In the digital finance age, your online reputation is as valuable as your investment portfolio. Financial services companies, like investment firms, banks, and insurance agencies, operate in a landscape where trust and credibility are paramount.

One wrong move or false allegation can significantly impact your business. That’s why online reputation management (ORM) is not an optional strategy; it’s a necessity.

Here are five tips to help you master online reputation management in the financial services sector.

Table of contents

- What does online reputation management for financial service firms mean?

- Reputation management: Why is it important for financial services?

- How should financial service firms manage their online reputation?

- Why does online reputation management matter to mortgage lenders?

- 5 Tips for the finance industry to improve online reputation management strategy

- Financial services online reputation management FAQs

- Birdeye’s reputation management solution for financial services

What does online reputation management for financial service firms mean?

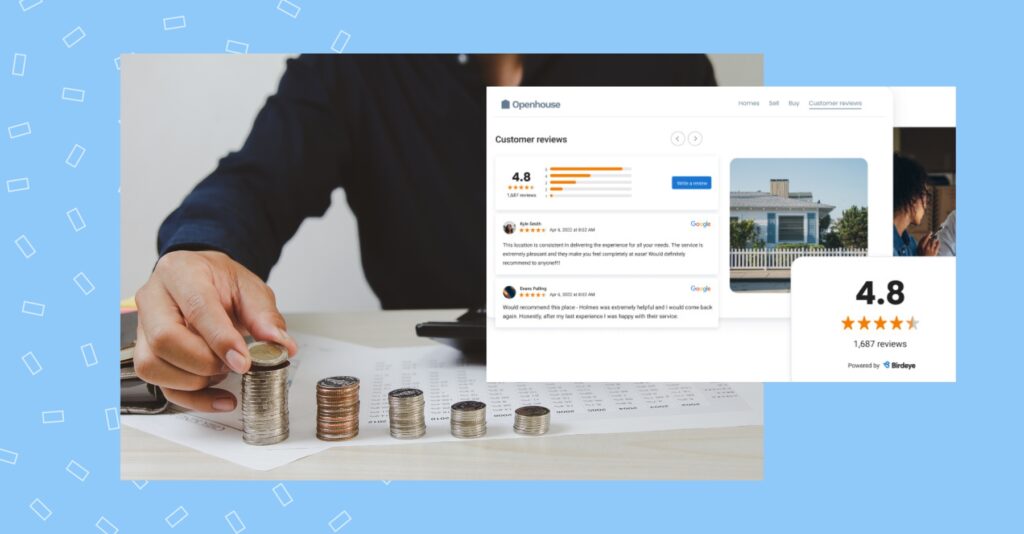

Online reputation management for financial service firms involves the strategic monitoring, improvement, and maintenance of the public perception on digital platforms.

Given that financial services are highly regulated and deal with sensitive personal and financial information, consumer trust is paramount.

