In financial services, trust isn’t built through advertising — it’s built through proof. Customers compare banks, lenders, and investment firms based on real experiences shared online. That makes financial reputation management a core performance driver, not a marketing activity.

Summary

A single negative review, outdated listing, or slow response can influence credit decisions, account openings, and lending volumes. This guide explains how online reputation management for financial services works, where most institutions fall behind, and how your firm can build a measurable, compliant, high-trust presence across all digital touchpoints.

This guide covers the fundamentals of financial reputation management, the risks of unmanaged reviews, and how to strengthen credibility. It also includes practical steps for bank reputation management, how bank listings influence discovery, and where AI tools — like Birdeye’s AI Agents and Search AI — fit into a modern finance ORM strategy.

Table of contents

- What does online reputation management for financial service firms mean?

- 7 key benefits of online reputation management for financial services

- 5 tips on how financial service firms manage their online reputation

- Why does online reputation management matter to mortgage lenders?

- How Birdeye and its AI Agents transform reputation & marketing for financial services

- How Birdeye Agents help financial institutions

- Why Agentic Marketing matters for financial institutions

- Financial services online reputation management FAQs

- Birdeye’s reputation management solution for financial services

What does online reputation management for financial service firms mean?

Online reputation management for financial service firms refers to the systems used to monitor feedback, improve public perception, and maintain accurate information across digital channels. This forms the base of strong financial reputation management, especially in a highly regulated environment.

Financial institutions handle sensitive data, so credibility and compliance matter as much as service quality. Effective ORM includes:

- Monitoring reviews, comments, and mentions

- Responding quickly and compliantly to customer concerns

- Keeping business listings accurate and consistent

- Promoting positive experiences

- Maintaining communication standards required for bank reputation management

How Madden Partners improved their online reputation

A similar approach to listings and reputation management for banks applies to accounting and financial service firms. Here is an example of how Madden Partners — an accounting and financial planning firm — managed and improved their online reputation.

Since they started using Birdeye’s all-in-one platform, they’ve boosted their online presence and increased their customer base. One of the most proactive steps they took to improve their reputation was building a positive brand perception.

To ensure they maintain a strong online reputation, they tested various ORM strategies, like:

- Encouraging satisfied customers to leave positive reviews

- Optimizing their business listing management with relevant keywords

- Engaging with customers promptly

Thanks to these efforts, they saw:

- 76 new reviews generated

- 46% increase in direction requests

- 32% increase in discovery searches

- 14% increase in Google profile views

7 key benefits of online reputation management for financial services

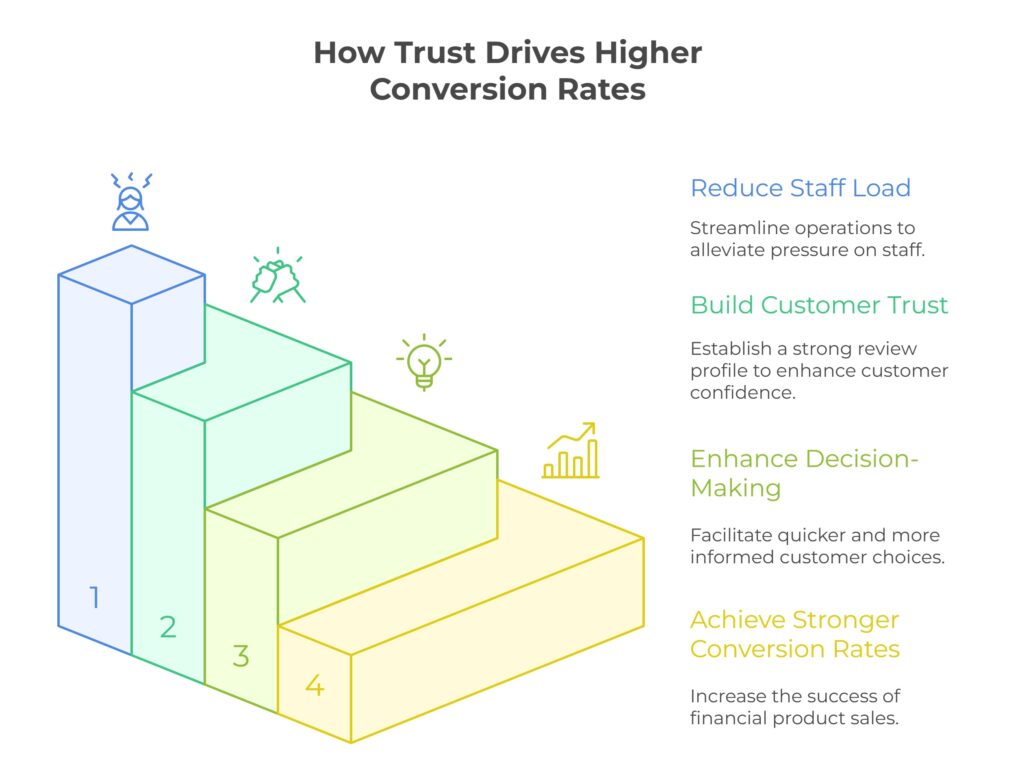

Strong reputation is no longer a “soft” metric in finance — it directly impacts discovery, lead quality, and conversion. Effective financial reputation management helps institutions reduce acquisition costs, increase trust-based conversions, and maintain consistent communication across multiple customer touchpoints.

Below are the core business benefits financial service firms see when ORM is handled correctly.

