Local discovery today is fast, frictionless, and highly data-driven. Search engines and map apps surface a small set of listings, and in just one tap, consumers can call, book, or get directions. For multi-location brands, these listings are no longer a background SEO tactic. They’re a real-time driver of foot traffic, calls, and revenue.

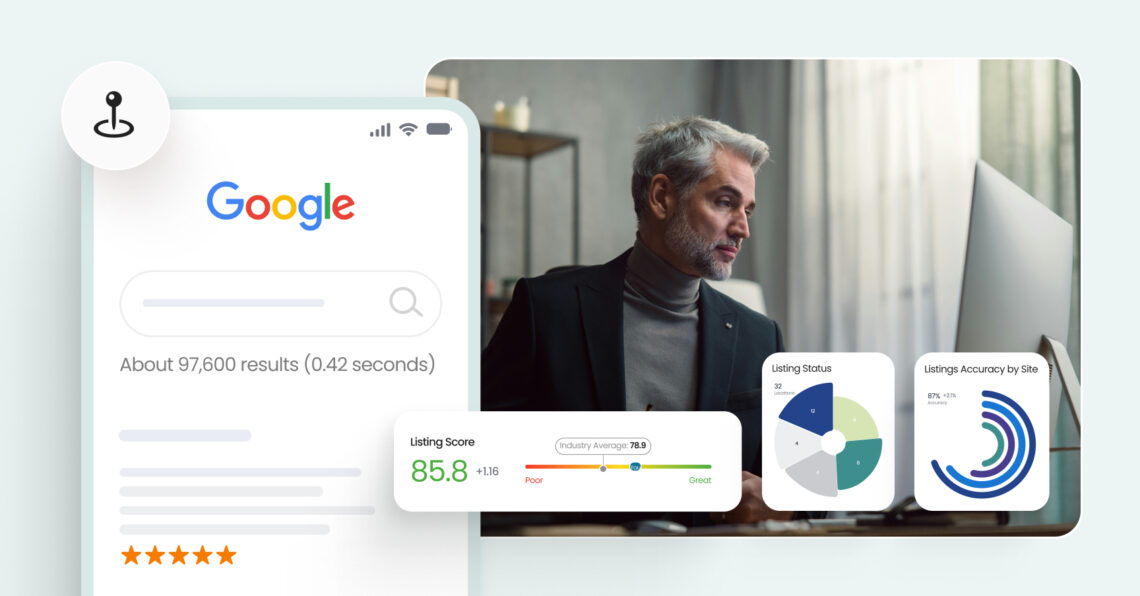

Yet, many marketing teams still measure success by the number of directories they appear on or the total citations they control. While counts were once proxies for visibility, they no longer correlate with business impact. What matters now is a short list of business listing metrics that describe user action and, to a lesser extent, listing quality.

The shift is evident. Google accounts for more than 83% of all business listing interactions, while long-tail directories contribute little. Cunningham Restaurant Group, with 42 locations across three states, proved the point when it retired 60 low-value listings and focused on its Google and Apple profiles. Within 30 days, Google’s share of web sessions rose to 48.91 %, and listing-driven traffic jumped by 1,048%.

The vanity metrics trap

Legacy metrics like citation count once offered comfort — more listings meant more reach, or so we thought. Today, they often signal wasted resources and misaligned effort. Obsessing over accuracy on 100+ longtail directories like bizpages.org or ibegin.com creates complexity without payoff. In fact, it can hurt performance as spending resources on accuracy initiatives are resources not being spent on tactics that do move the needle today.

Cunningham Restaurant Group’s move to phase out dozens of low-impact directories wasn’t just operational cleanup — it was a strategic realignment. With the help of Birdeye Listings AI, they refocused on a handful of high-impact platforms and the business listings metrics reflecting real customer intent. This meant prioritizing Google Business Profile, Apple Maps, Facebook, Yelp, and a few industry-specific sites. By escaping the vanity metrics trap, they freed up resources to double down on metrics that matter.

