One industry that has repeatedly prioritized efficiency with cost-effective innovation is healthcare. However, some businesses, from large hospitals to independent practices, still struggle with outdated payment processing systems. These old systems create friction, frustrate patients, delay payments, and result in lost revenue.

What is a healthcare payment system? A healthcare payment system is the process for handling financial transactions related to medical services, including determining costs, collecting patient payments, and managing insurance reimbursements.

But before we delve deeper, let’s address the elephant in the room: Is your healthcare payment system up to par? Here are some tell-tale signs that it’s time for a revamp:

- Manual processes and paper-based billing

- Long wait times and patient frustration

- Difficulty accepting various payment methods

- Lack of transparency and reporting

- Security concerns and outdated technology

If the above situations seem familiar, rest assured – you’re not alone.

Many healthcare providers face these challenges, but there’s good news. Today, a robust healthcare payment system is necessary to boost your healthcare reputation management. Many innovative payment solutions are now available to revolutionize your approach.

This blog guides you through selecting a modern healthcare payment processing platform compliant with the Health Insurance Portability and Accountability Act (HIPAA) and ensures a secure and seamless patient experience.

Let’s dive in.

Table of contents

- Why do you need a modern healthcare payment system?

- What are the challenges of traditional healthcare payment systems?

- What is a healthcare payment automation platform?

- What are the different types of healthcare payment models?

- What are the costs associated with implementing a healthcare payment automation system?

- Why is it important for your healthcare payment processing platform to be HIPAA-compliant

- FAQs on the healthcare payment system

- Birdeye Payments: The healthcare payment system you need

Why do you need a modern healthcare payment system?

Just as a healthy heart ensures the smooth functioning of the entire body, a robust healthcare payment system ensures the seamless operation of your practice. Imagine running a marathon with an erratic heartbeat; it’s daunting, right?

Similarly, you need a modern healthcare payment system because an outdated one can hinder operations, slow revenue, and reduce patient satisfaction.

In the following section, we’ll explore the native challenges of traditional healthcare payment systems and how modern solutions can enhance your performance, get more healthcare reviews, and improve patient experience.

What are the challenges of traditional healthcare payment systems?

Traditional healthcare payment systems often face challenges such as:

- Administrative burden

- Patient experience

- Limited control

Here are some key questions you should ask to know if your system might be hindering your practice:

- Are your staff overwhelmed with manual data entry and reconciliation billings?

- Do these manual processes lead to costly errors and delays in claim submissions and payments?

- Do patients experience long wait times or difficulty making payments due to a complex billing system?

- Is your practice limited to traditional payment methods like cash or check, potentially inconveniencing patients?

- Does your current system allow you to analyze payment trends and patient behavior?

- Are you concerned about the security of patient data due to outdated technology or insufficient safeguards?

If you nodded a frightening yes to these questions, you should upgrade your system to a modern payment solution that allows you to automate such tasks.

Birdeye Payments: Your Reliable HIPAA-Compliant & Hassle-Free Healthcare Payment System

Want to see the impact of Birdeye on your business? Watch the Free Demo Now.

What is a healthcare payment automation platform?

A healthcare payment automation platform is a tech solution that simplifies and automates healthcare payments. It integrates with your practice management system (PMS) to make payment processing easier and more efficient. This saves time, reduces errors, and improves cash flow for your practice.