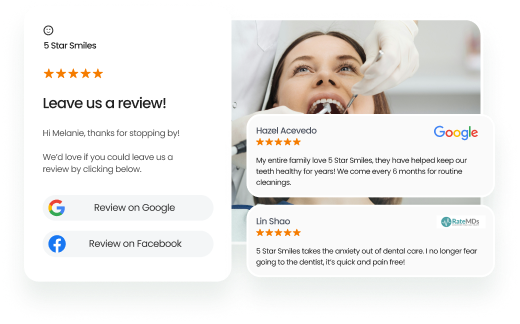

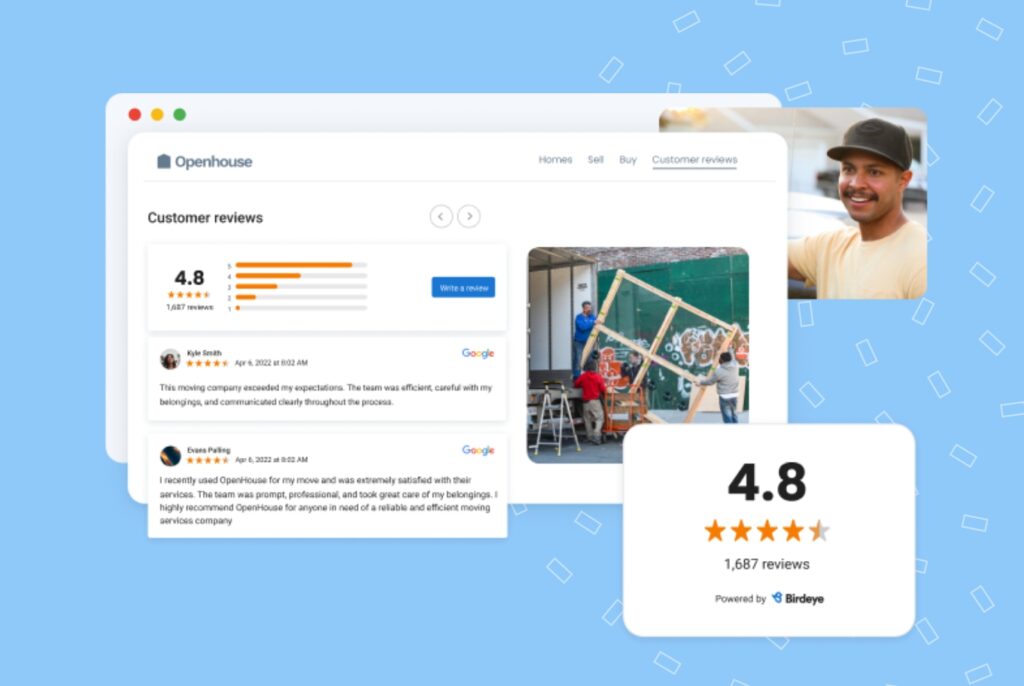

Reputation management includes managing online reviews, addressing negative comments promptly, promoting positive content and ensuring that your firm’s online presence aligns with its brand values and compliance requirements.

Effective online reputation management enables financial service firms to attract new customers, retain existing ones, and mitigate the impact of negative publicity.

Here is an example of how Madden Partners — an accounting and financial planning firm — managed and improved their online reputation.

Since they started using Birdeye’s all-in-one platform, they’ve boosted their online presence and increased their customer base. One of the most proactive steps they took to improve their reputation was building a positive brand perception.

To ensure they maintain a strong online reputation, they tested various ORM strategies like:

- Encouraging satisfied customers to leave positive reviews

- Optimizing their business listing management with relevant keywords

- Engaging with customers promptly

Thanks to these efforts, they saw:

- 76 new reviews generated

- 46% increase in direction requests

- 32% increase in discovery searches

- 14% increase in Google profile views

Reputation management: Why is it important for financial services?

Apart from maximum returns, trust is the foundation for financial service businesses. Consumers need to feel confident in their choice of financial institutions.

Here are some key reasons why reputation matters:

Trust and credibility

A positive reputation helps build trust among customers, investors, and the general public. Moreover, a strong reputation is crucial when people decide to invest in stocks. Investors are more likely to purchase shares from companies they trust, believing their investment will be secure and profitable. They are less likely to invest, open accounts, or seek financial advice from an institution that does not inspire credibility.

Customer retention

Retaining customers is as important as acquiring new ones. When working on reputation management for a finance service firm, a business should focus more on building proof of previously satisfied customers.

Customers who leave positive reviews are more likely to stay with a brand they trust and are likely to buy again.

Risk and crisis management

A strong reputation can act as a buffer during times of crisis or economic uncertainty. Finance services institutions with solid reputations are more resilient and better equipped to weather market volatility challenges.

Competitive advantage

A positive reputation management can set a financial services business apart from competitors. Customers are more likely to choose a company with a strong reputation over one with a questionable track record.

Financial performance

A solid reputation can increase revenue, improve shareholder value, and reduce borrowing costs. Maintaining a good reputation can help a finance firm demonstrate its commitment to ethical conduct and regulatory compliance, reducing the likelihood of regulatory scrutiny or penalties.

How should financial service firms manage their online reputation?

Just as a city’s image is shaped by the perceptions of its residents and travelers, a financial institution’s reputation is formed by the opinions and experiences shared by its customers.

So, how can financial institutions skillfully navigate this digital landscape to safeguard their credibility and trustworthiness? Here are some ways:

