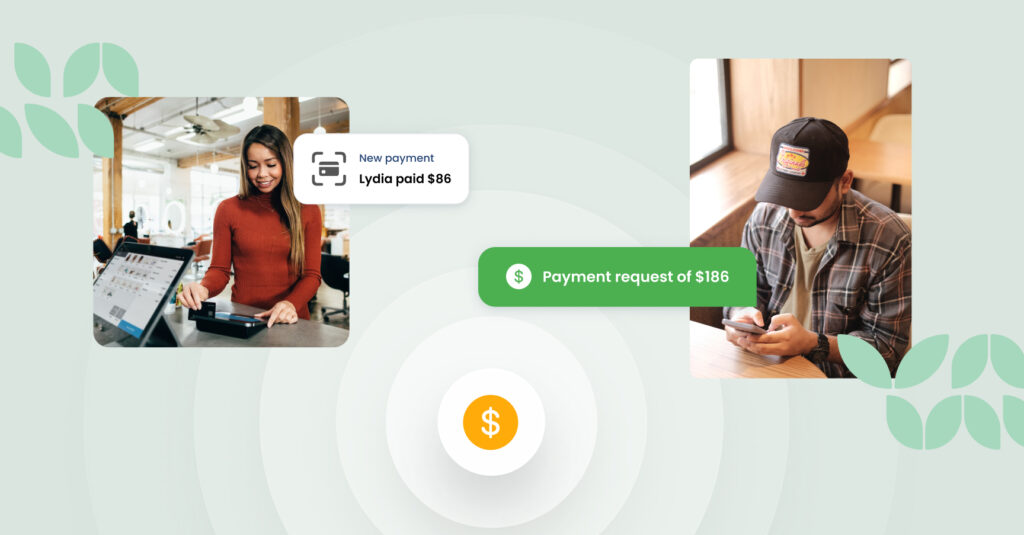

1. Birdeye

Birdeye is a comprehensive payment solution for local businesses. Whether online, in-person, or on the go, you can use Birdeye to accept various forms of payment. You can even accept EMV, contactless, and swiped card payments.

Birdeye also integrates with various familiar apps, including Wave, Freshbooks, QuickBooks, Xero, and others. This makes it a suitable solution for all small business types.

Pros:

- Accept an array of payment options.

- Predictable fee structure per transaction.

- Robust security features, including early fraud detection, world-class Stripe infrastructure, and PCI compliance.

- Robust integration features.

- You can use additional built-in tools to request reviews, manage customer conversations, and book appointments.

Cons:

- You will need to find a time to talk with a Birdeye representative to get set up with the software. But having hands-on help can be a major benefit, too.