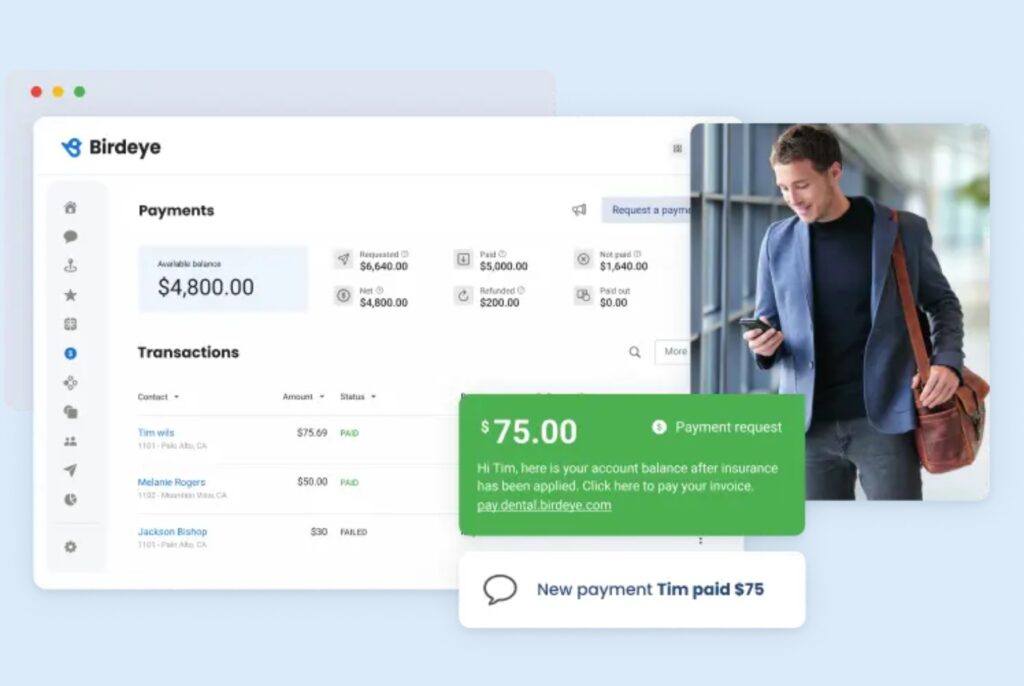

Birdeye Payments is a fine example of an efficient healthcare payment automation platform. It provides an effortless end-to-end payment experience across text, scan, card readers, your website, and beyond.

What are the benefits of healthcare payment automation?

Modern healthcare payment automation platforms revolutionize the way payments are handled, offering benefits like:

- Improved efficiency with AI in healthcare, as it automates tasks like data entry, saving time and reducing errors.

- Enhanced patient experience by providing online payment portals and multiple payment options.

- Faster payments, streamlined claims processing, and automated reminders, leading to faster provider reimbursements.

- Increased revenue cycle management with improved data insights to help optimize billing practices and maximize revenue collection.

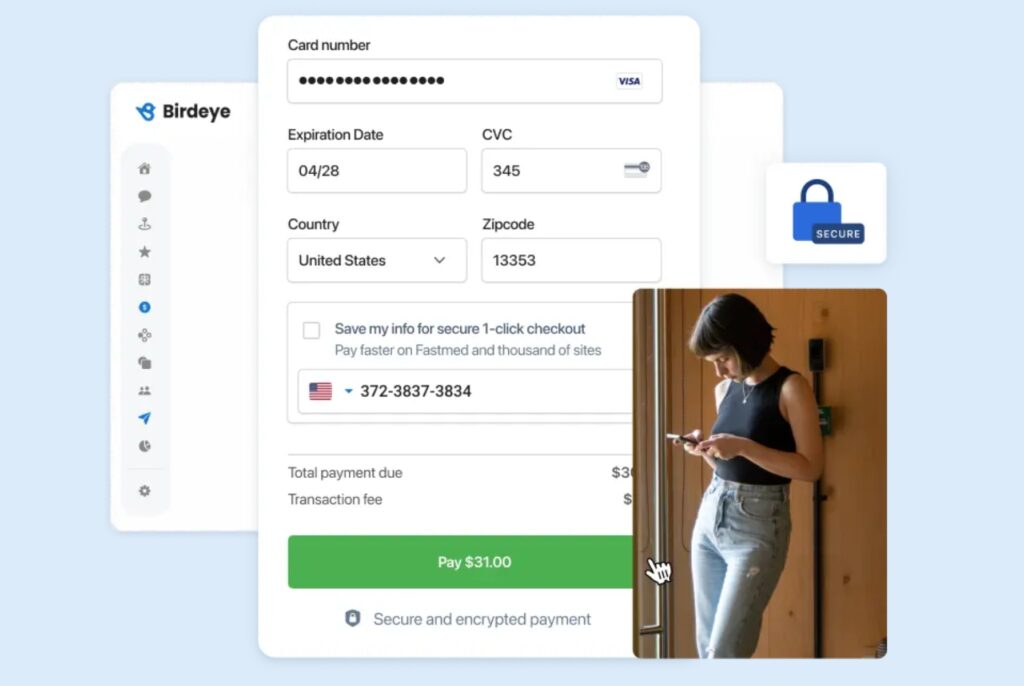

- Improved security by integrating with modern platforms offers robust security features to safeguard patient data.