So what metrics do matter? There are five in particular that I typically tell my clients to stay focused on as they directly correlate with business metrics like onsite revenue.

- Tap-to-call actions

- Direction requests

- Bookings or reservations sourced from listing profiles

- Search impressions for priority keywords

- Average star rating and recent review volume

Local search in 2025: Experience wins

The fundamentals of local search have changed. We’ve moved from quantity to quality, from static data to dynamic engagement. Today’s consumers expect rich, up-to-date information at their fingertips and will choose businesses that provide the best experience in search. That means the quality of your listing, accurate information, reviews, photos, and interaction now trump the quantity of sites you’re on.

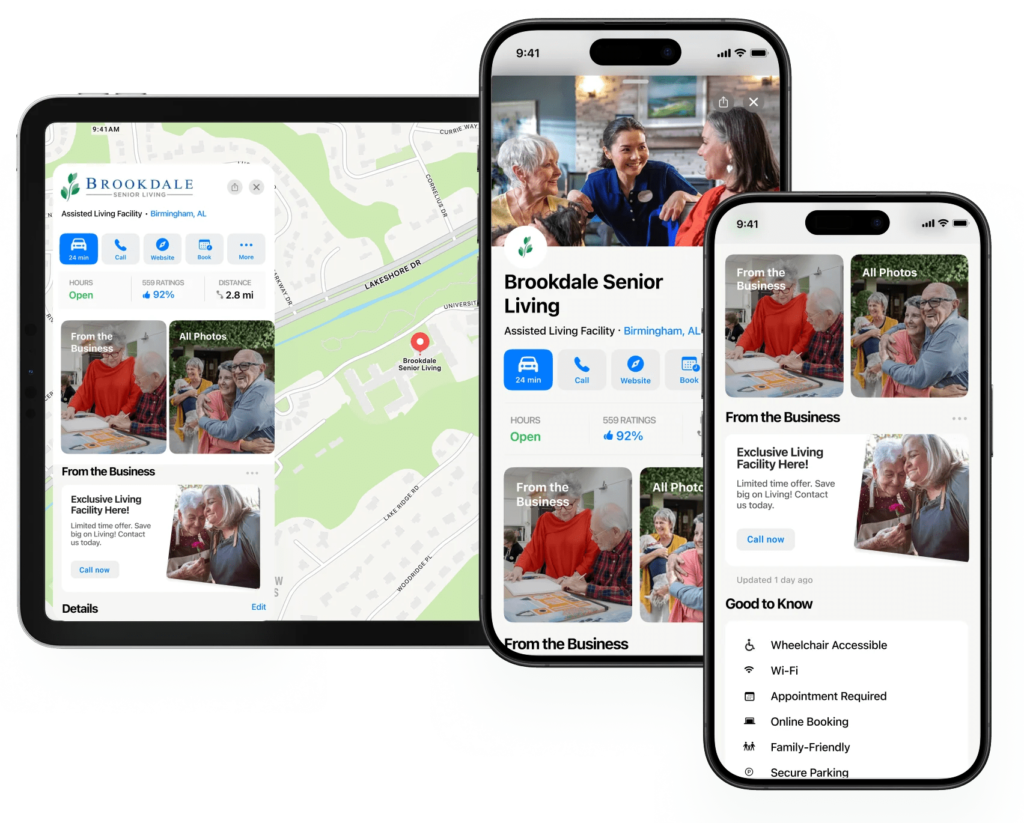

Several shifts underpin this new reality. First, Google’s dominance has only grown. With 91% of business searches happening on the platform, a fully optimized Google Business Profile is now a primary touchpoint, not just a listing.

Meanwhile, Apple Maps has emerged as a high-intent channel with Apple Business Connect giving brands more control over how they appear on millions of iOS devices. In short, being highly visible on the core listing sites (Google, Apple, Facebook, Yelp, Bing, etc.) is far more valuable than being marginally present on low-traffic directories.