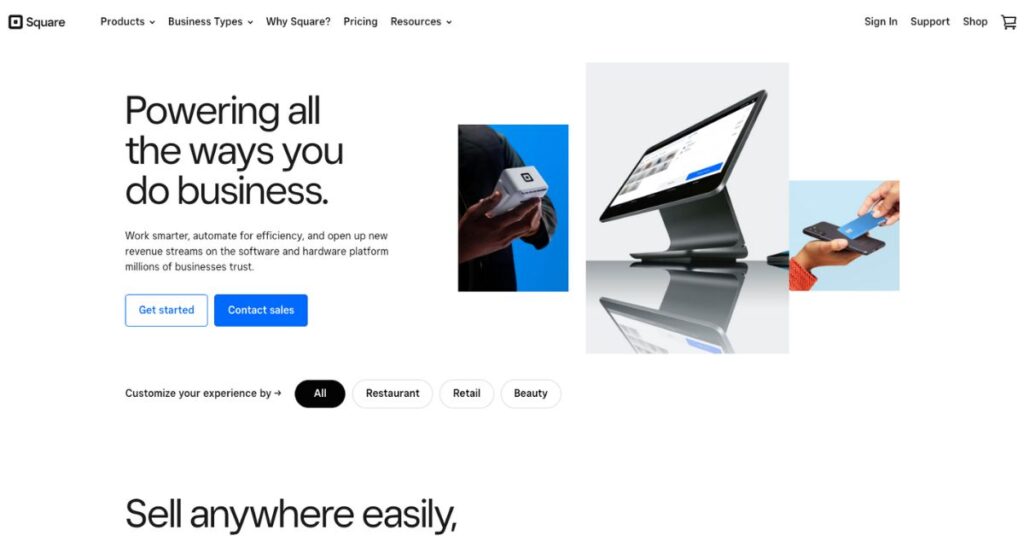

2. Square

Square is a popular credit card processing solution for all types of businesses. They offer software and hardware solutions, and their free app is downloadable on Google Play or the App Store.

Square has tailored payment solutions for both restaurants and retail-based businesses, and it has multiple third-party integrations.

Pros:

- You can get started with Square for free.

- Pay only a small fee per transaction.

- You are only ever charged on what you earn, making Square an excellent solution for smaller operations.

- An array of hardware-based solutions.

Cons:

- Your account can be frozen due to irregular activity.

- It is not a cost-effective solution for businesses doing higher volumes.

- Square does not offer phone support.

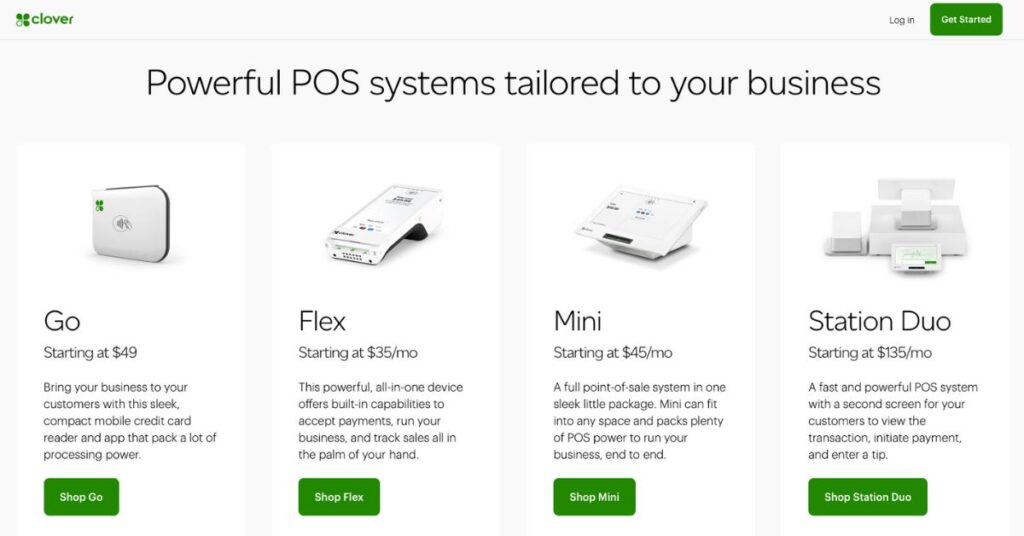

3. Clover

Clover is a credit card processing and point-of-sale (POS) solution well-suited to retail and hospitality businesses. With multiple payment options, secure and trackable payments, a great customer experience, and the ability to make a sale anywhere, Clover is impressive in functionality and scope.

Clover is a great tool for a business that already has a website and is interested in enhancing their offline presence.

Pros:

- Offers a 30-day free trial.

- A good option for companies that started online and are interested in growing their offline presence.

- Has hardware options to complement digital tools.

Cons:

- It can be pricey, especially compared to similar solutions.

- Additional features come with additional costs.

- Doesn’t have the best support tools.

- Requires you to have a website.