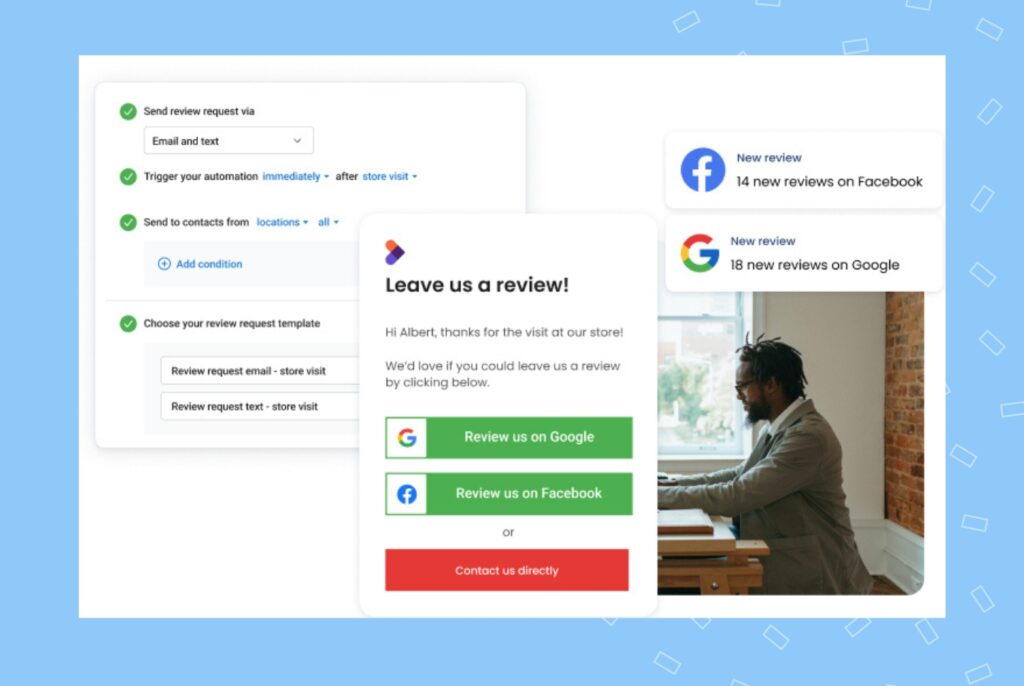

1 – Monitor online conversations on social media, review sites, and forums to stay aware of what customers and the public say about your firm.

Leverage Birdeye’s AI-driven Insights to understand customer sentiments, enhance the experience, and outperform the competition.

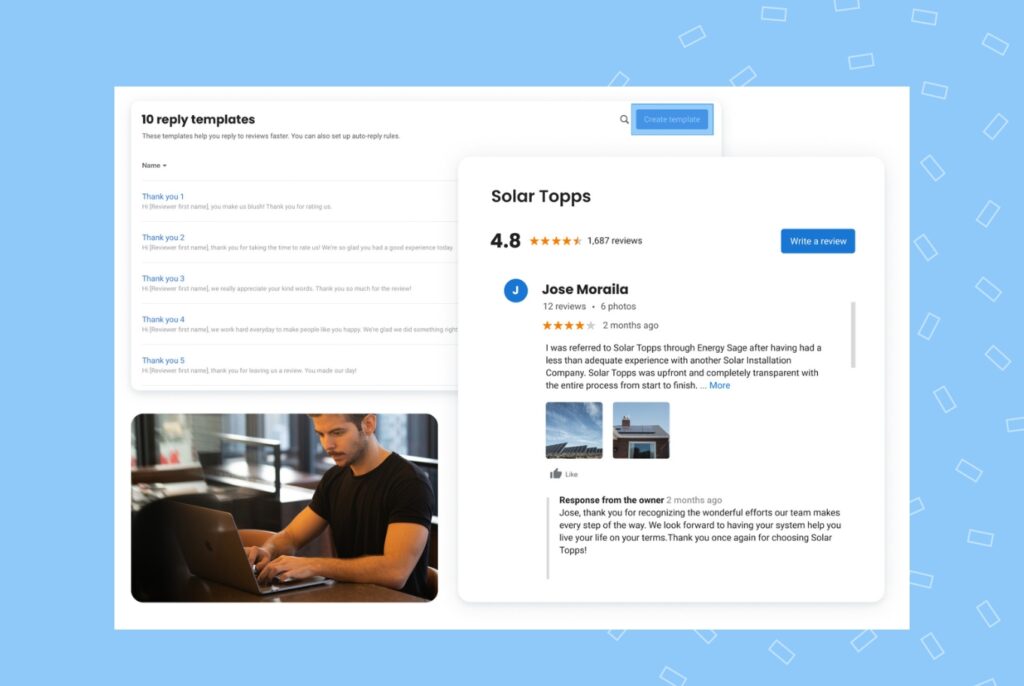

2 – Respond to positive and negative reviews. Oftentimes, businesses forget or do not think it is important to respond to positive reviews, but then get defensive when responding to a negative one. But the truth is that to win over the hearts of existing and potential customers, you should reply to both.

With Birdeye’s AI-powered Review, you can automatically generate personalized responses for every review.

