The marketplace is getting more and more competitive, and today’s credit unions need to do their best to be as visible as possible to potential members. So let’s talk about local SEO for credit unions.

Table of contents

Local SEO is optimizing your credit union’s appearance across the Internet so that you’re showing up high in search results. When you do Local SEO, you have a better chance of getting found and getting chosen by potential members.

Studies show that the sites that show up first in organic search results are the most likely to get chosen. Most consumers skip over paid ads. With the rise of mobile search, this effect is only becoming more prevalent. While desktop search shows ten results, mobile-only shows three.

5 Ways to Get Started with local SEO

Here are some easy steps that you can start taking to rank higher on local search.

1. Claim your Google My Business profile

The #1 factor determining your local search ranking is your Google My Business profile. So make sure that your profile is claimed and updated for each one of your different listings. The more detailed your listings, the better. So make sure to add each one with relevant contact information, high-definition photos, and relevant categories.

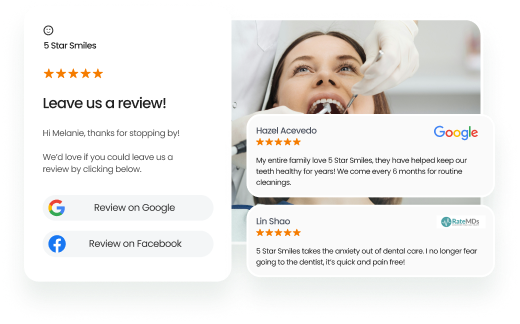

2. Collect more online reviews

Rember, potential members trust reviews. Reviews represent the authentic experiences of your existing members.

But that’s not the only way that reviews can help your credit union. According to Moz, reviews are the third-biggest factor determining local search ranking. The more reviews you have, the better search ranking you can expect.

The best way to collect online reviews is to send emails or text messages to your members that link to sites like Google and Facebook. For example, you can send a message like this:

Hey (member name),

Thanks for choosing (Credit Union name). Please provide feedback by clicking the link below.

Be sure to send these review requests the same day that members visit your credit union. That’s when they will be most likely to leave a review. The longer you wait, the less likely it is that they’ll be willing.

3. Respond to reviews

Responding to credit union member reviews matters. Remember, the best way to deal with a negative review is by leaving a polite response. It’s much easier to combat before it turns into a much larger issue.

Google has confirmed that responding to reviews helps improve local SEO. Remember, Google values the same things that your members value. When you regularly interact with your members, it shows both potential members and search engines that you sincerely care about every person who walks into one of your branches.

4. Claim your Birdeye profile

So let’s take a second to plug our own free service here: Birdeye profiles. Birdeye aggregates reviews from all over the Internet. If enough review signals are picked up by Google’s algorithm, you’ll start seeing these profiles ranking high in search results.

5. Fix your branch listings

What is a business listing? It’s simple: a listing is a mention of your business that contains a Name, Address, and Phone number (NAP). The more times your NAP is mentioned on authoritative sites, the more citation signals are sent to Google. According to Moz, these citations are the 5th-biggest-factor determining your local search ranking

While running multiple branches, it can be hard to keep track of different listings on different sites. Still, it’s important that both members and search engines can easily find this information. The more accurate your branch listings, the better chance you have of ranking on search. So start making sure that sites like Google and Facebook have accurate, up-to-date information about your listings.

How Baton Rouge Telco Federal started ranking higher on search

Baton Rouge Telco Federal is a 4-location credit union based in Louisiana. The organization realized that they could start attracting new members and ranking higher on search with online reviews. While they were originally using Grade.us, they were not happy with the results they were getting. That led them to Birdeye.

Birdeye helped the credit union collect more reviews from members. Since starting with Birdeye, Baton Rouge Telco Federal has collected more than 300 online reviews.

The credit union’s investment in Birdeye has paid off. Now Baton Rouge Telco Federal is the top-ranking credit union for the search query “best credit union Baton Rouge”.

Baton Rouge Telco now has the best online reputation management of any credit union in the area. Online reviews have helped to make the credit union the obvious choice in the area. These days, Baton Rouge Telco Federal is getting found and getting chosen by potential members more than ever before.

How Birdeye can help your local SEO

Software like Birdeye can help you start ranking higher on search engines. Here are a few ways that Birdeye can help your credit union’s local SEO.

Collect reviews automatically

With Birdeye, you don’t have to manually send review requests to your members. Instead, you can take care of the process automatically. Birdeye can help you send review requests to your members to write reviews on 100s of review sites like Google and Facebook.

Get found with custom-built profiles

While you don’t have to be a Birdeye customer to claim a profile, customers do get extra benefits. Add photos, respond to member reviews, and start getting discovered by more potential members. Our business profiles are optimized by search engine optimization.

Respond to credit union member reviews

Members are leaving reviews all across the Internet. Unfortunately, nobody has time to flip through hundreds of different review sites. That’s where Birdeye comes in. The Birdeye dashboard displays reviews from hundreds of different sites- all in one place. You can easily respond to all your reviews from one convenient dashboard.

Start ranking higher on search

There’s no review software on the market that can help improve your local SEO like Birdeye. No other company offers the ability to collect authentic reviews, automatically fix business listings, and rank higher with custom business profiles. Birdeye is the best option to help credit unions be found and chosen.

Originally published

![[Feature image] The best AI tools for business in 2025 A complete guide for productivity, content, and growth](https://birdeye.com/blog/wp-content/uploads/Feature-image-The-best-AI-tools-for-business-in-2025-A-complete-guide-for-productivity-content-and-growth-375x195.jpg)