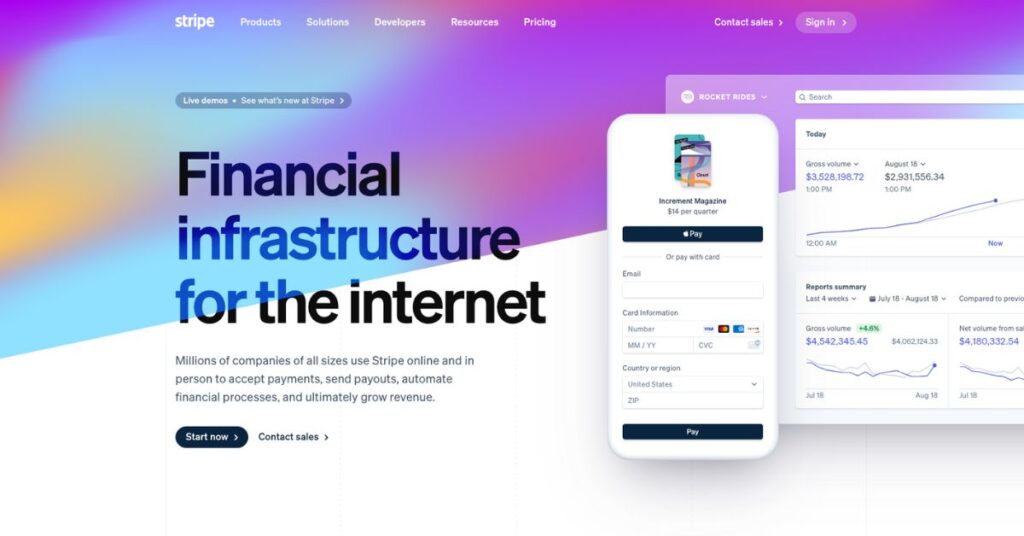

Stripe

The Stripe payment processing platform is a customizable solution for accepting over 130 currencies and dozens of payment methods. Thanks to its advanced developer tools and open API, you can even create customized checkout flows using Stripe.

Pros:

- The pricing is competitive.

- You can accept a host of payment methods and currencies.

- It’s a great solution for businesses with international customers that make most of their sales online.

- Highly customizable, thanks to advanced features.

Cons:

- It’s primarily for online merchants and caters less to offline sellers.

- If you want to take advantage of advanced functionality, you will likely need an experienced developer.

Adyen

Adyen is a one-stop shop for accepting online and offline payments, reviewing business insights, and enhancing security.

With zero monthly and setup fees, robust security, and sales optimization tools, Adyen is well-suited to any company looking to accept payments from multiple sales channels.

Pros:

- Makes it possible to accept payments online, in-store, and through apps.

- Offers options for global payments.

- No setup, monthly, integration, or closure fees.

- 24/7 customer support.

Cons:

- They have a minimum invoice amount requirement.

- They have relatively few features for brick-and-mortar businesses.

Apple Pay

Apple Pay is an easy-to-use, private, secure, and flexible payment processing solution. Since customers can pay for products by holding their iPhones over an NFC terminal — the ultimate convenience — it’s sure to enhance customer experience.

Apple Pay only works on Apple devices, but don’t count this payment processing option out — it’s very popular among the Apple user base.

Pros:

- Efficient Near Field Communication (NFC) / contactless payment system.

- Secure credit card handling with an anonymous, single-user token system.

- Allows customers to manage boarding passes, gift cards, movie tickets, and more.

- Features a high-reward credit card option.

Cons:

- Setup is more complicated than some competing solutions.

- It only works with Apple devices.

- The face recognition feature is finicky compared to Android’s.

Amazon Pay

Amazon Pay allows to pay for products and services via their Amazon account. If your customer base consists of frequent Amazon buyers, Amazon Pay will prove a valuable tool.

This platform boasts a range of integrations, like Shopify, Adobe Commerce, BigCommerce, and others. IT even gives customers the option to pay via Alexa-powered devices.

Pros:

- It’s a great solution for online sales.

- Supports global currencies.

- Pay per transaction. No setup or monthly fees.

- Integrates Alexa for placing and tracking orders.

Cons:

- Does not offer in-person payment support.

- Does not offer custom packages or volume discounts.

- Payouts may be delayed due to reserve policy. Newer accounts are affected the most.