3 – Update your business information across all platforms like Google Business Profile and review sites. This displays that you are consistent

You can use Birdeye’s AI-powered Listing tool to generate business descriptions that you can use across all the sites your business is on.

Be Found Where Your Customers Search You

Want to see the impact of Birdeye on your business? Watch the Free Demo Now.

Sargeants Conveyancing made the best use of reputation management for their property transactions and financial services.

Since they mainly serve customers in the Hawthorn area of Melbourne, they wanted to make the transactions smooth and stress-free.

A few key improvements they saw when they implemented Birdeye’s online reputation management platforms like Reviews, Listing, and Inbox into their businesses were:

- 121% increase in Google profile views

- 325 new reviews generated

- 71% increase in website visitors

- 87% increase in discovery searches

Why does online reputation management matter to mortgage lenders?

As per our recent study report the state of online reviews, 72% of customers won’t take action until they read reviews.

Whether a finance firm or a mortgage company, online reputation management is undebatable.

The mortgage industry is heavily regulated, and compliance is non-negotiable. So, a positive online reputation, built on ethical and compliant practices, helps you navigate regulatory challenges more smoothly.

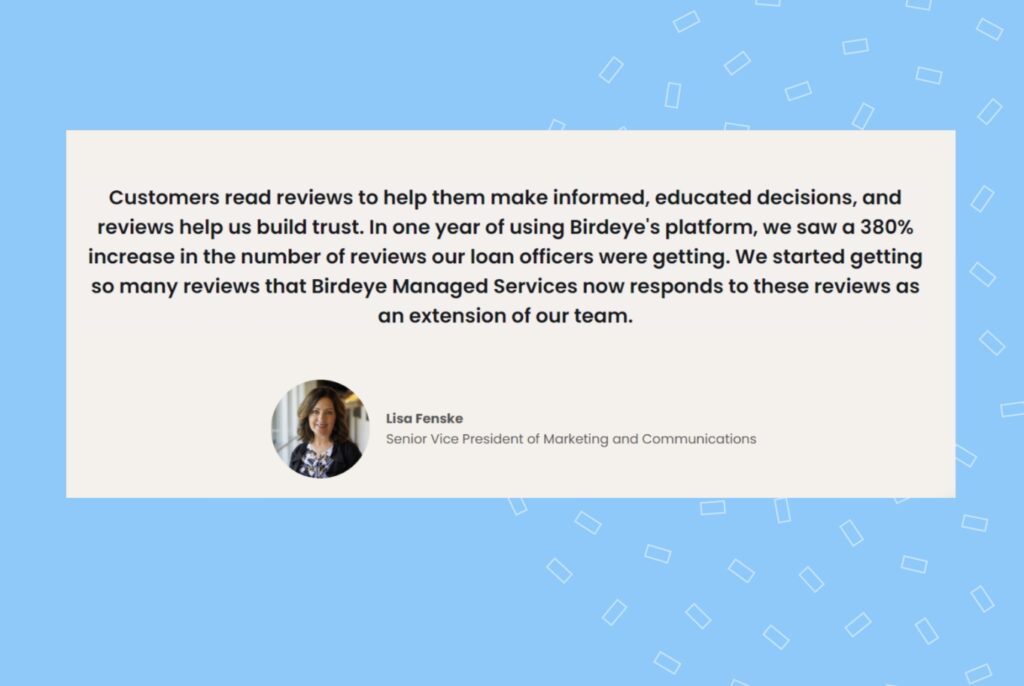

Borrowers are entrusting mortgage lenders with one of their most significant financial decisions – buying a home. And Waterstone Mortgage, a pioneer in the residential mortgage lender space, knew this.

Before using Birdeye, they faced challenges in generating and managing reviews, collecting feedback, getting referrals, and implementing actionable insights received from customers.

They knew a positive online reputation goes beyond making profits; it means better customer experience. That is when they turned to Birdeye and clocked:

- 380% increase in reviews

- 39% response rate for their surveys

- 338% increase in reviews and ratings

They made the best use of Birdeye’s 3000+ software solutions integrations, especially Encompass, that helped them automatically drive reviews from Google, Facebook, and Zillow.

5 Tips for the finance industry to improve online reputation management strategy

Online reputation is becoming a bigger driver of business performance than margin.

It does not mean we’re moving to a socialistic economy, where maximum financial returns will be overlooked. But more where socially reputable and likable finance services businesses will have equal importance, irrespective of their size and profitability.

Here are 5 tips for the finance industry to improve online reputation management strategy:

1 – Use AI-assisted review response reviews to showcase your commitment to customer satisfaction.

