The UK minimum wage and insurance changes 2025, announced by HMRC in April, bring significant financial adjustments for businesses. The Autumn Budget outlines increases to both the National Minimum Wage (NMW) and employer National Insurance Contributions (NICs), meaning businesses of all sizes need to prepare for rising costs and potential operational shifts.

These changes will put added pressure on business budgets, making efficiency and customer acquisition more critical than ever. Failing to adapt could lead to tighter margins and unexpected challenges.

So, how will these changes impact your business, and what steps can you take to stay ahead?

This article explores the UK tax changes in April 2025 and offers guidance to help your business stay compliant and prepared throughout the year.

Table of contents

Understanding the changes

With rising wages and increased tax obligations, UK businesses must adapt to ensure financial stability. Therefore, understanding the full scope of these adjustments is crucial for effective business planning and compliance.

1. National Minimum Wage (NMW) increase:

The UK Government reviews minimum wage rates annually based on the Low Pay Commission (LPC) recommendations. This independent body assesses factors like inflation, economic conditions, and business impact. Following the latest review, the government has announced a substantial wage increase for 2025.

- From 1 April 2025, the National Living Wage (NLW) for employees aged 21 and over will rise by 6.7%, from £11.44 to £12.21 per hour.

- For 18 to 20-year-olds, the NMW will increase by 16%, from £8.60 to £10.00 per hour.

- Under 18s and apprentices will see an 18% rise, with hourly pay increasing from £6.40 to £7.55.

Updated National Minimum Wage increase UK rates changes

| Wage band | Current rate (2024) | New rate (From 1 April 2025) | % Increase |

| Age 21 or over (NLW) | £11.44 | £12.21 | 6.7% |

| Age 18 to 20 | £8.60 | £10.00 | 16% |

| Under 18 | £6.40 | £7.55 | 18% |

| Apprentice | £6.40 | £7.55 | 18% |

2. Employer National Insurance increase 2025:

Employer’s NICs are a payroll tax paid by businesses, separate from the deductions employees make from their wages. This year, the UK NI changes 2025 introduce major changes that will significantly impact business expenses:

- The employer NIC rate will increase by 1.2%, from 13.8% to 15%. This means businesses will pay a higher tax on employee wages.

- The secondary threshold—the earnings level at which employers start paying NICs has decreased substantially from £9,100 to £5,000 per year. This means employers will pay NICs on a larger portion of employee salaries.

Employer National Insurance increase 2025 rate changes

| NIC component | Previous rate (2024/25) | New rate (2025/26) |

| Employer NIC Rate | 13.8% | 15% |

| Secondary Threshold | £9,100 per year | £5,000 per year |

The impact on business budgets

The rise in wages and National Insurance increase 2025 will lead to higher labour costs, particularly for industries that rely on lower wage workers, such as retail, hospitality, and care services. Hence, businesses must adjust their financial strategies to maintain profitability.

Here’s how these changes could impact operations.

- Increased prices: To offset higher payroll expenses, businesses may need to raise prices on products and services.

- Reduced staff hours: Some employers may cut employee hours or shift to more part-time roles to control costs.

- Hiring freezes or job reductions: To manage rising labor costs, businesses may pause hiring or reduce staff numbers.

- Operational efficiency improvements: Businesses will automate tasks, optimise workflows, or invest in technology to reduce reliance on manual labour.

The challenge for multi-location businesses

For businesses operating across multiple locations, the UK tax changes April 2025 pose an even greater challenge, as rising labour costs and increased overheads multiply across different sites.

- Higher payroll costs across multiple locations: The combined effect of wage and NIC increases results in significantly higher payroll expenses across all sites. Businesses with larger workforces will feel a greater financial strain, making it harder to manage overall labour costs.

- Consistent operational efficiency needed: Each location needs to maintain profitability and invest in centralised software to gain a better ‘birdeye view’ of the whole operations despite increased overhead costs. Differences in local demand, staffing, and cost structures can create inconsistencies, making it more difficult to maintain overall efficiency.

- Managing customer experience at scale: As expenses rise, retaining and acquiring customers becomes more difficult. Staffing shortages, pricing inconsistencies, and service variations can impact satisfaction and loyalty, affecting the overall customer experience.

How Birdeye helps businesses minimise the impact

As 2025 brings significant financial changes for UK businesses, staying ahead of policy updates and avoiding costly missteps is more critical than ever. Birdeye offers powerful tools to help businesses streamline operations, attract more customers, and enhance customer engagement strategies. This ensures they remain competitive despite rising costs.