But platform consolidation is only part of the shift. AI is redefining how consumers search. Search engines are getting smarter at interpreting user intent. For instance, Google’s integration of AI into Maps allows it to interpret conversational or voice queries and recommend relevant local places using large language models.

For multi-location brands, the takeaway is clear: stop counting how many directories carry your NAP and start tracking how effectively your highest-impact listings attract and convert customers. It’s no longer enough to be listed. You have to be the most useful result.

Now, let’s take a look at five crucial business-listing metrics you should watch to keep performance and revenue in view.

The 5 metrics framework

To bridge the gap between vanity and value, here’s a five-part framework focusing on the business listing metrics that drive outcomes.

Conversion metrics

Conversion metrics track customers’ concrete actions from your business listings that lead to revenue or lead generation. These business listing metrics prove a listing isn’t just being seen, it’s driving customers to act. Key conversion metrics include:

- Calls made from a listing (e.g., clicking the phone number on Google, Apple, or Yelp)

- Driving direction requests (a strong indicator of intent to visit)

- Website clicks from the listing (bringing a customer into your online property)

- Bookings or appointments made via the listing (for businesses that enable appointment scheduling or reservations)

These metrics are direct indicators of intent and ROI. Tools like Google Business Profile Insights and a dedicated call-tracking provider quantify these actions, while GA4 with UTM links ties every ‘Visit website’ click back to revenue.

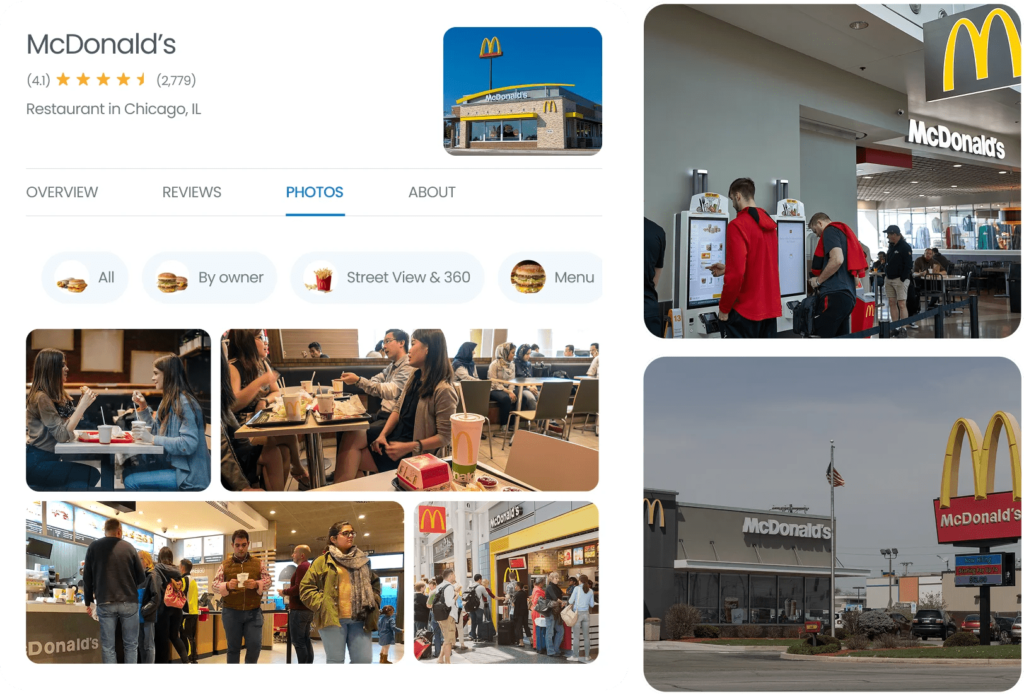

Engagement metrics

High engagement often precedes conversion. When users interact with your listing- browse photos, check menus, ask questions- they signal interest. Therefore, engagement metrics are vital for understanding the user’s intent and improving your local presence. You can track these engagement signals in Google Business Profile Insights and supplement them with Apple, Yelp, and Facebook Page Insights to cover platforms outside Google’s ecosystem. Here are some key engagement metrics to consider:

- Profile views on listing platforms (how many people viewed your Google listing, Yelp page, Facebook page insights, etc.)