Consistently responding to reviews is crucial, but it can also be tedious. Luckily, AI can help you get more done in less time.

- Automate your review generation requests

- Engage on autopilot with automated replies

- Turn reviews into marketing assets

- Respond to reviews in your customers’ language

With Birdeye, you can monitor reviews on 200+ consumer sites.

2 – Stay active on social media

An active social media presence helps you build credibility. It’s an obvious signal to potential customers that you’re still in business.

- Respond promptly to comments, messages, and inquiries

- Share valuable financial insights to build authority

- Automate the content creation process and post more topical information

3 – Multiply your customers with trackable referrals

Referrals are golden opportunities for finance firms. Gain customers with satisfied customer’s word-of-mouth marketing by sending referral requests. To drive more revenue, you can also:

- Add rewards to your referral requests

- Read our complete guide to referral marketing for mortgage lenders

4 – Act diligently on customer feedback

Feedback is worth nothing if you don’t take action on it. Your customers want to know that you listen and make changes when necessary.

- Collect insights from surveys

- Understand your business’s strengths and weaknesses

- Analyze data to spot emerging trends and areas of opportunity

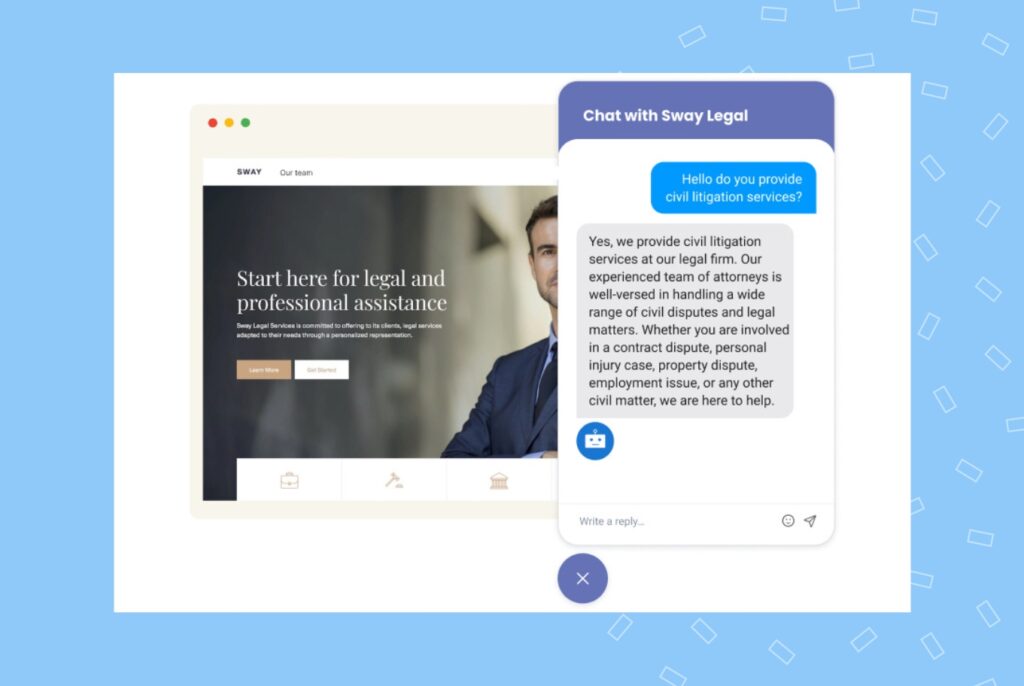

5 – Convert web visitors into leads

Your website can be a lead generator if you know how to leverage it.

- Be available 24/7 for your customers via live web chats

- Scale your customer support without adding more resources by using auto-response templates

- Drive more conversions with auto-responses to customer FAQs

Financial services online reputation management FAQs

Yes, online reputation management works very well for businesses offering finance services. It improves their credibility and gives them a competitive edge. This is the best form of efficient marketing.

Park Community Credit Union is an example of using online reputation management to its advantage. Earlier, they lacked a systemized way to generate and manage reviews.

Since using Birdeye, they have upped their market credibility by getting 300 monthly reviews.

Birdeye’s reputation management solution for financial services

Whether your finance service includes mortgage, banking, working in the credit union, or debt relief services, one thing is clear – happy customers become brand advocates. A well-managed online reputation management is a win-win on all spectrums.

Implementing these five tips for improving the financial services online reputation management is simpler with Birdeye. More than 150,000 businesses trust us to delight their customer experience. It’s time for you to get in on the action.

Originally published