By automating tedious tasks and streamlining workflows, healthcare payment automation fosters a win-win situation for patients and providers.

But then a question arises…

How does a healthcare payment automation platform work?

Modern healthcare payment automation platforms differ from traditional ones by addressing their challenges. Integrating this automation improves efficiency and boosts the bottom line.

Here’s how these healthcare payment automation platforms work:

- Claims are electronically submitted to insurers, reducing errors and speeding up processing.

- Patients can securely pay online using credit cards or e-checks.

- Reminders nudge patients to settle outstanding balances.

- Payments automatically match with claims, reducing manual work and errors.

- Platforms like Birdeye Payments provide valuable insights into automatic fraud detection and PCI compliance.

What are the different types of healthcare payment models?

Healthcare payment automation platforms streamline the way you process payments, but it’s also important to understand the different models that dictate how those payments are structured. Understanding these models empowers you to:

- Make informed decisions as you know the different reimbursement structures and can choose one that best aligns with your practice’s goals and patient population.

- Optimize revenue cycle management by comprehending the financial aspects of each model and develop strategies to improve cash flow.

- Stay ahead of the curve as payment models are constantly being refined so being informed ensures you can adapt your practice to emerging trends.

Recommended read: How review automation helps healthcare providers save time and accelerate growth.

Here are the common healthcare payment models:

- Fee-for-Service (FFS): Patients are directly billed for each service received, like doctor visits, lab tests, and procedures.

- Capitation: A fixed payment is provided to a healthcare provider for managing a patient’s care over a specific period, regardless of the services used.

- Bundled payments: A fixed price is set for a specific episode of care, such as surgery or a chronic illness treatment.

- Value-based care: Providers receive incentives based on the quality and efficiency of care they deliver, not just the volume of services.

Now you can choose your healthcare revenue management that is perfect for your practice.

Did you know: You can integrate Birdeye with your other healthcare software!

What are the costs associated with implementing a healthcare payment automation system?

The cost of implementing a healthcare payment automation system can vary depending on the features, size of the practice, and chosen vendor. Here are some general factors to consider:

- Subscription fees: Monthly or annual costs associated with the platform usage.

- Transaction fees: Per-transaction fees the processing company charges for each payment received.

- Setup fees: One-time costs associated with system implementation and integration.

While there are upfront costs, the long-term benefits of efficiency and increased revenue often outweigh the initial investment.

Look out for the 7 signs of an effective healthcare referral management✅

How do you select the right healthcare payment processing company?

Contrary to popular belief, selecting the right healthcare payment processing company is one of those experience marketing strategies for healthcare practices that can improve your workflow, protect patient data, and enhance the overall patient experience.

Here are some key factors to consider:

✅HIPAA-compliant platform.

✅Scales with your practice and keeps pace with changing technologies.

✅Integrates with your existing PMS for a streamlined workflow.

✅Prioritize reliable customer experience and troubleshooting assistance.

✅Aligns with your needs and budget.

If your preferred healthcare payment automation platform checks all the boxes, you should choose them.

Now, let’s dive deeper into how choosing a HIPAA-compliant payment software can benefit your healthcare organization.

Why is it important for your healthcare payment processing platform to be HIPAA-compliant

HIPAA establishes stringent standards for safeguarding patients’ Protected Health Information (PHI).

What is Protected Health Information (PHI)? PHI refers to any identifiable information about a patient's health condition, medical history, or healthcare services received. This includes details like names, dates of birth, Social Security numbers, diagnoses, and treatment details.