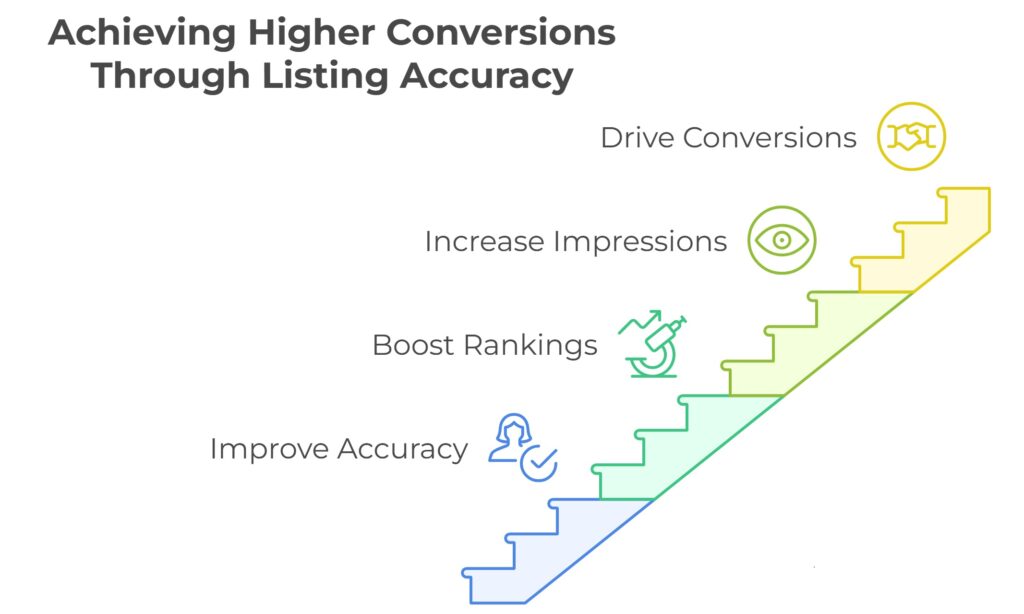

1. Increased visibility in local search

Most customers search for financial services using queries like “bank near me,” “mortgage advisor,” “investment planner,” or “loan provider.”

A strong reputation improves:

- Ranking in local search results

- Google Maps visibility

- Website clicks and direction requests

- Frequency of brand impressions in discovery searches

This is especially important for multi-location institutions where bank reputation management impacts branch-level performance.

2. Higher lead volume and quality

Customers trust institutions with strong review profiles.

More trust = more high-intent inquiries.

ORM drives:

- Increased conversion from profile views to “contact” actions

- More mortgage inquiries

- More investment consultations

- More account openings

Consistent reviews also boost credibility on comparison sites and aggregator platforms.

3. Consistent and accurate listings across platforms

Incorrect listings cause customers to drop off — wrong hours, wrong location, outdated services.

With accurate listings:

- Branches are easier to find

- Service offerings appear in relevant searches

- NAP (name, address, phone) signals improve ranking

- Customers navigate to you without friction

This matters most in listings and reputation management for banks, where every branch depends on accurate, synchronized data.

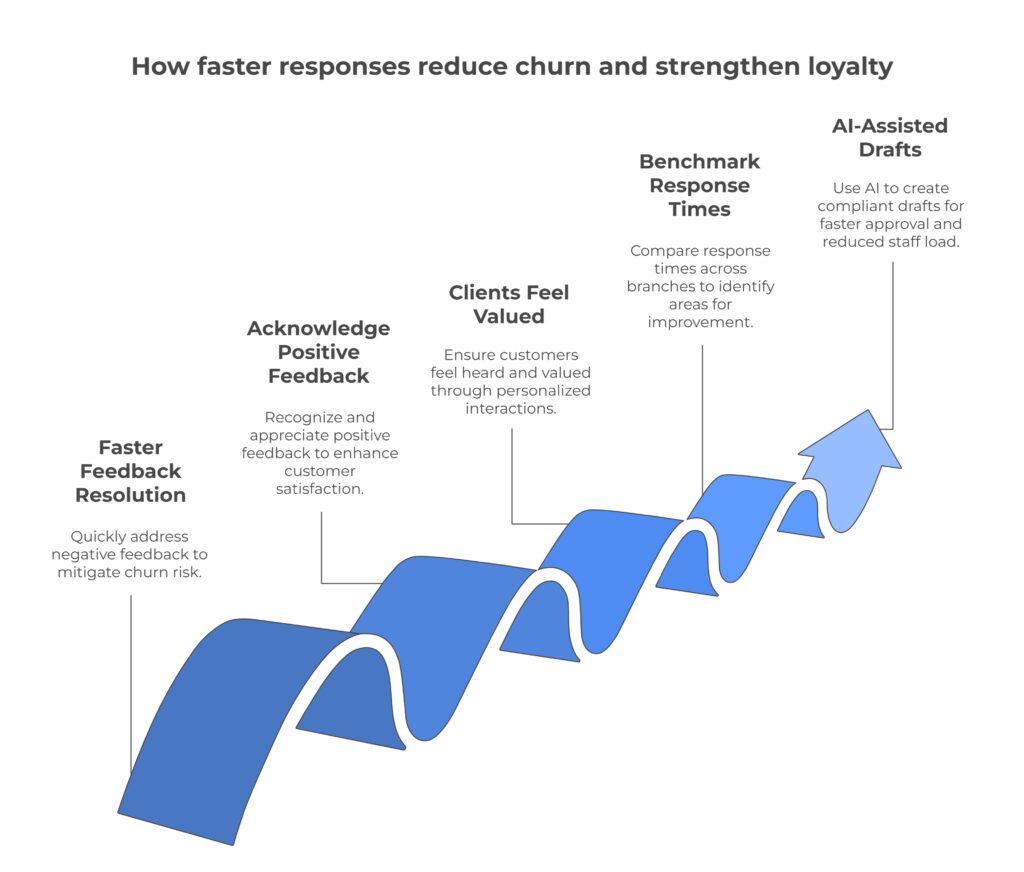

4. Better customer experience through faster response

Finance customers expect fast support — slow responses increase churn risk.