PayPal

PayPal is one of the oldest and most recognizable online payment processors. It is trusted by many, and customers especially find it easy to use. The widely-known platform allows you to accept payments online and offline.

PayPal allows you to accept various payment methods — credit cards, Venmo, and cryptocurrency, to name a few. The platform allows you to open a Paypal Personal or Business account, depending on your needs.

Pros:

- Easy to set up and use.

- One of the most recognized and trusted payment processors.

- Works globally across 55 countries and six currencies.

- Boasts excellent security.

- Great customer service.

Cons:

- Complicated pricing structure.

- Extra processing fees may apply on international credit cards.

- $20 chargeback fees may apply in some scenarios.

- Hardware comes at an additional cost.

What to consider when choosing a payment processing solution

As you review your payment processing system options, consider the following factors.

Costs

There are many fees associated with payment processors, including processing fees, setup fees, transaction fees, monthly fees, and closure fees.

Small to medium-sized businesses must be especially strict regarding budgets — breaking the bank could break your business.

While exploring online payment processors, take some time to review what your business can afford as well as the potential upsides of implementing an online payment processor. The goal is to find a best-fit solution that is conducive to your current budget and can grow with your business over time.

Customer needs

A payment processor that’s good for you isn’t always good for your customers. For instance, maybe your customers want to pay you with cryptocurrency, but the processor you’re considering doesn’t accept those kinds of payments.

Feeling stuck? You can check user reviews to see what people say about a specific payment product or conduct surveys to determine what your existing customers care about regarding payments.

Flexibility

We touched on this above, but it bears repeating: You need a flexible solution that will grow with you. For example, you might only target domestic customers now, but there could come a time when you need to scale to accept international currencies.

So, as you investigate the different payment processors on the market, consider features you might need as you scale, including:

- Advanced customization

- App integrations

- Payment options

- Contactless payments

- Security features

- Online and offline payment handling

- Hardware or apps

Security

When evaluating payment processors, security is paramount for your business and customers.

Opting for a solution that guarantees the safety of customer data and transactions is essential. Doing so will provide peace of mind for your business and instill confidence in existing and potential customers.

Payment processing FAQs

Online payment processing refers to how digital transactions are handled and processed over the Internet. Payment processing systems enable you to accept payments through various electronic methods, typically including credit and debit cards and e-wallets. When a customer purchases online, the payment processor securely transmits the payment information, verifies the transaction, and ensures funds are transferred from the customer’s account to the business’s account.

The best online payment service depends on your specific needs and preferences. Birdeye has an incredible track record for small and local businesses and should top your list of considerations. Other popular options include:

– PayPal: Known for its widespread use and ease of integration.

– Stripe: Favored for its customization capabilities and developer-friendly tools.

– Square: Offers comprehensive solutions for both online and in-person transactions.

A payment gateway is a service that authorizes and processes credit card and electronic payments for online and traditional brick-and-mortar stores. It acts as an interface between a merchant’s website and its acquirer.

A payment processor, on the other hand, is a company that manages the credit card transaction process by acting as the intermediary between the merchant and the financial institutions involved.

Online payment processing refers to the payment solutions you use to accept digital transactions. Investing in a payment processing solution eliminates the need to create a proprietary, compliant, and secure solution — which can be a timely and costly endeavor.

Get paid faster with Birdeye

In summary, payment processors are essential for companies that want to do business online. The right processor for your business depends on your products, customers, and unique business needs.

Birdeye offers a powerful, comprehensive solution that ensures a smooth experience for you and your customers. And the cherry on top is that it can also help you improve your online reputation.

Ready to get started? Learn more about Birdeye Payments here or watch a demo today.

Originally published

![[Feature image] The best AI tools for business in 2025 A complete guide for productivity, content, and growth](https://birdeye.com/blog/wp-content/uploads/Feature-image-The-best-AI-tools-for-business-in-2025-A-complete-guide-for-productivity-content-and-growth-375x195.jpg)