Whether a payment processing provider needs to be HIPAA-compliant depends on the nature of the transactions they handle. Covered entities, including healthcare providers, health plans, and healthcare clearinghouses, must implement HIPAA measures to ensure the confidentiality and integrity of the patients.

Because payment processing providers handle financial transactions, including accessing and storing sensitive information related to medical services, it is crucial for them to maintain the highest standards of security.

Note: Not all payment transactions will involve PHI. For instance, a straightforward payment transaction that includes only financial information may not fall under HIPAA. However, if the payment details include information about medical treatments or health conditions, it becomes part of PHI, necessitating HIPAA compliance.

FAQs on the healthcare payment system

Look for features like user-friendly interfaces, secure payment processing, integration with existing systems, flexible payment options, and automated processes. Additionally, ensure it complies with relevant regulations like HIPAA.

Yes, a healthcare payment system can improve patient satisfaction by offering convenient, secure, and flexible payment options. It simplifies the billing process, making it easier for patients to understand and manage their payments.

Yes, most healthcare payment systems integrate with other healthcare software, such as electronic health records (EHR) and practice management systems (PMS), to streamline operations and ensure data consistency.

Healthcare payment systems typically support various payment methods, including credit/debit cards, online payments, electronic checks, and automated clearing house (ACH) transactions. This flexibility accommodates different patient preferences.

Absolutely. Since healthcare payment processors handle sensitive patient financial information, they must be HIPAA-compliant. This ensures they implement appropriate safeguards to protect this data from unauthorized access, disclosure, or misuse.

Yes, HIPAA regulations apply to patients’ financial records related to healthcare services. This includes information like billing details, payment history, and insurance coverage. Healthcare providers and their business associates must handle this data with the same level of security as other PHI.

Birdeye Payments: The healthcare payment system you need

As a reputable healthcare payment system solution provider, Birdeye follows all the HIPAA guidelines and also has a Business Associate Agreement (BAA) as a reliable payment processing provider.

Birdeye’s AI-powered healthcare payment system options

Birdeye’s payment processing solutions cater to all stakeholders within the healthcare ecosystem:

- For healthcare providers: Improved efficiency, reduced administrative burden, faster reimbursements, and enhanced revenue cycle management.

- For patients: Convenient online payment options, streamlined billing processes, and a more positive patient experience.

- For payers: Faster claim processing, reduced errors, and improved efficiency in managing healthcare payments.