With the right ORM process:

- Negative feedback gets resolved faster

- Positive feedback gets acknowledged

- Clients feel valued and heard

- Branches benchmark response times against each other

AI Agents create compliant drafts that teams can approve quickly

5. Stronger conversion rates across all financial products

Trust accelerates decision-making. When your review profile is strong, customers feel more confident choosing:

- Mortgage products

- Personal loans

- Investment advisory services

- Insurance policies

- Wealth management portfolios

This is a major ROI driver for finance online reputation management strategies.

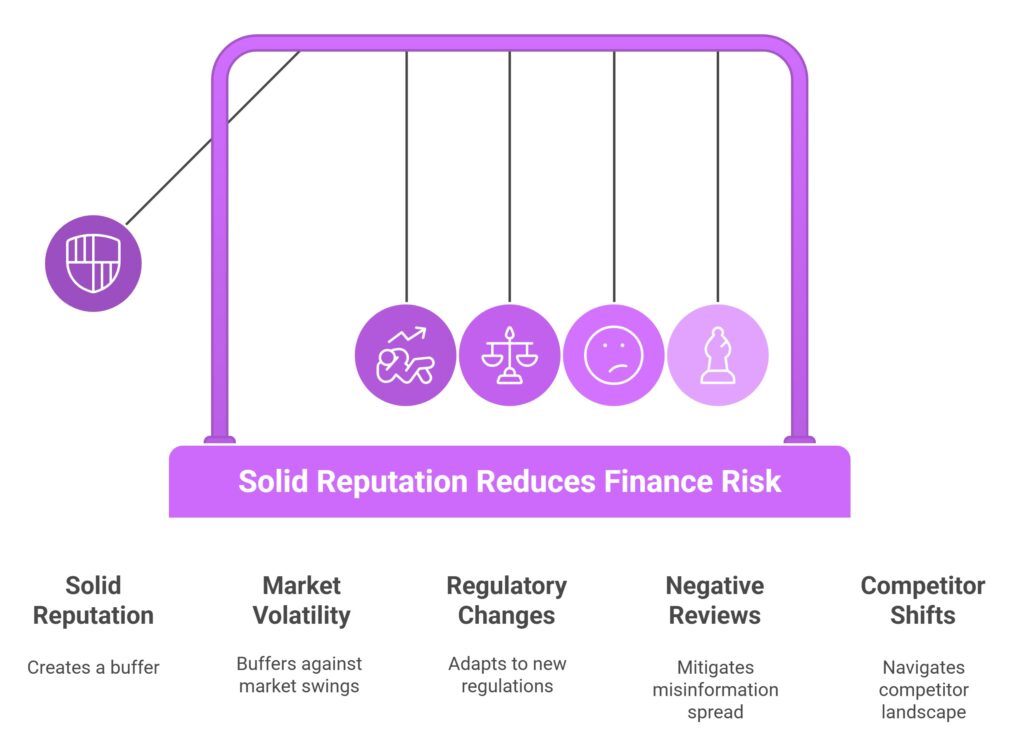

6. Reduced risk and smoother crisis management

A solid reputation creates a buffer during:

- Market volatility

- Regulatory changes

- Negative reviews or misinformation

- Competitor shifts

Institutions with consistent, positive sentiment recover faster and maintain customer confidence even during downturns.

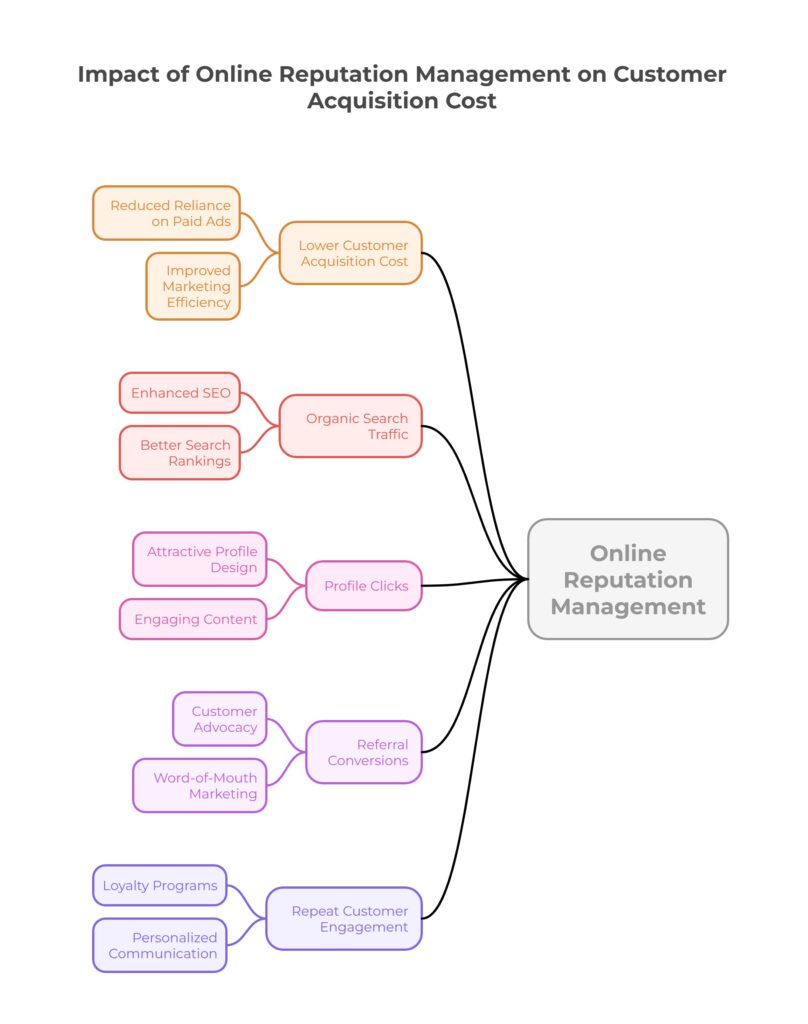

7. Lower Customer Acquisition Cost (CAC)

ORM reduces reliance on paid ads by increasing:

- Organic search traffic

- Profile clicks

- Referral conversions

- Repeat customer engagement

A strong review profile improves marketing efficiency and reduces cost per lead.