- Clicks on specific listing features (for instance, menu clicks, photo gallery views, clicks on “More info” or Q&A section).

- Messages or inquiries sent via listings (for instance, messages through Google’s Business Messaging or Facebook)

- Clicks on driving directions or share (if not counted as conversions, they indicate interest)

Visibility metrics

You can’t drive conversions or engagement if customers aren’t finding your listings in the first place. Important visibility metrics include:

- Search impressions: How often does your business listing appear in search results (e.g., in Google Maps searches or local pack results).

- Local search rankings: Your position in local search results or map results for key queries (e.g., “coffee shop near me”) on key sites – Google and Apple.

Visibility metrics are about reach. They answer how many people potentially saw your business. Tracking visibility across locations is critical for multi-location brands, as it helps pinpoint underperforming markets and ensures top-of-funnel awareness remains strong.

Reputation metrics

Your online reputation, primarily customer ratings and reviews, is intertwined with your listings. A business listing is often the front line where reputation is displayed (think Google star ratings right under your business name). Reputation metrics gauge the quality of your reviews and how you manage feedback. They drive revenue by building trust and influencing consumer choices. Key reputation metrics include:

- Average star rating on each platform (Google, Yelp, Facebook, etc.).

- Review volume (total number of reviews) and recency (new reviews in the last 30 days).

- Review sentiment or qualitative insights (common themes in customer feedback).

- Response rate to reviews (how often and quickly you respond to customer reviews).

Unified dashboard

Perhaps the most overlooked metric isn’t a metric — it’s visibility into all of them.

A unified dashboard lets you monitor conversion, engagement, visibility, and reputation in one place. This cross-location view enables you to compare conversion rates across locations, spot where engagement is lagging, or identify a dip in one store’s star rating, all at once. It means no more logging into ten different sites or wrestling with spreadsheets from each franchise location. Instead, teams can have one source of truth for business listing metrics, enabling faster decision-making and consistent improvement execution.

You can build this unified view by pulling data from GA4, GBP Insights, Apple Business Connect, and call-tracking tools into a business intelligence tool like Looker or Tableau, or use a platform like Birdeye Listings AI to bring every key business listings metric into one place.

Final thoughts: A new operating model

As the pace of local search transformation accelerates, so must how we measure success. It’s high time we stop treating business listings as static assets or SEO line items. They are dynamic, high-stakes entry points for customers ready to act.

I believe the path forward is clear:

- Focus on fewer, higher-impact platforms

- Track the metrics that connect to business outcomes

- Automate wherever possible, but never at the cost of quality

Here are five key moves you can apply today:

- Audit performance, not presence: Pull the last 90 days of listing traffic. If a directory delivers under 1% of actions, spend less (or no) time trying to improve it and double down on top channels.

- Enrich your high-traffic listings: On Google and Apple, add fresh photos, product or menu details, FAQs, and clear, tracked CTAs such as “Book online” or “Message us.”

- Tag everything: Use UTM links and call-tracking numbers so every click or tap is attributed to its source. Data you can’t trace is data you can’t improve.

- Set a weekly signal review: Focus on those metrics that correlate with business outcomes – specifically— calls, website clicks, bookings, and direction requests. If one drifts, look at improving your content content, CTAs, or review strategy before tinkering with citations.

- Leverage a platform if you are able: Use a listings management tool, like Birdeye Listings AI, to monitor anomalies, push updates, and surface insights.

Remember: the brands that win big in local search won’t be the ones with the longest citation list. They’ll be the ones who turn every listing into a performance asset and every interaction into revenue.

Originally published