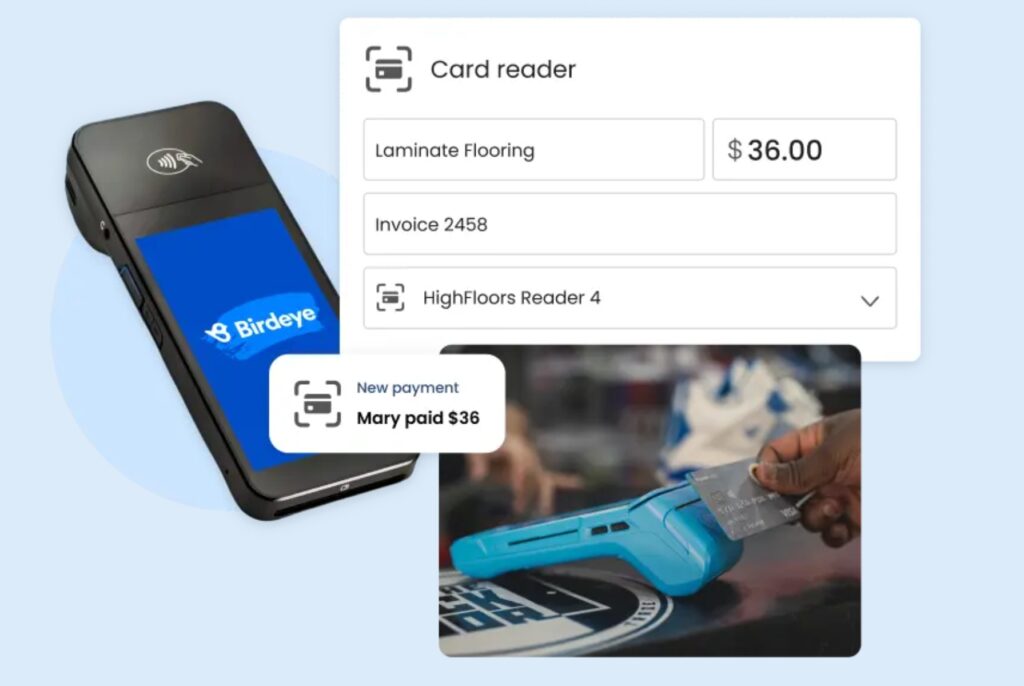

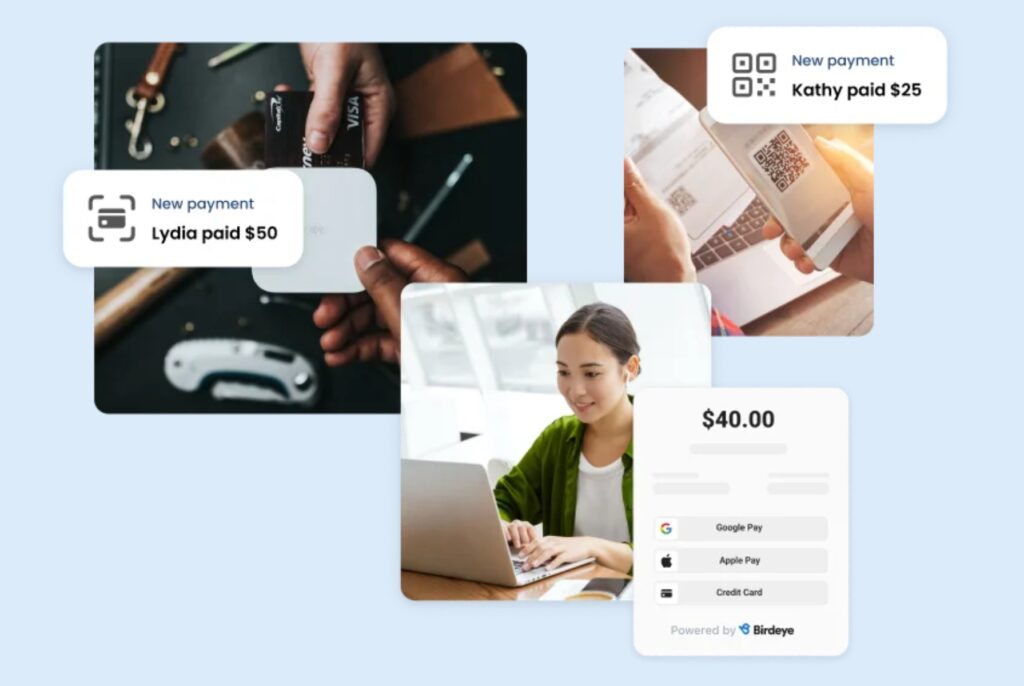

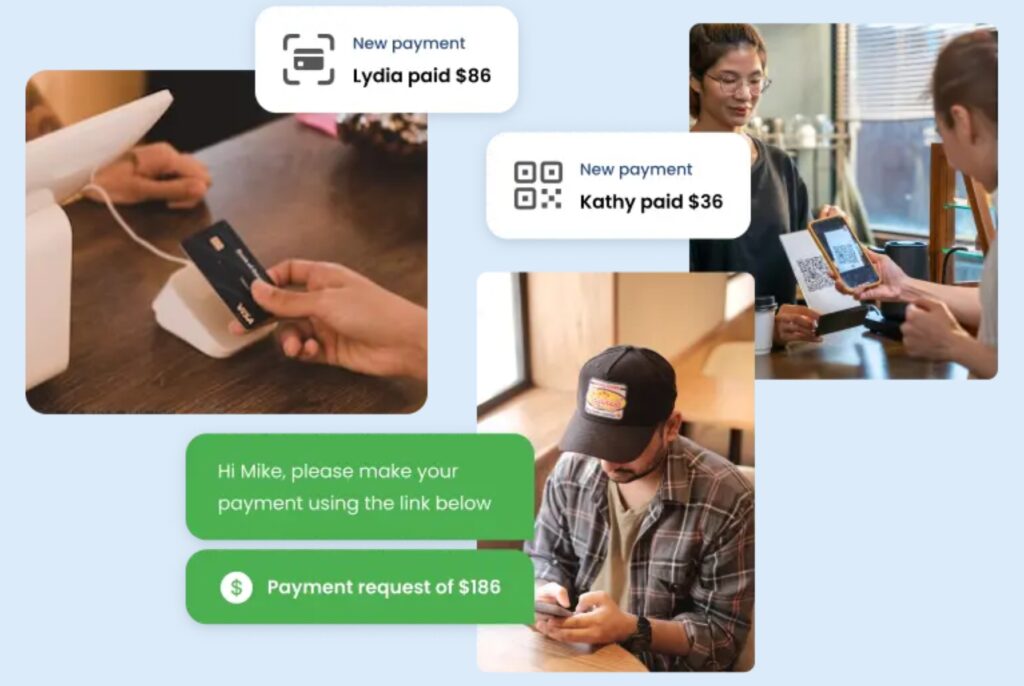

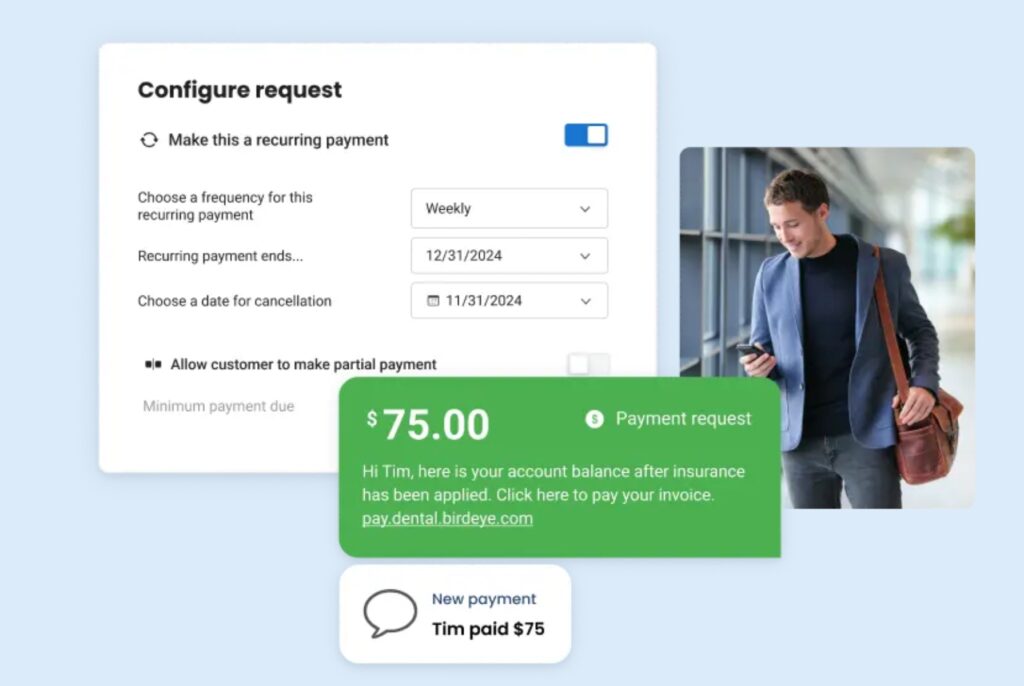

Whether you have a digital or in-store business, Birdeye’s effortless payments processing empowers you to:

- Offer digital payment options – tap, email, swipe, text, or scan

- Use one payment platform to request payments and accept

- Settle up on-site

- Save payment info for later

- Collect recurring payments

- Offer partial payment options

- Buy now, pay later

- Get reviews post-payment

- Track your transactions

- Monitor revenue and payouts

- Uniform and no hidden fees or chargebacks

- Protect your margins

- Minimize fraud risk

Ready to transform your healthcare experience? Schedule a free demo to know if we are your ‘the-one’ healthcare payment system provider!

Originally published