Strengthening your online reputation isn’t a branding exercise; it’s a measurable growth strategy. Birdeye helps financial institutions automate reviews, listing accuracy, and sentiment monitoring across 200+ platforms.

5 tips on how financial service firms manage their online reputation

Just as a city’s image is shaped by the perceptions of its residents and travelers, a financial institution’s reputation is formed by the opinions and experiences shared by its customers.

So, how can financial institutions skillfully navigate this digital landscape to safeguard their credibility and trustworthiness? Here are five tips:

1. Monitor all customer conversations in one place

Customers talk about financial brands across reviews, social media, Google, forums, and industry-specific platforms. Tracking all of this manually causes delays and missed insights.

What to do:

- Track reviews across Google, Trustpilot, Zillow, and niche finance directories

- Monitor social media comments and complaints

- Flag high-risk mentions that require compliance review

- Give branch managers visibility into location-wise sentiment trends

Example:

Sargeants Conveyancing made the best use of reputation management for their property transactions and financial services.

Since they mainly serve customers in the Hawthorn area of Melbourne, they wanted to make the transactions smooth and stress-free.

A few key improvements they saw when they implemented Birdeye’s online reputation management platform into their businesses were:

- 121% increase in Google profile views

- 325 new reviews generated

- 71% increase in website visitors

- 87% increase in discovery searches

2. Respond to all reviews—quickly and compliantly

Financial customers expect fast, respectful responses. Slow replies affect conversions. For multi-location institutions, a consistent tone is essential for strong bank reputation management.

What to do:

- Respond to both positive and negative reviews

- Use compliance-approved templates

- Acknowledge concerns without providing financial advice

- Escalate sensitive complaints to the right department

Birdeye advantage:

AI-powered Review Response drafts personalized, compliant replies automatically—reducing workload for branch and support teams.

3. Maintain accurate listings across all platforms

Incorrect branch hours, outdated numbers, or missing services lead to customer drop-off. Listings accuracy improves discoverability and credibility.

What to do:

- Audit all listings regularly

- Sync business info across Google, Apple Maps, Bing, and 200+ directories

- Add services (Home Loans, Personal Loans, Insurance, Wealth Management) to improve rankings

- Keep NAP (Name, Address, Phone) consistent

This is essential for strong listings and reputation management for banks, especially multi-branch institutions.

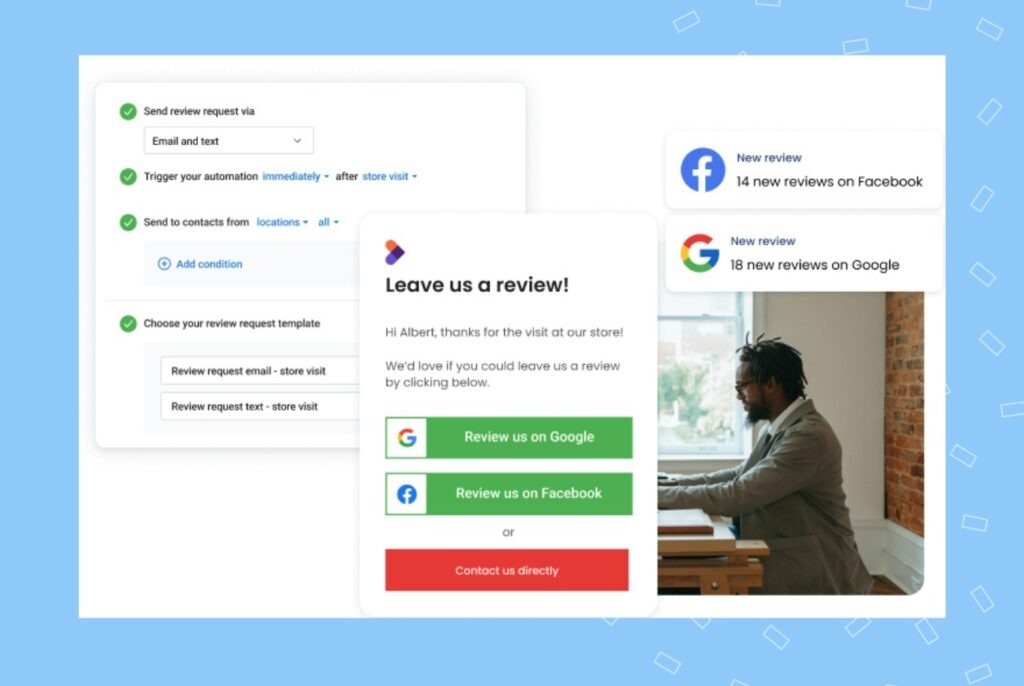

4. Automate compliant review generation

Finance customers rarely leave reviews unless reminded. Automated, timely requests boost review volume and credibility.

What to do:

- Trigger review invites post-loan approval, account opening, insurance policy issuance, or an advisory session

- Use SMS-based invites for higher response rates

- Store consent + timestamps for audit safety

- Track review volume by branch, advisor, or RM team

5. Analyze feedback patterns and close the loop

Reviews reveal operational gaps that analytics dashboards miss. Closing the loop improves customer experience and reduces future complaints.