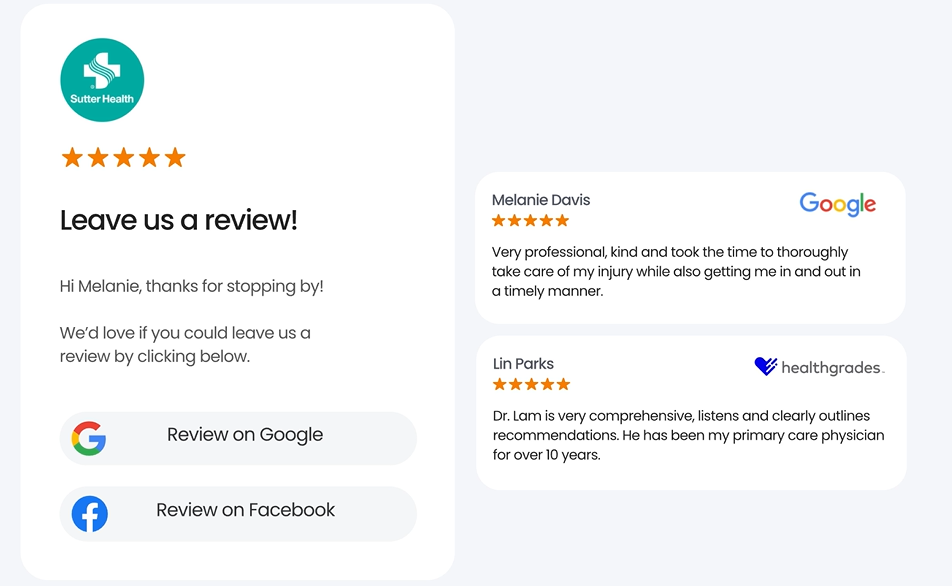

1. Automated review and customer engagement

Birdeye Reviews AI helps businesses mitigate the impact of rising labour costs by streamlining customer engagement while maintaining high-quality interactions.

- Increase online visibility and attract more customers by automating review requests and responses

- AI-powered responses ensure timely and personalised engagement without requiring additional staff time

2. Multi-location management

Birdeye Listings AI provides a unified dashboard that allows businesses to monitor and manage customer feedback, online reputation, and business listings across multiple locations.

- The platform’s AI-driven tools automate routine tasks, such as updating business information across directories

- Ensures consistency in branding, customer interactions, and operational efficiency while reducing reliance on manual processes

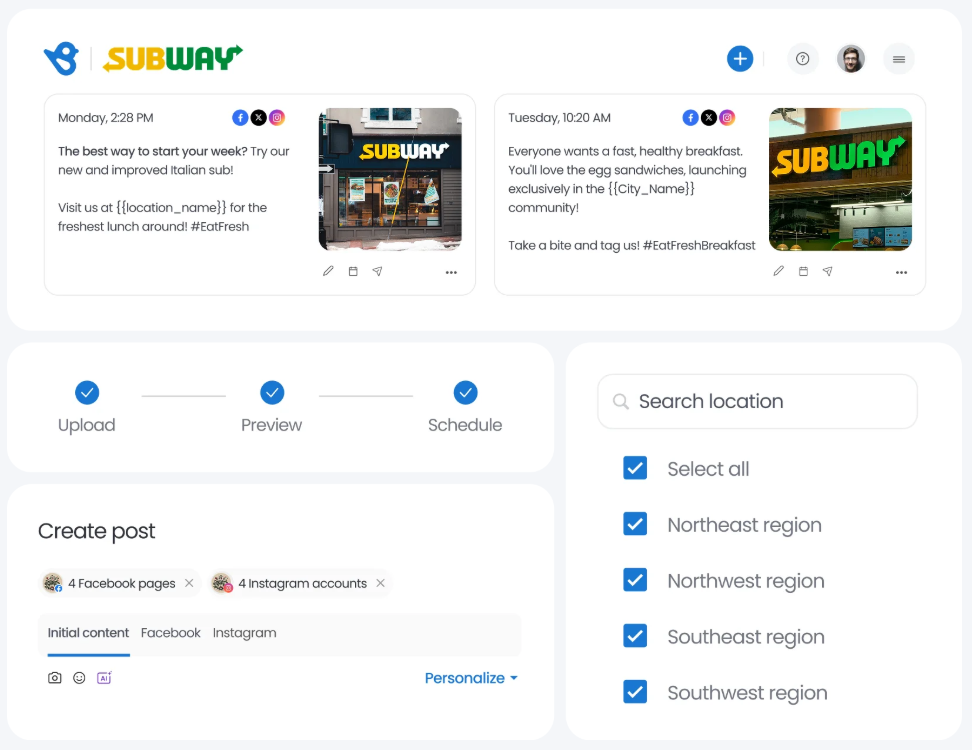

3. Social media and listings optimisation

Birdeye Social AI enables businesses to create, schedule, and monitor social media posts across multiple platforms from a single dashboard.

- This centralised approach ensures consistent messaging and enhances customer engagement

- Birdeye’s automated business listings management keeps information accurate and up to date across all platforms. This improves search rankings and drives foot traffic

4. AI-driven insights and analytics

Birdeye Insight AI gives businesses actionable insights into customer behavior, sentiment, and online reputation.

- This facilitates informed decisions to optimise operations

- With AI-generated recommendations, businesses can refine marketing strategies and allocate resources effectively to maximise revenue

Navigating the 2025 tax changes: Turning challenges into opportunities

The April 2025 HMRC updates on wage and National Insurance increase bring significant financial pressures, particularly for businesses with multiple locations. However, adapting to these changes doesn’t mean shrinking margins or cutting staff.

By embracing technology-driven solutions like Birdeye, businesses can streamline operations, enhance customer engagement, and drive growth despite rising costs. The tool will help navigate immediate challenges caused by the minimum wage rise 2025 UK and position businesses for long-term success.

Originally published