What to analyze:

- Sentiment around service quality, speed, and clarity

- Repeated pain points (interest rate confusion, documentation hurdles, attitude issues)

- Advisor-level or branch-level performance differences

- Trends in complaints from specific regions or demographics

Birdeye advantage: AI Insights groups feedback by themes, helping leadership prioritize service improvements.

Be Found Where Your Customers Search You

Want to see the impact of Birdeye on your business? Watch the Free Demo Now.

Why does online reputation management matter to mortgage lenders?

The mortgage industry is heavily regulated, and compliance is non-negotiable. So, a positive online reputation, built on ethical and compliant practices, helps you navigate regulatory challenges more smoothly.

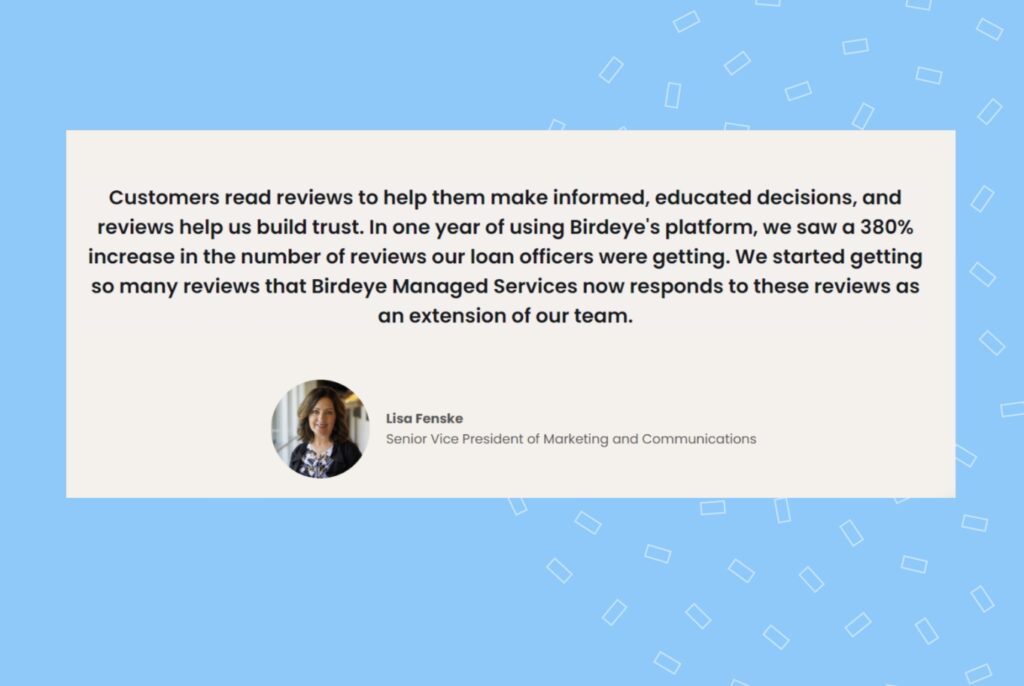

Borrowers are entrusting mortgage lenders with one of their most significant financial decisions – buying a home. And Waterstone Mortgage, a pioneer in the residential mortgage lender space, knew this.

Before using Birdeye, they faced challenges generating and managing reviews, collecting feedback, securing referrals, and turning customer insights into actionable actions.

They knew a positive online reputation goes beyond making profits; it means a better customer experience. That is when they turned to Birdeye and clocked:

- 380% increase in reviews

- 39% response rate for their surveys

- 338% increase in reviews and ratings

They made the best use of Birdeye’s 3,000+ software solutions integrations, especially Encompass, which helped them automatically drive reviews from Google, Facebook, and Zillow.

How Birdeye and its AI Agents transform reputation & marketing for financial services

Financial institutions operate under intense scrutiny. Every review, listing update, response, and customer touchpoint must be accurate, compliant, and timely. Traditional marketing teams or branch-level staff can’t manually keep up with the volume of feedback, regulatory requirements, or the speed at which customers expect responses.

This is where Birdeye’s Agentic Marketing changes the game.

Most automation tools help teams “do things faster.”

Birdeye Agents do the work themselves — with contextual understanding, compliance awareness, and measurable business outcomes.

Built on Birdeye’s proprietary LLMs and guided by an adaptive Outcome Framework, these AI agents act like fully trained digital teammates for banks, NBFCs, mortgage lenders, credit unions, wealth management firms, and insurance providers.

They operate with:

- Reasoning → understanding what the customer is asking

- Memory → remembering past interactions or branch preferences

- Compliance context → avoiding advice, numbers, or claims

- Brand alignment → same tone across every branch

- Outcome-driven intelligence → tying actions to business metrics (reviews, leads, visibility, conversions)

How Birdeye Agents help financial institutions

Birdeye’s suite of AI agents each handles a complete job that would normally require an entire digital team — crucial for regulated sectors where precision and compliance matter.

Below are the agents and how they directly benefit financial services:

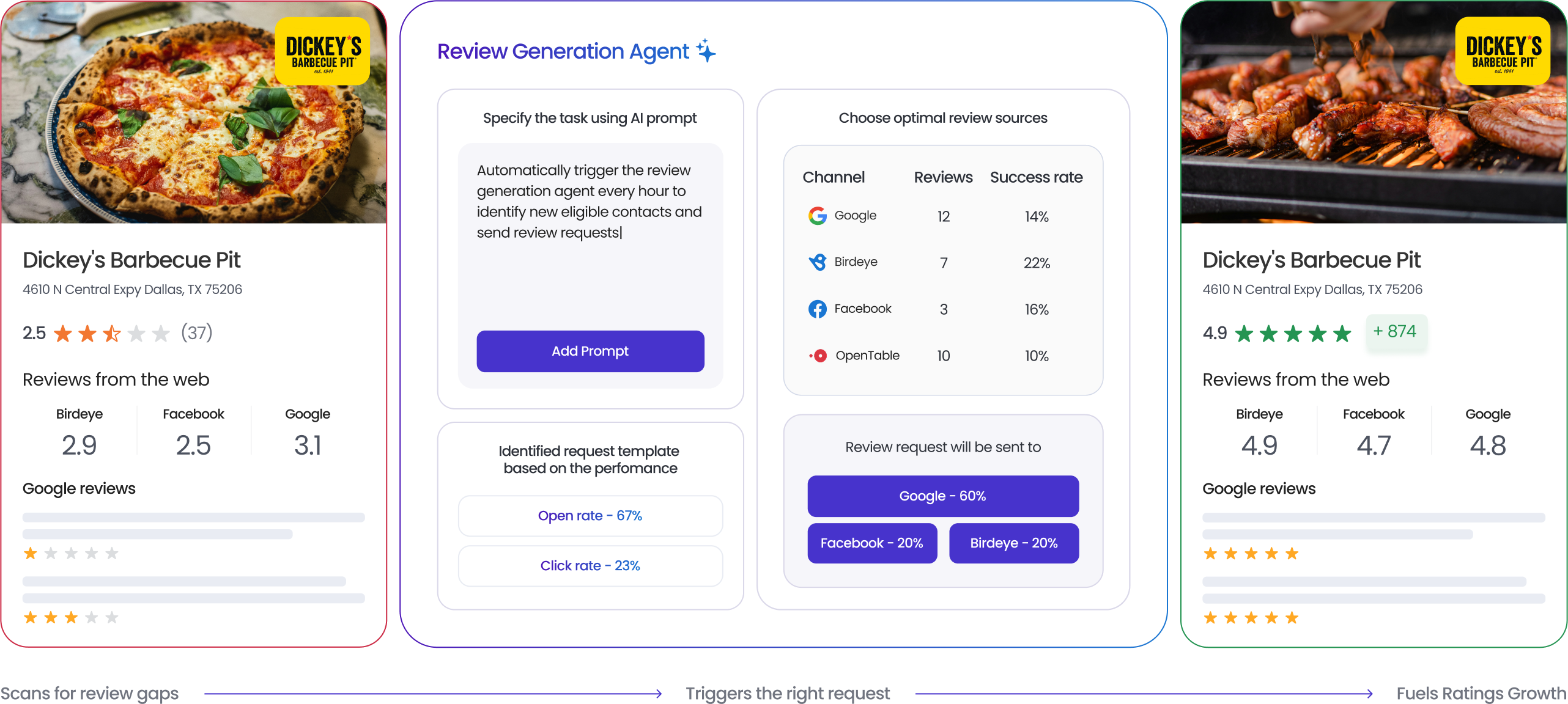

1. Review Generation Agent – Boost compliant reviews automatically

Banks and lenders rely heavily on social proof, but customers rarely leave reviews unless prompted.

Birdeye’s Review Generation agent:

- A/B tests the best timing for sending review invitations

- Chooses platforms that matter most

- Avoids biased or non-compliant phrasing

- Adapts strategy for loan officers, branches, or advisors

Impact: Higher review volume → higher local search ranking → more qualified leads.

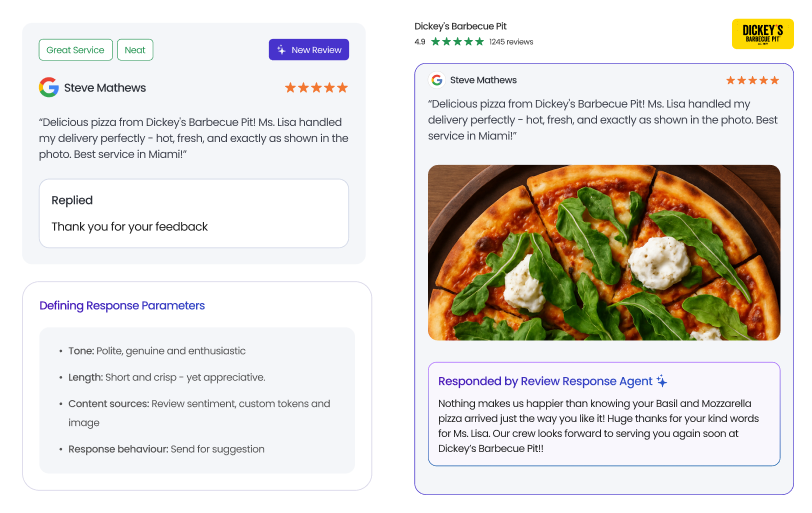

2. Review Response Agent – Real-time, compliant, hyper-personalized replies

Financial institutions must avoid giving financial advice in responses and remain consistent across branches.

- Writes personalized replies in seconds

- Adjusts tone for banks, advisors, or mortgage teams

- Flags sensitive feedback for supervisor approval

- Understands context from images, documents, or screenshots

- Ensures every reply is compliant and audit-ready

Impact: Stronger customer trust and faster resolution.

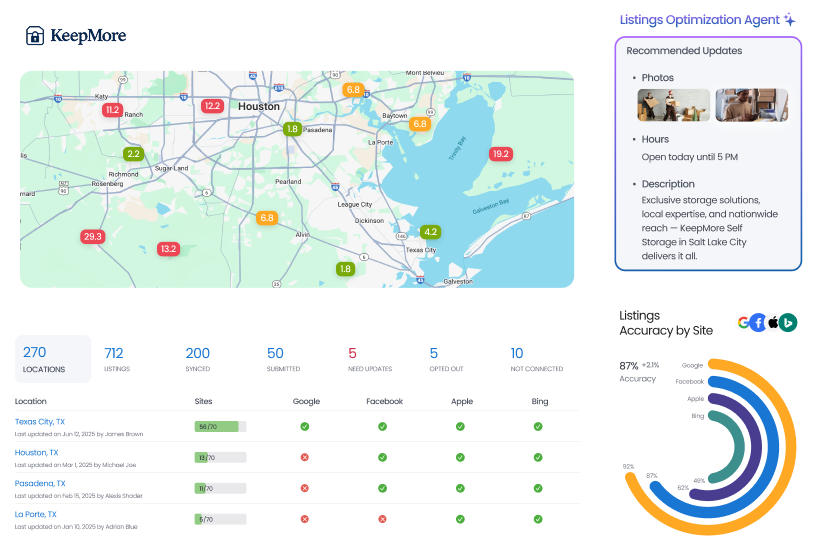

3. Listings Optimization Agent – Prevents listing errors across 200+ platforms

For finance, incorrect listings can lead to regulatory complaints, missed appointments, or lost deals.

This Listings Optimization Agent:

- Scans 200+ directories for outdated information

- Fixes discrepancies in branch hours, services, and phone numbers

- Detects missing product-level keywords (e.g., “home loans,” “SIP investment,” “credit card services”)

- Recommends SEO improvements based on local demand

Impact: More visibility, more discovery, more branch traffic.

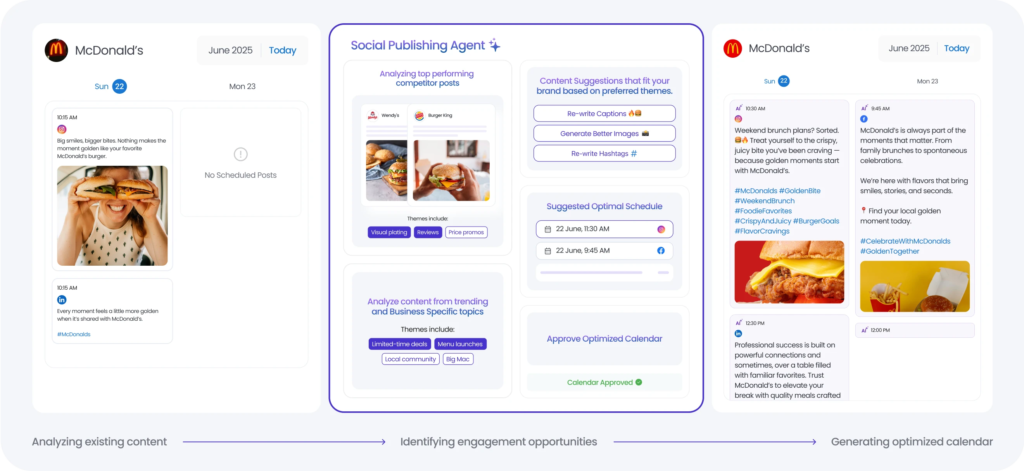

4. Social Publishing Agent – Maintains compliant, consistent content at scale

Banks and wealth management firms struggle to post regularly without risking non-compliant messaging.

- Writes, designs, and schedules posts automatically

- Ensures every post uses approved language

- Adapts content for regional branches or advisors

- Monitors competitor and market trends (e.g., rate updates, financial news)

Impact: Stronger brand presence without compliance risks.

5. Social Engagement Agent – Responds to social queries like a trained RM

Financial queries require careful handling — especially complaints or rate-related questions.

- Responds instantly to comments, DMs, and inquiries

- Detects urgency and routes high-risk messages

- Escalates loan-related or policy-related questions

- Maintains a polite, compliant tone across all touchpoints

Impact: Higher engagement + lower reputational risk.

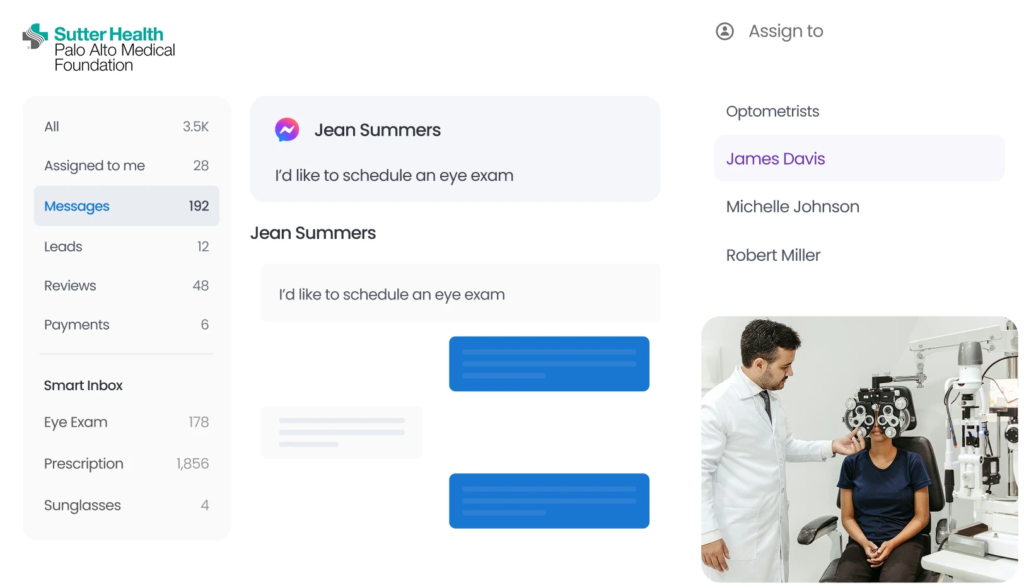

6. Lead Generation Agent – Never miss a lead on any channel

Financial leads convert fast — but only if someone replies instantly.

- Qualifies leads via chat, SMS, WhatsApp, or social

- Categorizes intent (loan inquiry, investment request, insurance query)

- Books appointments or routes to the right RM

- Works 24/7 for every branch or advisor

Impact: More closed loans, policies, and accounts.

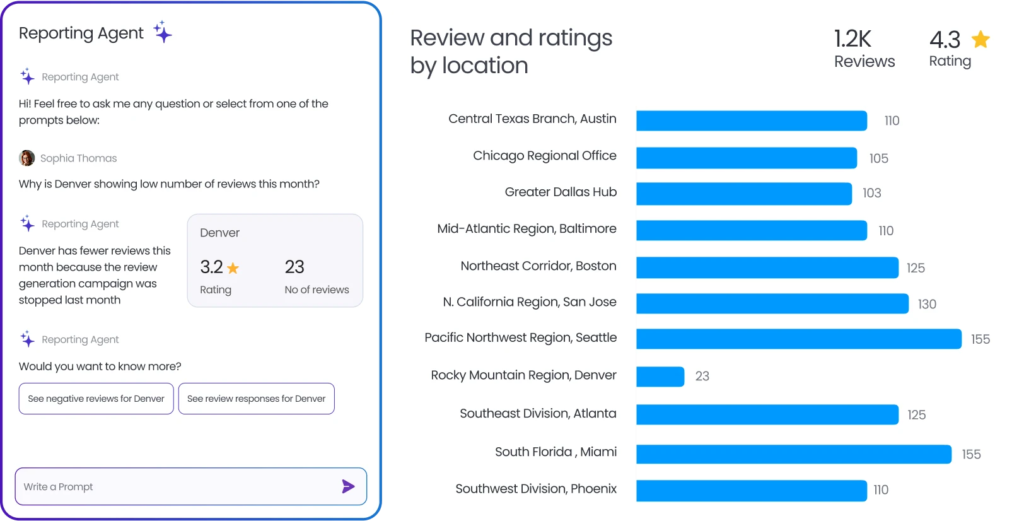

7. Reporting Agent – Turns complex financial data into clear insights

Instead of downloading multiple reports or dashboards, teams simply “ask” the reporting agent.

- Summarizes performance by branch, region, product, or advisor

- Pulls insights from reviews, surveys, listings, and leads

- Highlights compliance risks or recurring service issues

- Helps leadership make faster, data-backed decisions

Impact: Instant clarity on brand health across all locations.

Why Agentic Marketing matters for financial institutions

Traditional marketing tools only automate tasks. Birdeye Agents complete jobs — autonomously, accurately, and compliantly.

For financial services, this means:

- Outcome-linked marketing that drives account openings, loan inquiries, and policy conversions

- Zero missed reviews, leads, or messages

- Faster customer engagement without compliance risk

- Consistent tone across all branches

- More reviews and higher search visibility

- Lower operational cost per location

- Fewer errors in listings, responses, or communications

- Real-time insights into every customer touchpoint

Financial services online reputation management FAQs

Yes, online reputation management works very well for businesses offering finance services. It improves their credibility and gives them a competitive edge. This is the best form of efficient marketing.

Park Community Credit Union is an example of using online reputation management to its advantage. Earlier, they lacked a systemized way to generate and manage reviews.

Since using Birdeye, they have upped their market credibility by getting 300 monthly reviews.

Encourage compliant reviews by sending automated review requests after confirmed transactions, using neutral, non-influencing language. Avoid offering incentives tied to positive sentiment. Always include disclosure or opt-in where required. Direct customers to share their genuine experience without mentioning rates, returns, or financial advice. Use platforms like Birdeye to store consent, timestamps, and maintain audit-ready review request logs.

Key review sites for financial services include Google Business Profile, Facebook, Trustpilot, WalletHub, Zillow (for mortgage lenders), LendingTree, and local finance directories. Google carries the strongest impact on search visibility and lead volume. Industry-specific platforms such as Zillow and Bankrate influence research-driven customers. Maintaining consistent profiles across these sites strengthens credibility and conversions.

Track KPIs such as review volume, average rating, response time, sentiment trends, listing accuracy, discovery impressions, direction requests, and conversion rate from profile views to inquiries. Branch-level reputation performance, NPS, referral growth, and issue recurrence rates also matter. These metrics show the real impact of ORM on trust, lead generation, and customer satisfaction.

AI supports finance ORM by automating review monitoring, drafting compliant responses, analyzing sentiment, and detecting emerging risks across branches. It reduces manual workload, surfaces insights faster, and ensures consistent, audit-safe communication. Tools like Birdeye’s AI Agents help teams manage high review volume, maintain tone consistency, and improve response speed without violating regulatory guidelines.

Common pitfalls include giving financial advice in responses, discussing confidential details, sounding defensive, ignoring positive reviews, using inconsistent tone across branches, and failing to escalate sensitive complaints. Responses must remain neutral, professional, and compliance-approved. Avoid mentioning loan approval likelihood, rates, or investment performance. Always acknowledge the feedback and offer a private channel for resolution.

Birdeye integrates with 3000+ financial systems, including LOS platforms (like Encompass), CRMs, core banking systems, and mortgage origination tools. Integrations automate review invites, sync customer data, trigger surveys, and unify messages across branches. This creates a seamless, end-to-end reputation workflow with audit trails, compliance controls, and centralized reporting.

Birdeye’s reputation management solution for financial services

Whether your finance service includes mortgage, banking, working in the credit union, or debt relief services, one thing is clear – happy customers become brand advocates. A well-managed online reputation management is a win-win on all spectrums.

Implementing these five tips for improving the financial services’ online reputation management is simpler with Birdeye. More than 200,000 businesses trust us to delight their customer experience. It’s time for you to get in on the action.

Originally published